At long last, dear reader, Poland has decided that fumbling about with cryptic wallets and mysterious private keys is so last decade. Instead, Polish investors may now participate in Bitcoin’s curious dance through their trusty brokerage accounts-imagine that, without diving into the cryptic labyrinth of exchanges!

With a population of 38 million souls and a fintech sector that grows faster than a magician’s assistant escaping a box, Poland’s move might just be the first domino in a game of financial Jenga stretching across Eastern Europe. Yet, while ETFs slap a shiny “regulated” sticker on Bitcoin, the real question remains: can this humble digital dog learn new tricks? Enter stage left, the mischievous trickster called Bitcoin Hyper ($HYPER).

Enter Poland’s ETF-Like A Nobleman at the Warsaw Ball

The noble Bitcoin BETA ETF made its grand entrance this week on the Warsaw Stock Exchange (GPW), such a spectacle it might make even Woland himself raise an intrigued eyebrow.

Under the cautious gaze of AgioFunds and the ever-watchful Polish Financial Supervision Authority-whose name alone sounds like a character from a Kafka novel-the fund offers traditional investors a chance to dip their toes into Bitcoin’s tempestuous seas without ever wrestling with a digital wallet.

No, no bitcoin in hand here-but futures contracts dancing on the Chicago Mercantile Exchange’s stage, with DM BOŚ playing the role of the cunning market maker, ensuring liquidity flows smoother than vodka at a midnight soiree.

Of course, nothing is free: a management fee of up to 1% is politely charged, and currency risk is softly tamed through forward contracts-because even Bitcoin does not like such drama as USD/PLN volatility. The launch, naturally, is a polite bow to an ever-demanding investor crowd.

“Offering exposure to Bitcoin through an ETF listed on GPW increases safety of trading as investors can participate in the cryptocurrency market using an instrument which is supervised and subject to the transparency standards applicable to a regulated capital market.”

– Michal Kobza, GPW Board Member, probably drinking tea with a sly smile

With over 400 companies boasting a combined worth of $600 billion strutting around GPW’s halls, it remains the heavyweight champ of Central and Eastern Europe-or at least the financial equivalent of one.

Why Should Eastern Europe Care? (Spoiler: Because Poland Said So)

Poland, ever the showman, has positioned itself as an unshakable leader in digital finance for the region. The timing? Impeccable. Just as the European Union rolls out the MiCA regulatory framework, giving investors a much-needed dose of clarity-because confusion has been the unofficial currency for years.

