Well, well, well! BNB has decided to break all the rules and soar past the $1,200 mark, reaching a shiny new all-time high. Traders, however, were left crying into their screens as liquidations flooded the market like a storm-too bad they didn’t pack an umbrella. According to CoinMarketCap, BNB was priced at a glorious $1,202.01, with a trading volume that could make even the most seasoned traders raise an eyebrow at $4.21 billion. And still, the overall crypto market took a small dip, dropping 1.12% to $4.22 trillion. Go figure.

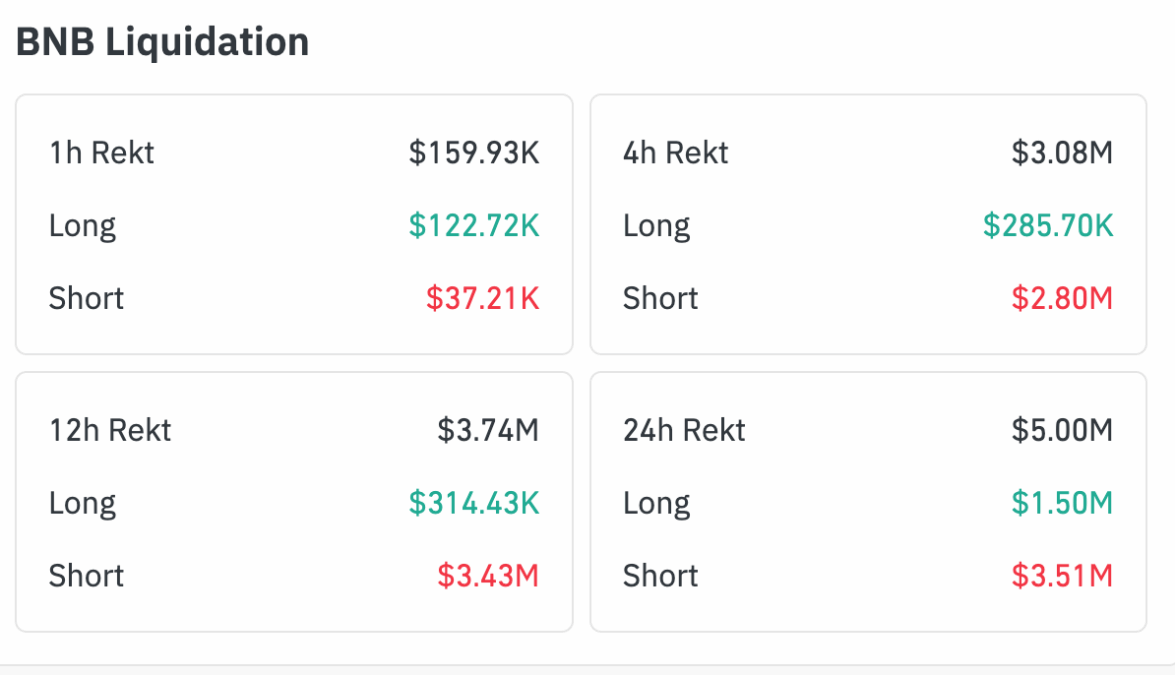

Let’s dive into the disaster zone, shall we? Data from Coinglass shows that around $5 million worth of BNB positions were liquidated in just 24 hours. Most of this carnage came from short traders, who collectively lost a jaw-dropping $3.51 million. The long traders? Well, they were “only” down $1.50 million. But hey, it’s not *all* bad for the longs, right? At least they didn’t lose their shirts-just their shoes.

What’s the moral of the story? Simple: Prices went up, and the shorts got caught with their pants down. In the first 12 hours, $3.74 million in liquidations were logged, mostly from the shorts who thought they had this market figured out. And in the last four hours? Another $3.08 million went up in smoke, again, mostly from shorts. They just can’t catch a break. Someone please send them a sympathy card!

