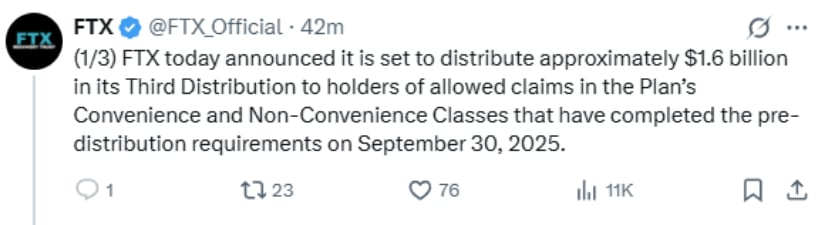

Gather ’round, folks! FTX Trading Ltd. and the FTX Recovery Trust just dropped a bombshell on September 19, 2025. 🎉 And no, it’s not another Sam Bankman-Fried vegan meal plan-it’s a whopping $1.6 billion payout to creditors on September 30! 🤑

This latest cash splash brings the total creditor recoveries to over $8 billion. Yep, you heard that right! FTX already shelled out $6.2 billion in two earlier rounds-$1.2 billion in February and $5 billion in May 2025. 💸 Who says crypto’s all about rug pulls and tears? 😂

Eligible creditors will get their dough through the crypto trifecta: BitGo, Kraken, or Payoneer. Payments should land in your accounts faster than a meme coin pump and dump-one to three business days after September 30. ⏳

Who’s Getting the Crypto Gold and How Much? 🏆

Not everyone’s getting the same slice of the pie. Here’s the breakdown, served with a side of sarcasm:

- FTX.com customers: An extra 6%, bringing their total to 78%. Almost there, folks! Just 22% more to go! 🤡

- U.S. customers: 40%, reaching a total of 95%. Uncle Sam’s got your back! 🇺🇸

- General unsecured creditors: 24%, hitting 85%. Better than a kick in the blockchain! 🚀

- Small convenience claims: 120% of their original amount. Finally, someone’s getting a fair deal! 🎊

Missed the August 15 deadline? Tough luck, buddy! You’ll have to wait for the next round. Maybe try setting a reminder next time? 📅

Court Approval: The Real MVP 🏛️

A Delaware bankruptcy court made this payout possible by slashing FTX’s disputed claims reserve from $6.5 billion to $4.3 billion, freeing up $1.9 billion. But hey, they’re only paying out $1.6 billion. Where’s the other $300 million? Probably in SBF’s sock drawer. 🧦

The court also resolved disputes over contested claims, reclassifying them so the rightful owners can finally get paid. Justice served-with a side of crypto drama! ⚖️

Remember when FTX filed for bankruptcy in November 2022? Good times. Sam Bankman-Fried’s now serving 25 years for fraud. His prison cell probably has better Wi-Fi than FTX’s servers. 🛜

Geographic Restrictions: The Crypto Border Wall 🌍

Here’s the kicker: FTX wants to freeze $470 million in claims from 49 countries with “unclear crypto regulations.” China’s leading the pack with $380 million. Other unlucky nations include Russia, Egypt, Ukraine, Pakistan, and Saudi Arabia. FTX’s excuse? “We don’t want our execs ending up in a foreign jail.” Fair, but still a bummer. 🌏

Over 300 Chinese creditors are fighting back, led by Weiwei Ji. Their argument? “U.S. dollars are legal here, and crypto’s personal property!” A judge told FTX to rethink their plan, saying, “You can’t just seize funds and run!” 🏦

Valuation Method: Crypto Time Travel ⏰

FTX’s calculating claims using November 2022 crypto prices. Back then, Bitcoin was $16,000-$20,000. Now? Over $120,000. Creditors are getting paid in nostalgia coins. Thanks, FTX! 😭

The court’s sticking to this method for “consistency,” but creditors might sue. Because who doesn’t love a good legal battle? 🤺

Despite this, FTX’s plan allows up to $16.5 billion in repayments-full principal plus 9% interest. Not bad for a company that almost went the way of the dodo. 🦤

Requirements and Security: Don’t Get Phished! 🎣

To get paid, creditors must:

- Verify their identity on the FTX Customer Portal (no deepfakes allowed!)

- Submit tax forms (because the IRS always gets their cut)

- Set up an account with BitGo, Kraken, or Payoneer (choose wisely!)

- Pass sanctions screening (no shady business!)

Sold your claim? Transfers must be finalized, and a 21-day challenge period must pass. FTX also warns about phishing scams. Pro tip: If it sounds too good to be true, it probably is. 🚫

The Road Ahead: More Crypto Drama Unfolds 🚗

About $4.3 billion remains in disputed claims. Geographic restrictions and valuation battles mean this saga’s dragging into 2026. Grab your popcorn! 🍿

A secondary market’s emerged for FTX claims, with $5.8 billion traded. Claims from restricted countries? Down 20-30%. Ouch. 😣

Recovery Against the Odds: Crypto’s Phoenix Moment 🦜

When FTX collapsed, only 0.1% of Bitcoin and 1.2% of Ethereum were recoverable. Now, 98% of creditors are getting at least 119% of their 2022 claims. That’s what I call a crypto miracle! ✨

FTX’s legal team deserves a standing ovation for recovering billions in misplaced funds. Who needs a white knight when you’ve got lawyers? 🗡️

The Final Chapter: Almost There! 📖

This payout brings closure for thousands who lost money in crypto’s biggest flop. Legal battles remain, but September’s distribution proves even the worst crashes don’t mean permanent losses. 🌟

FTX’s case could set precedents for future crypto bankruptcies, especially for international creditors and asset valuations. Stay tuned for the sequel: “Crypto Bankruptcy 2: The Regulation Strikes Back.” 🎬

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- Will the Crypto Circus Repeat? Or Is This Just the Act Before the Altseason Entertains?

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

2025-09-20 01:38