Well, knock me down with a feather and call me a wizard, but it seems the crypto world has gone and turned itself upside down! Since the dog days of August, Ethereum has been strutting its stuff, leaving poor old Bitcoin in the dust when it comes to spot trading volume. And let’s face it, Bitcoin’s been looking a bit like a wizard who’s lost his staff-still powerful, but not quite as flashy as he used to be. 🧙♂️💨

- Ethereum’s trading volume has been doing the dance of the seven veils, leaving Bitcoin in the shadows. 💃✨

- Traders are flocking to altcoins like pigeons to a park bench, and Ethereum’s the shiny crumb they’re pecking at. 🐦🥖

- The Fed’s rate cuts are like a dragon’s sneeze-unpredictable but oh-so-exciting for the altcoin crowd. 🐉🤧

Bitcoin, the old guard of the crypto realm, has long been the king of the liquidity castle. But as it teeters near its record highs, investors are doing the crypto two-step, waltzing over to altcoins. And who’s the belle of the ball? Why, Ethereum, of course! As of September 11, it’s leading the spot trading volume waltz, a feat it hasn’t managed in seven long years. Time to dust off those dancing shoes, Ethereum! 💼💃

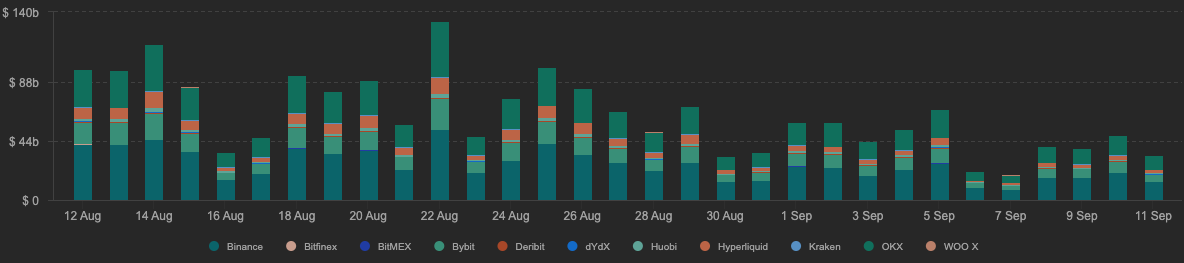

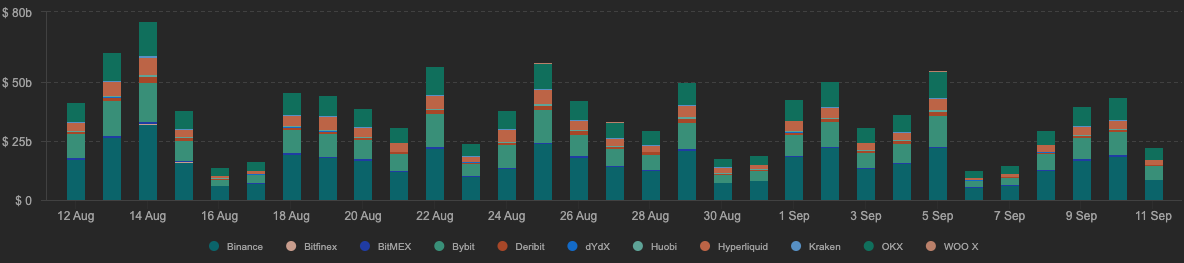

From early August to September 9, Ethereum’s trading volume stood at a whopping 32.9%, according to CryptoRank. Bitcoin, meanwhile, was left in the dust with a mere 32.6%. And the fun didn’t stop there! By September 10, Ethereum’s spot trading volume hit $48 billion, while Bitcoin trailed behind at $43 billion. Talk about a crypto comeback story! 🚀📈

ETFs: Where Ethereum and Bitcoin Go Their Separate Ways

Just as Ethereum was stealing the spotlight, the ETF world decided to join the party. Ethereum ETFs pulled in $4 billion in August, while Bitcoin ETFs were left with their hats in their hands, experiencing outflows. It’s like Ethereum brought the punch to the party, and Bitcoin forgot the cups. 🥳🍹

Why the divergence, you ask? Well, it seems investors are feeling a bit like a witch on a broomstick-ready to take risks and soar to new heights. With Bitcoin hovering near its all-time high and the Federal Reserve hinting at lower interest rates, it’s the perfect storm for riskier bets. Ethereum, with its potential for higher returns, is the broomstick of choice. 🧹✨

Ethereum traders are now eyeing the $4,400 to $4,500 resistance zone like a goblin eyes a gold coin. If it breaks through, $5,000 could be within reach. But if it stumbles, a fall below $4,000 might be on the cards. It’s a high-stakes game of crypto hopscotch, and everyone’s watching to see where Ethereum lands. 🎯🤞

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- How Ripple’s Saudi Adventure Might Just Redefine Your Morning Coffee

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- Circle’s USDC Surpasses $75B: A Triumph of Modern Finance?

2025-09-11 19:35