Oh, the drama! The US dollar, once the titan of global currencies, is crumbling like a soggy pancake, and market pundits are scrambling to tell us that the new shiny toys are gold and Bitcoin. Bitwise, a very fancy market analyst group, has dubbed this the “debasement trade,” which basically means everyone is rushing to buy hard assets in case their paper money turns into confetti. It’s like a high-stakes game of Monopoly, but with real-world consequences.

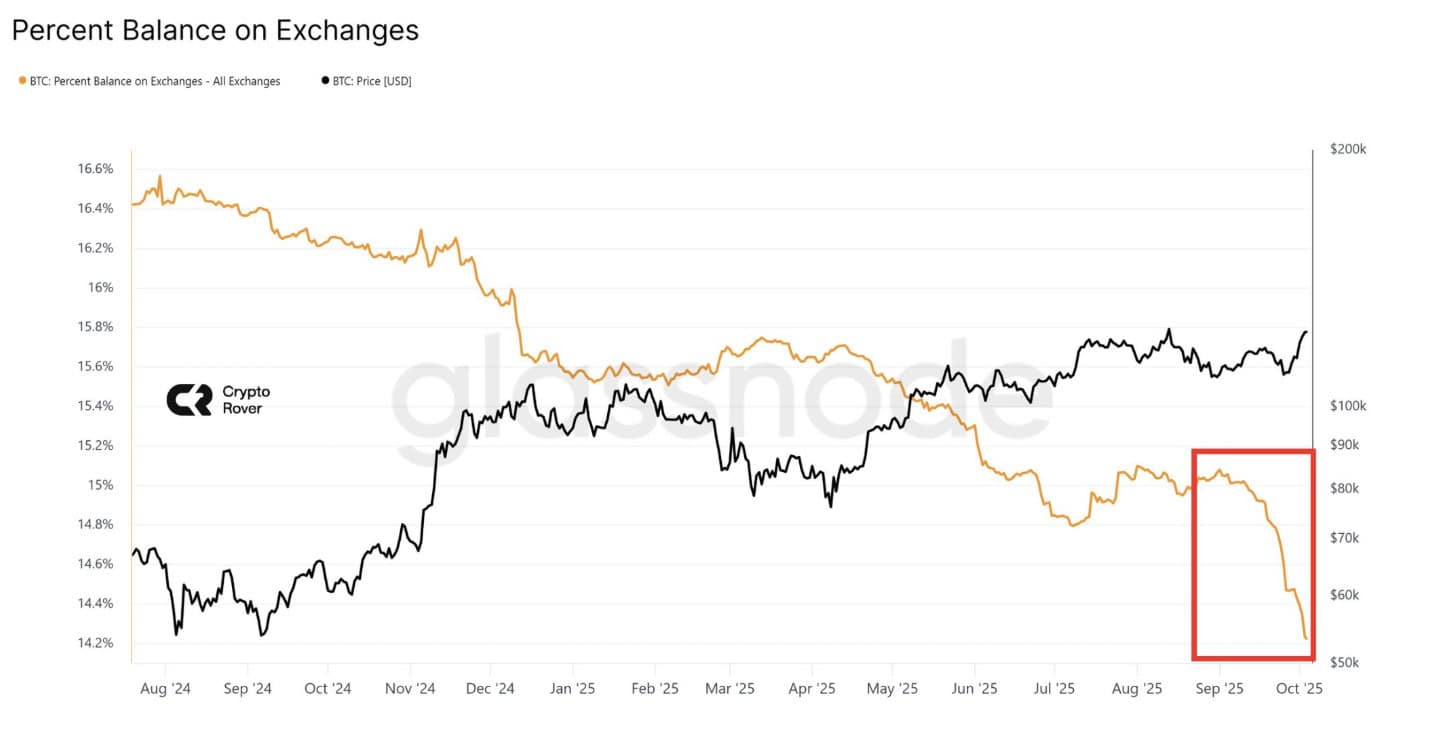

And let’s talk numbers-because who doesn’t love a good number fest? The DXY index has plummeted by 10% this year, while gold and Bitcoin have respectively jumped by 26% and 25%. Sounds like a party, right? Not so fast. Bitwise also points out that a staggering 49,158 $BTC have been withdrawn from exchanges-just more evidence that the big players are hoarding, not selling. Talk about a game of “Who Can Hold the Most Coins?”

