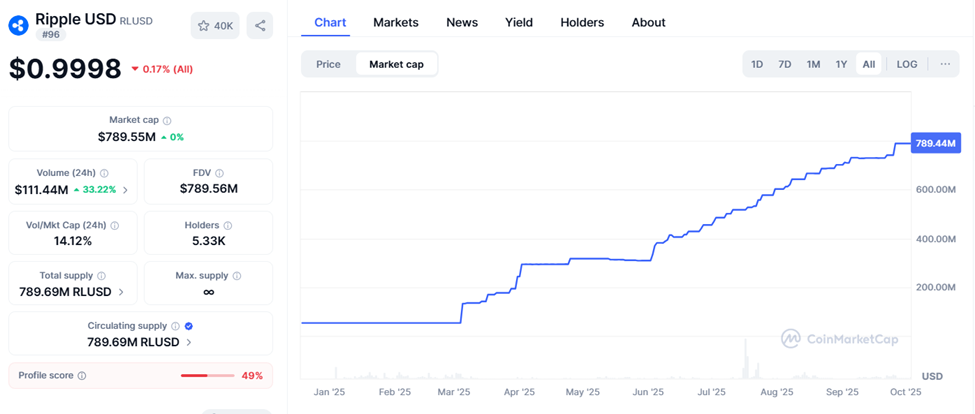

Ripple’s RLUSD has ascended to a market capitalization of nearly $789 million, a feat one must admire if only for its audacity. Launched in late 2024 as a savior of cross-border payments and DeFi dreams, this US dollar stablecoin has lured the likes of DBS and Franklin Templeton into its glittering web.

Yet, hidden beneath this gilded growth lies a truth so banal it could make a Victorian poet weep: most of RLUSD’s supply resides not on XRPL, Ripple’s blockchain, but on Ethereum. How ironic, don’t you think? 🐍

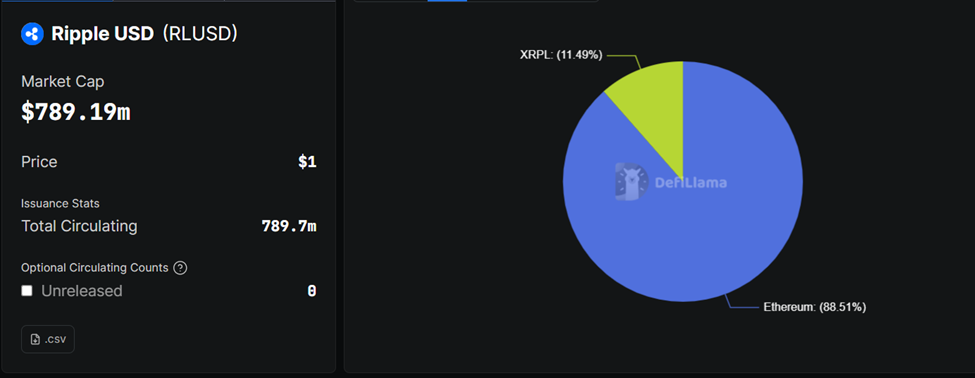

Ethereum Dominates RLUSD Supply

Per the alchemists at DefiLlama, over $700 million-or 88% of RLUSD’s supply-dwells on Ethereum, while a mere $90 million simmers on XRPL. One might say Ripple’s native blockchain is the forgotten cousin at a family reunion, left to sip lukewarm tea while Ethereum sips champagne. 🥂

Despite Ripple’s valiant attempts to frame XRPL as RLUSD’s beating heart, new issuances since 2025 have all but abandoned it for Ethereum. A betrayal? Perhaps. A strategic pivot? One can only assume it’s a “strategic pivot.”

