Ah, Ethereum! That tempestuous soul of the digital realm, teetering on the precipice of $5,000, as if the very heavens themselves conspired to rewrite its destiny. No longer a mere plaything for the speculative rabble, it now ascends to the altar of institutional reverence, a reserve asset for those who dare to dream in zeros and ones. 🌪️✨

Behold, a CryptoQuant report-a tome of revelations-proclaims that the surge is driven by the trifecta of ETF inflows, whale greed, and staking fervor. Oh, the irony! The very forces that once mocked it now bow at its altar. 😏

Ethereum ETFs: The Institutional Siren Song

The report, with its dry precision, declares that Ethereum ETFs have become the harbinger of this rally. Nine US-listed funds now clutch 6.7 million ETH in their cold, algorithmic embrace-nearly double since April’s awakening. A $10 billion influx in July and August? Mere pocket change for the titans of finance, yet enough to crown ETFs as the darling of institutional folly. 🤑

Ethereum is in one of its strongest cycles yet.

Institutional demand, staking, and on-chain activity are near record highs.

ETH is cementing its role as both an investment asset and the leading settlement layer.

– CryptoQuant.com (@cryptoquant_com) September 11, 2025

September, with its languid pace, still saw $640 million in fresh capital, according to SoSoValue. Ah, the slow dance of the wealthy, ever cautious, yet ever lured by the siren song of profit. 💃🕺

And the whales? Those leviathans of the crypto deep? They, too, have joined the feast, hoarding 6 million ETH in their cavernous wallets. Their reserves now stand at 20.6 million ETH, a mirror to Bitcoin’s own institutional courtship. Greed, it seems, is the only constant in this chaotic ballet. 🐳💎

Staking: The Chains of Long-Term Commitment

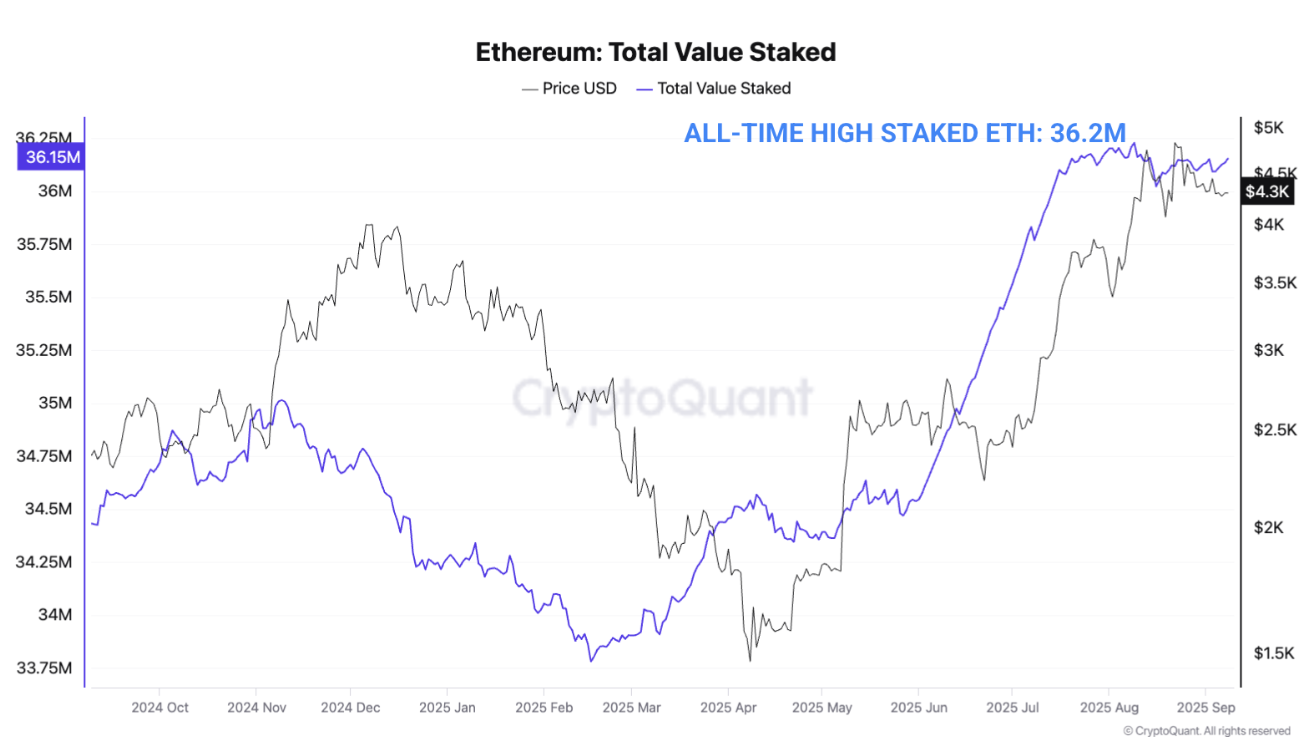

But wait, there’s more! Ethereum staking, that noble act of locking away one’s digital treasure, has reached unprecedented heights. Since May, 2.5 million ETH have been staked, bringing the total to 36.2 million-nearly 30% of the supply. A supply squeeze, you say? Nay, it is the market’s way of whispering, “I am here to stay.” ⛓️🔒

This is no fleeting romance, no speculative fling. It is a marriage of convenience, sealed by the chains of staking. The price rises, not on whims, but on the unyielding commitment of its believers. 🌍💍

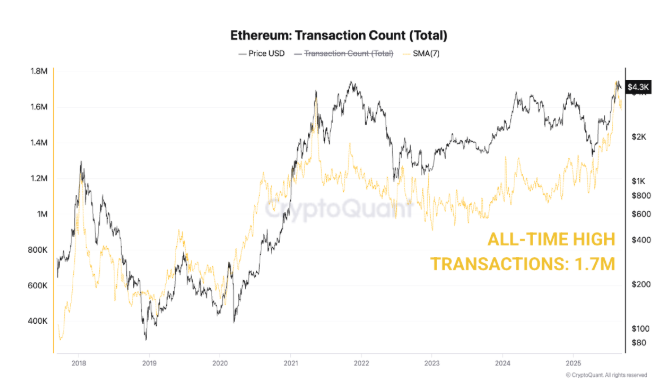

And what of Ethereum’s on-chain utility? Ah, the network hums with life! 1.7 million daily transactions, 800,000 active addresses, and 12 million smart contract calls per day. It is the backbone of decentralized finance, the lifeblood of stablecoins, the scaffold for tokenized assets. Ethereum is no longer a dream-it is the very ground beneath our digital feet. 🏗️⚡

In this grand tapestry of greed, commitment, and utility, Ethereum’s valuation is no longer a mere reflection of market sentiment. It is a testament to its role as the functional spine of digital commerce, a strategic hold for those who dare to gaze into the future. And yet, as we stand on the precipice of $5,000, one cannot help but wonder: is this the zenith, or merely another step in the endless waltz of human ambition? 🕺💫

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- ETH PREDICTION. ETH cryptocurrency

- TRX PREDICTION. TRX cryptocurrency

- Powell’s Dilemma: The Fed’s Crumbling Confidence and Bitcoin’s Wild Ride 🚨

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

2025-09-14 20:57