So, it turns out the crypto market had a worse week than a salmon trying to climb a waterfall. 🌊🐟 Almost every chart looks like it’s been attacked by a particularly vicious red pen, and let’s just say, it’s not a pretty sight. 📉

It all kicked off when Bitcoin decided to have a little party, jumping to $118,000 on Thursday morning after the Fed’s rate cut. 🎉 But, as is often the case with parties involving Bitcoin, the fun didn’t last. By Friday, it was nursing a hangover at $116,000. 🥴

The weekend was about as exciting as watching paint dry, but then Monday happened. Bitcoin took a nosedive from $115,500 to $112,000, liquidating more leveraged positions than a bartender on a busy Friday night. 🍸💥 The bulls tried to save the day, but their heroic efforts only got BTC to $114,000 before it face-planted again. 🐂🤦♂️

Enter the bears, stage left. 🐻 They initiated a series of leg downs that would make a staircase jealous. By Friday, BTC was at $108,600, its lowest point since the month began. It was like watching a slow-motion car crash, but with more zeros. 🚗💥

The culprit? None other than Jerome Powell, the Fed Chair, who sent mixed signals about inflation that were about as clear as a mud puddle. 🌧️ Crypto, being the drama queen it is, took this as a sign to panic and dump riskier assets faster than a bad blind date. 💔

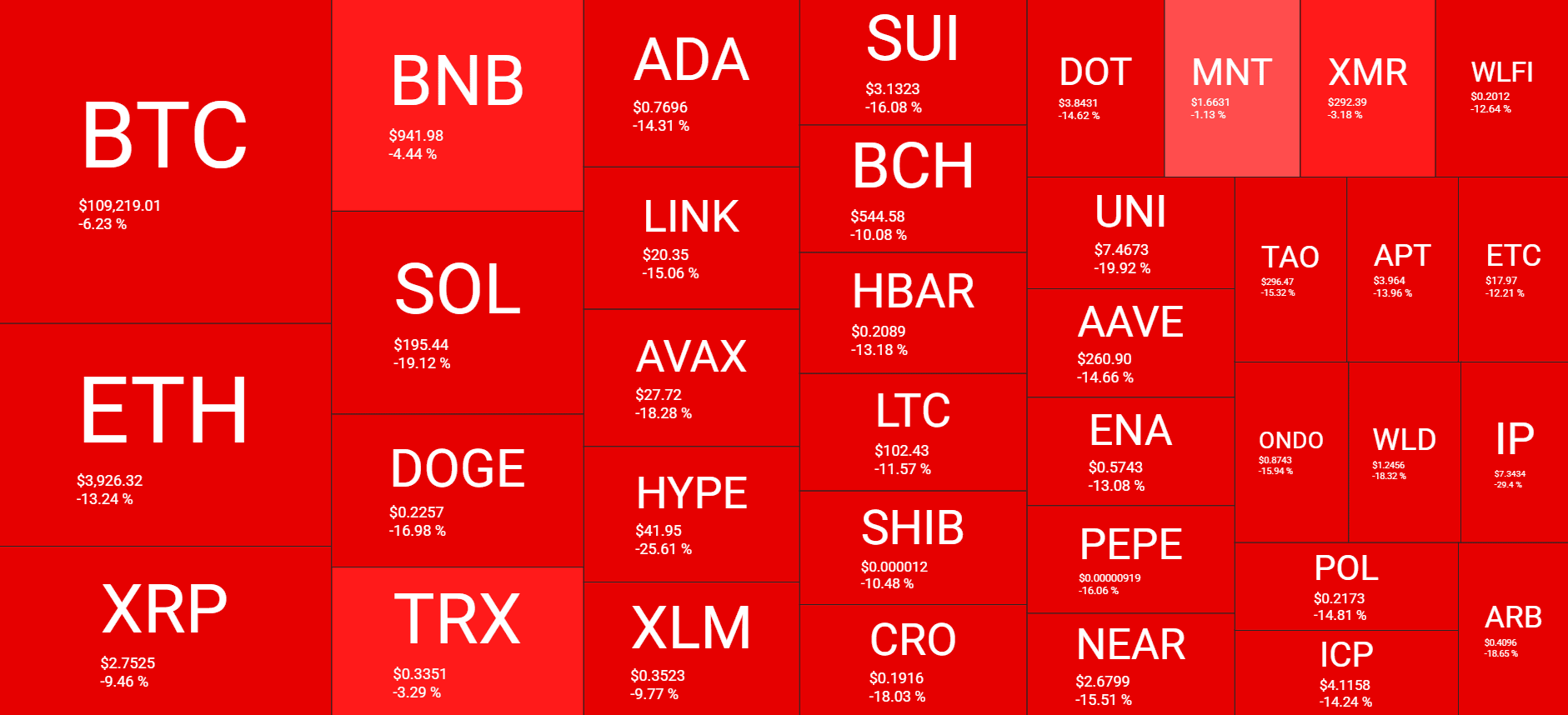

While BTC has since crawled back up a bit, it’s still below $110,000. Its 6.2% weekly drop is the crypto equivalent of a paper cut-annoying but not fatal. Meanwhile, ETH, DOGE, SOL, ADA, LINK, AVAX, and especially HYPE (which lost over 25% because, well, hype is fickle) are all nursing much larger wounds. 🩹

The total market cap? It went from $4.150 trillion to under $3.850 trillion faster than you can say “crypto winter.” ❄️💸

Market Data

Market Cap: $3.840T | 24H Vol: $238B | BTC Dominance: 56.8%

BTC: $109,200 (-6.2%) | ETH: $3,920 (-13%) | XRP: $2.75 (-9%)

This Week’s Crypto Headlines You Can’t Miss (Unless You’re Living Under a Blockchain)

Tether’s $20B Power Move: Because Why Not? Tether decided to flex on Circle by securing $15-$20 billion for a 3% stake, valuing itself at a cool $500 billion. Circle’s $30 billion valuation? Cute. 😏💪

Fear and Greed Index: It’s Fear O’Clock Somewhere After BTC lost $10,000, the Fear and Greed Index hit a 5-month low. Is it a warning or a buying opportunity? Probably both. 🤷♂️🛒

SBF’s ‘gm’ Tweet: The Comeback No One Asked For Sam Bankman-Fried tweeted “gm” and somehow caused FTT to spike. Also, rumors of a Solana-based perp dex. Because why not add more drama? 🍿🚀

Peter Schiff: Still Bearish, Still Wrong? BTC’s dip gave Peter Schiff the chance to declare a bear market. Again. Will he ever be right? Stay tuned. 🐻🤡

Whale Turns $300K Into $7M on ASTER: Because Why Work Hard? One lucky whale rode ASTER’s meteoric rise to turn $300K into $7M. Meanwhile, the rest of us are still trying to figure out how to pronounce “ASTER.” 🤑🚀

‘Uptober’ Predictions: Because Hope Springs Eternal Despite this week’s carnage, analysts are predicting a massive October rally. Because nothing says “bullish” like a market that just lost $300 billion. 🎢🤞

Charts: Because Who Doesn’t Love a Good Line Graph?

This week, we’ve got chart analyses for Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid. Click here if you enjoy staring at lines that go up and down. 📈📉

Read More

- Brent Oil Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- DOGE PREDICTION. DOGE cryptocurrency

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

2025-09-26 16:29