Bitcoin, as of September 13, 2025, traded at a remarkable $115,975, with a market cap sitting at $2.31 trillion and a 24-hour trading volume of $43.07 billion. The cryptocurrency’s daily price showed some wild fluctuations, ranging between $114,838 and $116,705. It seems Bitcoin is in one of those moods-consolidating gains, but not too thrilled to make a decision just yet.

Bitcoin

Bitcoin is like that person who just got a nice promotion and is enjoying the perks but still can’t help but look over their shoulder-testing the waters near its resistance level at $116,000. While there’s some caution in the air, the market seems to have a generally bullish attitude…for now. Some oscillators, however, are throwing in a bit of skepticism. Could we be headed for a short-term break? Stay tuned.

On the daily chart, Bitcoin appears to be on a redemption arc, bouncing back from a dismal downtrend that bottomed out around $107,270. Since then, we’ve seen a consistent pattern of higher highs and higher lows, with volume creeping up-talk about a comeback. Yet, here it is, testing the $116,000 resistance. A close above this zone would be the green light for a further surge. Entry points? Well, it was better when it was on the rise, but those trailing stops at $113,500 are looking like a good safety net. Price targets? They range from $117,500 to $120,000, but don’t get too comfy just yet.

Looking at the 4-hour chart, Bitcoin is still riding high from its breakout at $110,624, with a peak at $116,805. But don’t get too excited-the candles are starting to get smaller, like a party slowing down when the drinks run out. There’s still some support between $114,500 and $115,000, but the momentum seems to be slowing. Still, a breakout above $117,000 could lead to further gains, maybe even towards $118,000. Just remember to make sure the volume is in your corner when that happens. Bulls, take notes: Wait for those key confirmations.

