Oh, what a splendid week for crypto ETFs! Bitcoin swooped in with a staggering $887 million, while Ether quietly kept pace with $557 million-because apparently, they’re in a race to see who can make the most bankers blush. Thanks to Blackrock and Fidelity, the ETF scene looks more like a gold rush than a stock market. Who knew ETFs could be so dramatic? 💰🚀

Crypto ETFs Live the Dream: Billions Flown Like It’s Vegas, Because Apparently It Is

It’s like a carnival of capital last week-both Bitcoin and Ether ETFs showed up with their wallets open, turning heads and opening floodgates. From September 15th to 19th, Bitcoin’s big sibling pulled in nearly $887 million, while Ether, never one to be outdone, managed a cool $558 million. Institutional confidence? More like institutional obsession. 💸🎢

Bitcoin ETFs: The Good, The Bad, and The Slightly Turbulent

Bitcoin ETFs had a week of mostly sunshine with a cloud or two. Blackrock’s IBIT led the charge, grabbing a jaw-dropping $866.84 million-probably because they have a crystal ball. Grayscale’s Mini Trust? Not far behind, with $39.59 million. Fidelity? Oh, just a modest $34.62 million. The usual suspects-Ark 21Shares, VanEck, Franklin-each threw in their lot, doing what they do best: making money, not necessarily friends.

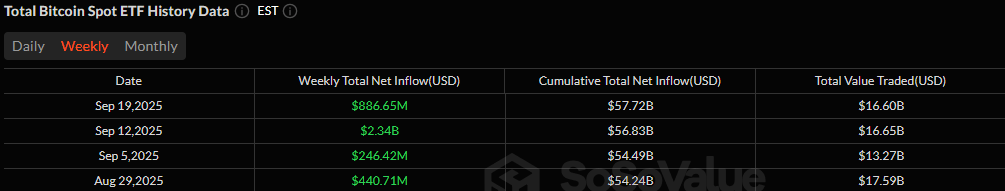

Of course, not everyone was happy-Grayscale’s GBTC and Bitwise’s BITB decided to take their ball and go home, exiting with a -$86.14 million and -$29.39 million. But even with those sob stories, the total inflow still came out strong: $886.65 million, enough to make even the most *stoic* bear reconsider. Midweek saw trading hit $4.24 billion-because what’s life without a little trading adrenaline? Assets closed the week at a princely $152.31 billion. 🎯💥

Ether ETFs: The Slightly Bumpy but Buoyant Road

Ether came to play, albeit with a few more wrinkles in its ‘smooth ride’ hat. Blackrock’s ETHA was the star on the red carpet, pulling in a nifty $513 million. The rest? Steady Eddie: Grayscale’s Ether Mini ($17.99M), Fidelity’s FETH ($15.18M), and a few others. But then there was Vaneck’s ETHV dragging its heels with an -$8.16 million. Still, overall, Ether kept the good vibes rolling, raking in $557 million-like a short trip to the amusement park, only with fewer cotton candies and more billions.

Across the week, total trades soared to $8.9 billion-because what’s life without a little flux? Assets swelled to $29.64 billion, proving once again that Ether is still playing catch-up but with a lemonade stand in sight. 🍹📈

Closing Curtain: The Blackrock Monopoly?

It’s pretty obvious: Blackrock’s ETF juggernaut isn’t just rolling; it’s flattening the competition. Both IBIT and ETHA are hogging the spotlight, leaving the rest of the field to play in the mud. With a steady stream of weekly trade activity, it’s shaping up like a battle of titans-except Titans care about asset management, not just smashing things. Looks like the ETF game isn’t just hot-it’s combustible. 🔥🤖

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- USD CNY PREDICTION

2025-09-22 20:19