Goodness me, what a spectacle the ASTER price has presented of late! Surging from a mere $0.0718 to a staggering $2.43 in but a week, it has quite turned heads in the market. Yet, as is often the case with such parabolic antics, the token has since tumbled below its rising channel, leaving the more prudent amongst us to wonder: can this rally possibly sustain itself? With $1.95 looming as a formidable resistance, traders are no doubt clutching their ledgers in anticipation of the next dramatic twist. 🧐📉

The ASTER Chart: A Tale of Exhaustion and Woe

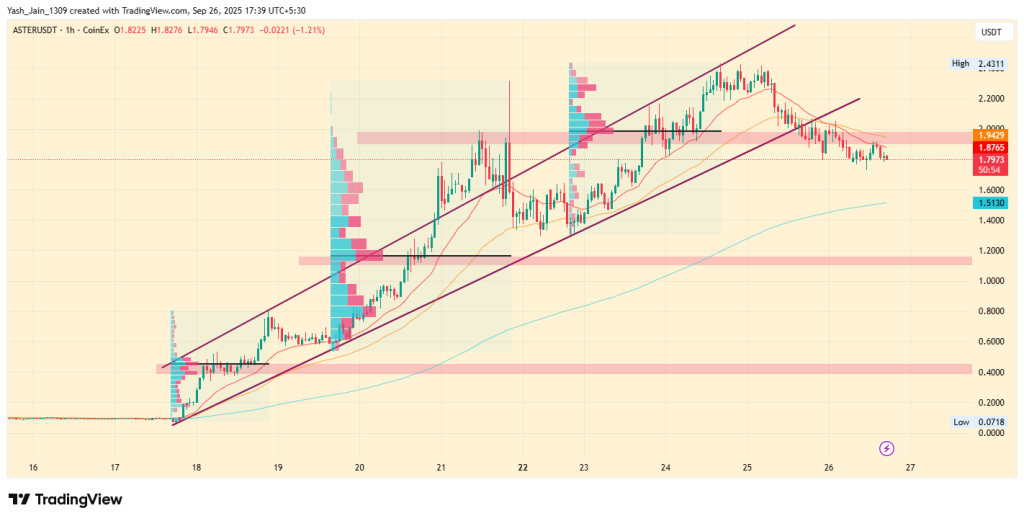

Pray, let us cast our eyes upon the ASTER price chart, which tells a story of initial exuberance followed by a rather predictable retracement. The token, in its mid-September heyday, formed a steep rising channel, peaking at $2.43 before modestly retreating to $1.82-$1.83 at the time of this scribbling. The break below the channel support on September 24 was but the first whisper of exhaustion, hinting at deeper corrections to come. Alas, the fickleness of the market! 😓📊

A formidable resistance cluster now stands between $1.85 and $1.95, a zone where trading volume has accumulated with quite the fervor. Should ASTER fail to reclaim this territory, one may expect selling pressure to intensify, much like a society matron’s disapproval at a poorly executed curtsy. 😱💔

Immediate support rests at $1.50, aligning neatly with the 200 EMA on the 1-hour chart. A decisive break below this level could herald a sharper decline toward the $1.20 demand zone, which also coincides with a previous FRVP POC level. Beyond that, extreme support lingers in the $0.40-$0.50 range, where ASTER first captured the attention of those ever-discerning institutional investors. 🏦📉

Momentum indicators, ever the harbingers of truth, confirm this weakness. The RSI, having cooled from its overheated state, suggests that consolidation-or perhaps another pullback-is in order before any sustainable upside may be entertained. For a bullish reversal, ASTER must reclaim the $1.95-$2.00 zone. A clean breakout above $2.00 could target $2.25-$2.43, retesting previous highs. But let us not hold our breath, for the market is as unpredictable as a debutante’s affections. 💫📈

Adoption and Growth: ASTER’s Silver Lining

While the chart may paint a picture of pullback, the fundamentals tell a tale of rapid adoption. ASTER, positioning itself as a next-gen perpetual DEX, enjoys the backing of YZi Labs, which invests in ventures with strong Web3, AI, and biotech foundations. Quite the pedigree, would you not agree? 🌐🤖

On its official X account, ASTER recently boasted over $46 billion in trading volume within 24 hours on its perpetual products-a figure that underscores accelerating usage. Pray, consider the following proclamation:

Over $46,000,000,000 in trading volume on Aster perps during the past 24 hours.

– Aster (@Aster_DEX) September 26, 2025

Additionally, new listings on Aster Pro with up to 50x leverage and partnerships with trusted wallets, such as Trust Wallet, are helping to bolster its credibility. These growth drivers may yet sustain positive sentiment in the ASTER price forecast, even as short-term corrections play out. After all, what is a little volatility amongst friends? 😉🚀

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- DOGE PREDICTION. DOGE cryptocurrency

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Coinbase Aims for a Billion-User Open Era

2025-09-26 15:28