Funding rates signal bullish bias

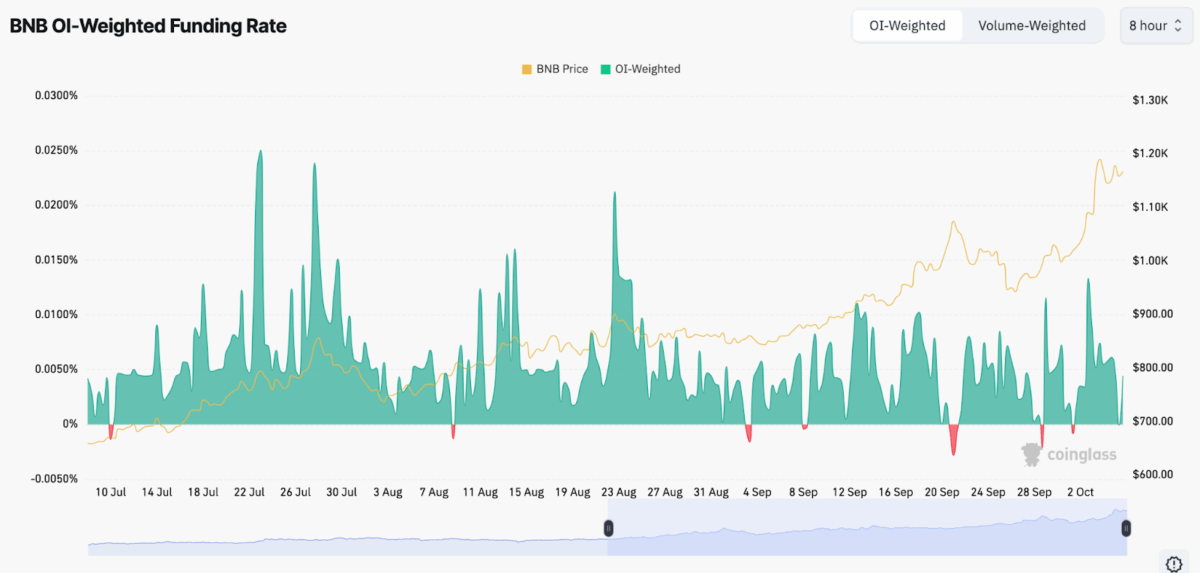

Meanwhile, the funding rates for BNB have been holding strong and positive since mid-July. A small fee paid by those betting on a price increase to those betting against it-just a little token of appreciation for the bulls. And of course, these rate jumps in late July, mid-August, and late September were perfectly in sync with BNB’s price rallies. Bulls, you’ve got the power. We see you flexing.

At the start of August and again in mid-September, the funding rates briefly dipped into the negative zone, giving the sellers a fleeting moment to bask in control. But don’t get too comfy, sellers-buyers swooped right back in, and optimism started to shine through again. The bulls are back, baby!

Market sentiment and technical outlook

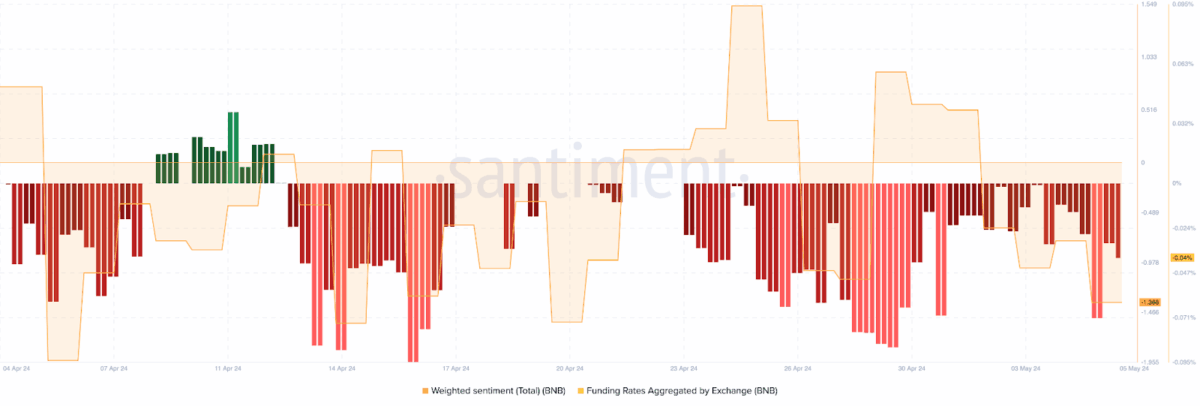

According to Santiment, investor sentiment around BNB took a little nosedive from late March to early May 2024. Those funding rates were deep in the red, and the market was feeling a tad…let’s say, uncertain. But now, with BNB’s recent price moves, it seems like everyone’s pulling up their socks and getting back in the game. Things are looking up-well, for now!

Crypto Claws, ever the optimist (or not), pointed out, “$BNB just hit a new all-time high, signaling potential exhaustion after a strong parabolic rally.” Basically, hold on to your hats! The analyst warned that smart money might take its profits soon, leading to a potential price correction toward $700 by December. We can only hope that Christmas will come early for the bears.

So, while BNB’s leap above $1,200 shows strong buying power, the growing liquidations and those ever-high funding rates might just signal that this market needs a little breather soon. Don’t get too comfy, folks. The rollercoaster isn’t over yet!

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

2025-10-06 14:18