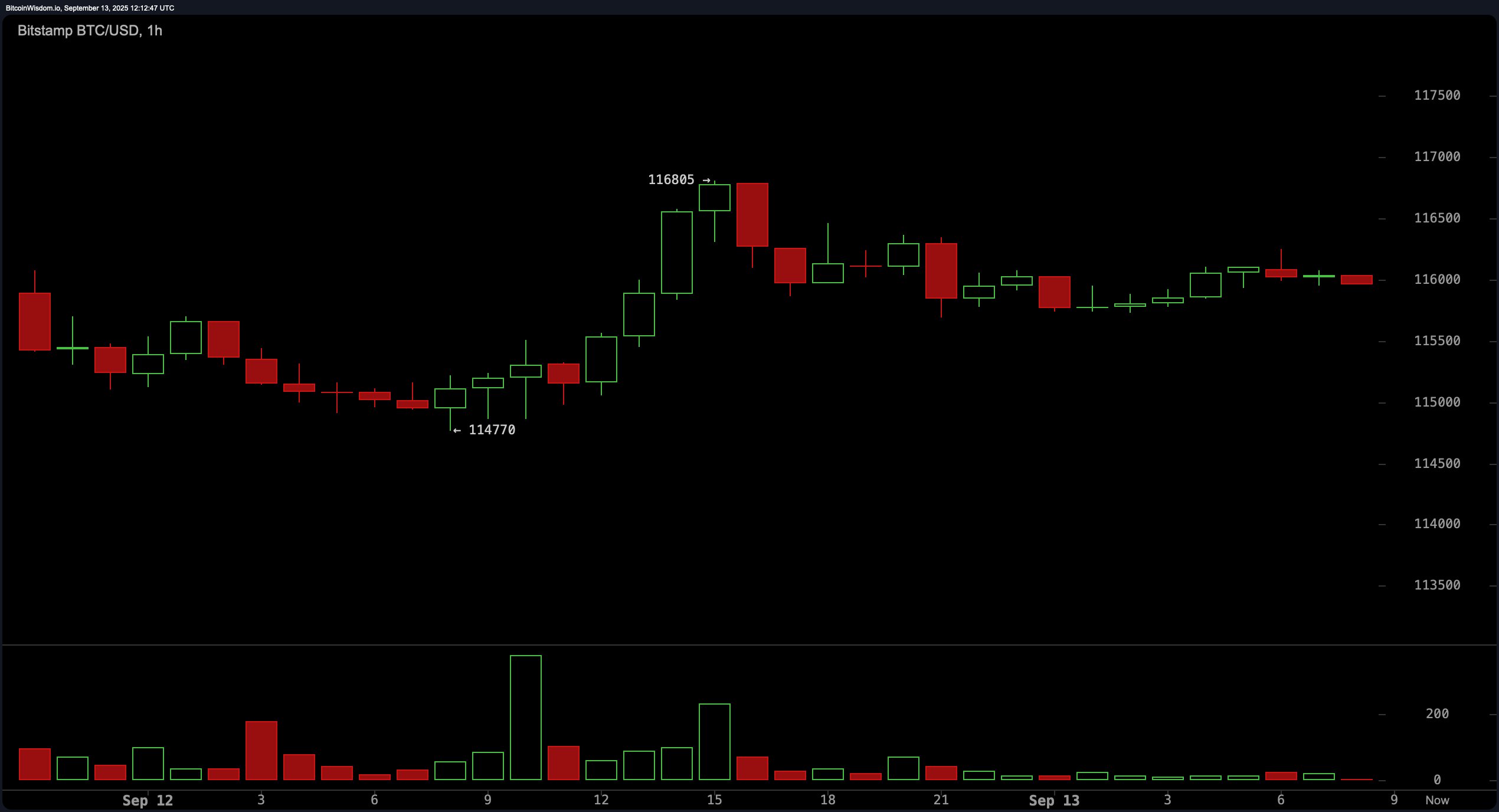

Now, on the 1-hour chart, Bitcoin is stuck in a bit of a pattern-consolidating below that $116,805 high. It looks like it might be forming a bullish flag or just taking a breather. You know, the usual pre-breakout stuff. Support’s hanging out around $114,770, and as long as Bitcoin stays above $115,500, the bulls are still in charge. But for those looking to make quick gains (you know who you are), there could be opportunities either on a breakout above $116,800 or a bounce near $115,000. But, seriously, keep those stops tight-because, you know, things can change fast in this game.

Now, if we pull out the technical indicators, the story becomes clearer. Moving averages are firmly in the bullish camp, all signaling buy conditions. If you’re wondering about the specifics, the 10-period EMA sits at $113,586, and the 200-period SMA hovers around $102,349. So, on a macro level, Bitcoin’s still playing the long game. Of course, don’t forget those pesky oscillators-RSI’s at 59 (neutral, nothing too exciting), the stochastic oscillator’s at 95 (uh-oh, overbought alert), and the CCI and momentum are sounding some alarms. But overall, we’ve got some conflicting signals-so, don’t get too comfortable.

Oscillators are giving mixed signals. RSI’s hanging out at 59, suggesting neutrality. Stochastic’s at 95, so maybe don’t buy with both hands just yet. The CCI is issuing a sell signal, but the MACD and Awesome Oscillator are throwing a “buy” signal. Guess it’s up to you to make sense of this cocktail of contradictions.

Bull Verdict:

Bitcoin’s holding strong above key support levels, and the moving averages are clearly showing a bullish tilt. If buyers can break through the $117,000 resistance with some solid volume, well, it’s clear skies for $120,000. Get your seatbelts fastened.

Bear Verdict:

Of course, there’s a shadow in this sunny outlook. Those overextended oscillators and weakening short-term momentum are raising eyebrows. If Bitcoin breaks below $114,770 on decent volume, then we might just see the bears make a surprise entrance and drag things back to $113,500. Proceed with caution, my friends.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- TRUMP PREDICTION. TRUMP cryptocurrency

- South Korea’s Crypto Clampdown: Leverage Gets the Boot 🚪💸

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-09-13 16:28