This revelation has left XRP holders in a state of existential dread, their hopes of RLUSD boosting XRP’s demand now as fleeting as a duchess’s patience at a bad play. After all, every transaction on XRPL demands XRP fees-yet RLUSD’s Ethereum soiree renders XRP irrelevant. 🤡

Even RLUSD’s adoption by VivoPower, a renewable energy firm, offers little solace. Why? Because XRP plays no role in Ethereum-based transactions. A tragedy, surely, but one that’s become tragically fashionable. 🎭

“Though Ripple issues RLUSD on both XRPL and Ethereum, the majority of its supply has been minted on Ethereum,” quipped a Twitter account with the wisdom of a thousand-year-old owl. Or perhaps a very bored hedge fund manager. 🦉

Zach Rynes of Chainlink, ever the optimist, noted that XRP’s burn rate from RLUSD transactions is negligible compared to its total supply. A man who truly understands the art of understatement. 🤷

“RLUSD displaces XRP for cross-border transactions. Over 80% of RLUSD is on Ethereum. XRP holders don’t get revenue,” he wrote, as if delivering a eulogy for a token that never stood a chance. 🕯️

Ripple’s Strategic Dilemma Amid RLUSD’s Limited Impact on XRP

Ripple has marketed RLUSD as a bridge between TradFi and DeFi, with ambitions stretching from tokenized money markets to repo trades. A noble vision, if only the bridge led to XRPL instead of Ethereum. But no-Ethereum, that serpentine rival, has claimed RLUSD as its own. 🐍

Partnerships with DBS, Franklin Templeton, SBI Holdings, and African fintechs have propelled RLUSD’s market cap to $789.44 million. Yet one cannot help but wonder: is this triumph for Ripple, or merely a Pyrrhic victory for Ethereum? 🤔

RLUSD’s Ethereum-centric existence has shattered Ripple’s narrative that XRPL remains its ecosystem’s backbone. As user jfab.eth lamented, “He later swapped his XRP for LINK and ETH.” A wise move, perhaps. Or a cry for help. 🙏

“A long-time XRP holder discovered RLUSD lives on Ethereum. He was in awe and wondered what the point of Ripple was,” they wrote. A sentiment as profound as it is devastating. 💔

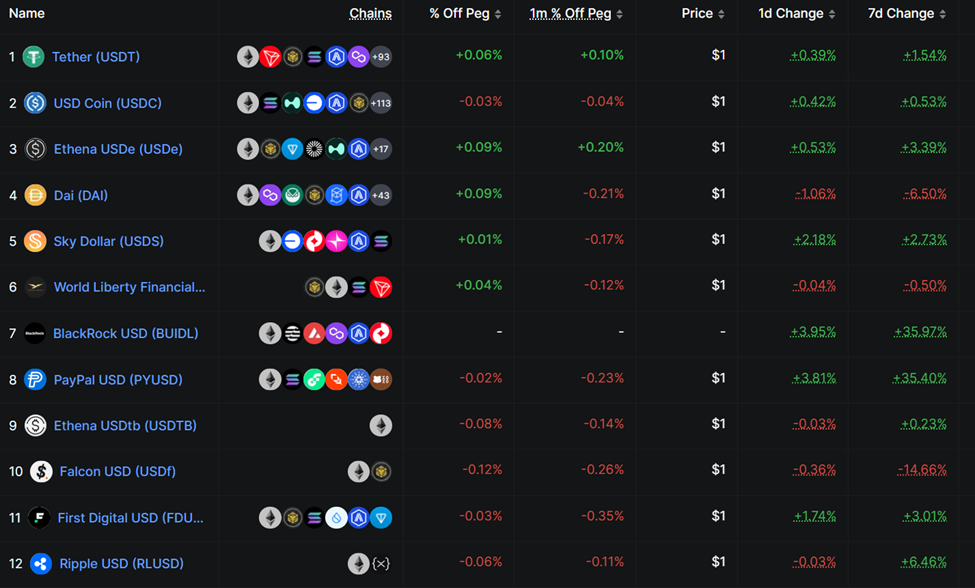

Meanwhile, RLUSD trails behind PYUSD, BUIDL, and WLF in market cap. One might say Ripple’s stablecoin is the Cinderella of the crypto ball-except Cinderella had a fairy godmother. RLUSD has… Ethereum. 🌟

While Ethereum’s DeFi liquidity is undeniably alluring, it leaves XRP holders in a quandary: celebrate RLUSD’s success or mourn the absence of utility. A dilemma as old as time itself. Or at least as old as 2025. ⏳

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

2025-10-03 11:43