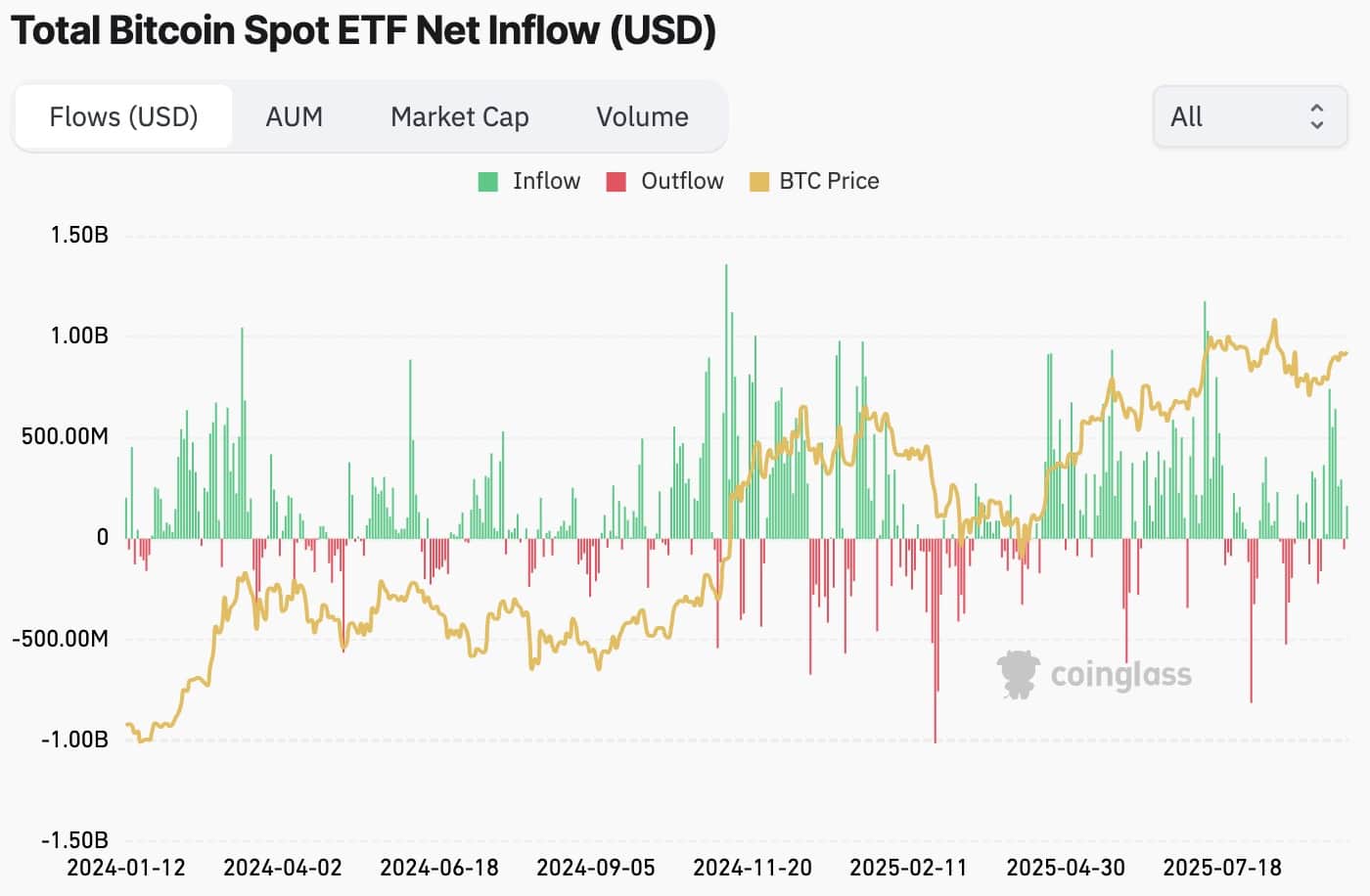

And it fits the global puzzle too. North American ETFs gulp down thousands of $BTC daily, proving that traditional finance prefers cattle herds over wild stallions.

If Warsaw repeats the trick, Bitcoin might finally stroll past the dreary visa checks of Eastern Europe’s mainstream finance.

Bitcoin: From Precious Metal Doppelgänger to Slightly Fancier Turnip

Bitcoin’s debut as a store of value is now as official as a letter sealed with wax. Institutions may now cozy up to digital gold without risking their passwords getting pirated by some digital Rasputin.

Alas, the great Bitcoin remains slow, expensive, and practically mute on programmability, especially compared to the flashy Ethereum ($ETH) or the sleek Solana ($SOL), which dance circles around poor old Bitcoin’s lumbering gait.

Among these knights in shining code armor is none other than Bitcoin Hyper ($HYPER), striving to bestow upon Bitcoin the developer-friendly charms Solana and Ethereum have long enjoyed. For those tired of ETFs’ “slow and steady” shtick, $HYPER offers a rocket-fuel injection into Bitcoin’s utility vein.

Bitcoin Hyper ($HYPER): The Layer-2 Conjurer With Ethereum’s Tricks and Solana’s Mojo