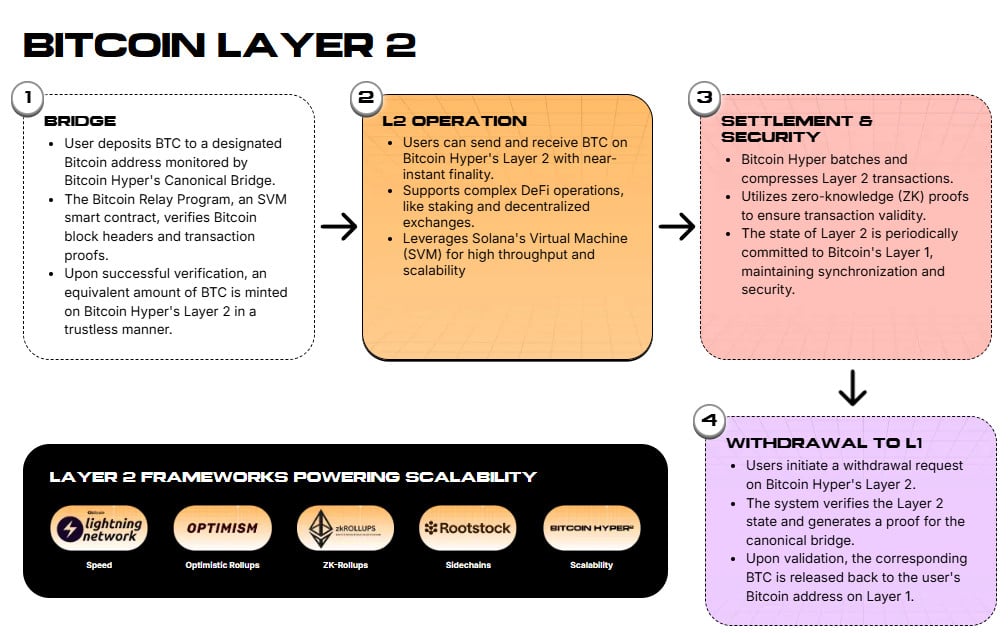

Speaking of soaring prices, Bitcoin-linked projects like Bitcoin Hyper ($HYPER) are riding this bull run like it’s a wave on a surfboard made of gold. $HYPER is a Layer 2 scalability solution that, spoiler alert, could very well be the future of Bitcoin’s performance. Get ready, folks, the revolution is here.

Institutions Take the Wheel: Bitcoin’s Rally Gains Strength Despite Retail Slowdown

The big players are driving this bus, folks, and they’re doing it in style. US spot ETFs-yes, the likes of BlackRock’s IBIT and Bitwise’s BITB-are behind this rocket launch, and they’re not slowing down. Retail? Eh, not so much. Retail transactions have been as flat as a pancake since spring 2024, and it seems like the cool kids are all institutional investors.

For those who love graphs (and who doesn’t?), check out this beauty. It shows how Bitcoin’s price and Bitwise’s ETF purchases have been perfectly synchronized like they were dancing at a waltz competition.

Retail transactions are lagging behind, but is that such a bad thing? Analyst Axel Adler Jr. thinks not. If anything, the absence of small traders means less panic-buying and more stable growth. Hallelujah!

A Bubble or a Sustainable Trend?

Now, before you start screaming “bubble!” let’s take a breather. Bitwise is quick to point out that even though open interest and funding rates are climbing, they’re still nowhere near the over-the-top levels we saw during Bitcoin’s previous euphoric highs. Things are heating up, but we’re not yet at “uncontrolled fire” level.

Thank goodness for that. The last thing anyone wants is another Bitcoin bubble bursting like a bad first date.

What Does this Mean for the Bitcoin Ecosystem?

Big ETF inflows are a game-changer. They bring in institutional money that’s parked in more secure, regulated wrappers. Think of it like putting your money in a vault rather than under your mattress. This increased liquidity lowers the friction for big investors and acts as a tailwind for $BTC’s price.

And let’s not forget about scarcity. With exchange reserves going down and whales making their exits, Bitcoin’s rarity factor is turning up the heat, making its price swing faster than a pendulum at a funfair.

Then there’s the whole regulatory clarity thing. More rules mean less risk for large investors, which is just what the Bitcoin ecosystem needs to keep the institutional floodgates open. Who knew regulations could be a good thing?

With institutional forces at the helm, the stage is set for Bitcoin projects like Bitcoin Hyper to thrive in a more predictable, stable market.

From Slow to Seamless: How Bitcoin Hyper ($HYPER) Plans to Upgrade Bitcoin’s Performance

Bitcoin’s transaction speeds are slow. Like, really slow. We’re talking 7 transactions per second (TPS) slow. But don’t worry-Bitcoin Hyper ($HYPER) is here to save the day. It’s the upgrade Bitcoin desperately needs to solve its speed and transaction cost issues, while also making the network scalable.

By integrating the Solana Virtual Machine (SVM), Bitcoin Hyper is set to bring some serious speed to the Bitcoin party. SVM lets transactions and smart contracts happen in parallel, which is a huge leap from Bitcoin’s slowpoke single-threaded approach.

Why It Matters

Bitcoin Hyper isn’t just about speed; it’s about making Bitcoin truly usable. Real-time payments? Check. On-chain apps? Check. Staking and DeFi? Double check. And let’s not forget those meme coin launches. It’s about bringing Bitcoin into the modern age-no more waiting around like it’s the Stone Age.

Investors Flock to the $HYPER Presale

Hold onto your hats because $HYPER is making waves. It’s already raised a staggering $22.5 million, and a recent whale buy of $267,799 shows that investors are all in. Right now, $HYPER is priced at $0.013085, with 52% APY staking. Not bad for a little passive income, huh?

So, what are you waiting for? Jump in on the $HYPER presale today and become part of Bitcoin’s evolution. Because, let’s face it, the future is happening whether you’re ready or not.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

- Powell’s Dilemma: The Fed’s Crumbling Confidence and Bitcoin’s Wild Ride 🚨

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- BNB: To $1,000 or Total Chaos? 🤯

2025-10-08 10:38