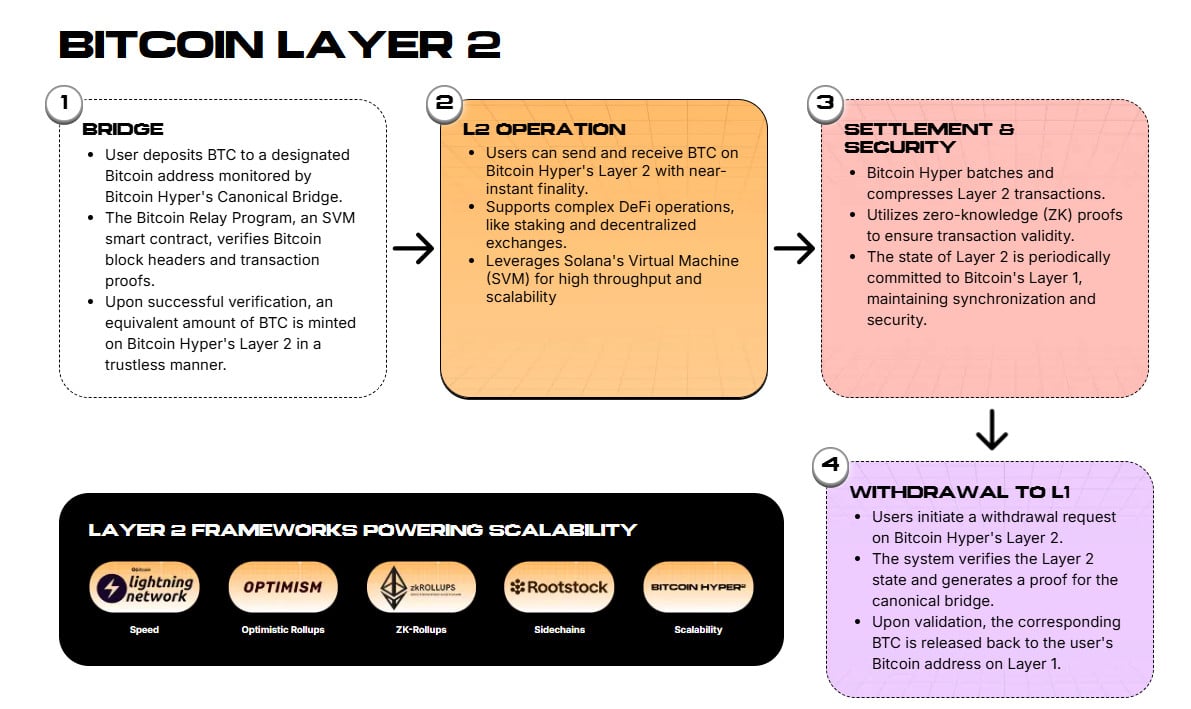

Behold Bitcoin Hyper ($HYPER), a bold architecture built upon the Ethereum stage and secretly wielding the Solana Virtual Machine’s finesse. This is no mere facelift; it is Bitcoin’s attempt at becoming the clever magician who can actually pull a rabbit out of the digital hat.

But wait, there’s more! Because $HYPER embraces SVM, it seamlessly tucks into existing Solana apps, opening a veritable Pandora’s box of Bitcoin-native dApps, DeFi playgrounds, and meme coins so wild they’d make even Bezdomny blush. All this whimsical fun runs on the $HYPER token-the power source behind transactions, staking, and governance.

So cunning is Bitcoin Hyper’s design that investors can finally gain exposure to Bitcoin’s “execution layer,” while the venerable BTC stays firmly the old reliable monetary base. No surprise, then, that the presale has blasted past $16.9 million-and yes, some whales have happily splashed $161.3K on this venture, as if money grew on the trees of Poland’s finest forests.

Currently, $HYPER flickers at $0.012945 with a jaw-dropping 68% APY for staking-enough to entice even the most skeptical of babushkas.

Sure, Poland’s ETF is the polite, well-mannered introduction for institutions into the realm of Bitcoin. But Bitcoin Hyper? That’s the wild cousin crashing the party to actually get things moving-and raking in 10x the potential excitement.

Where ETFs whisper the safety lullabies of regulation, $HYPER barks the thrilling cries of usage and power. Our prediction? This cheeky “meme coin” may soar to $0.2 by year-end, promising a staggering 1,445% return for fearless pilgrims.

Feeling brave? Dive headfirst into the $HYPER presale before the winds of fortune shift.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- TRUMP PREDICTION. TRUMP cryptocurrency

- Telegram’s Blockchain Gambit: From Messengers to Billion-Dollar Unicorns!?🤯

- Square’s Bitcoin Bonanza: Merchants Go Crypto Crazy! 🤯💰

2025-09-19 16:47