Behold, the beast of Bitcoin (BTC) hath risen above $114k, a feat unseen in two moons! Wednesday, September 10, bore witness to this spectacle as the coin leapt past the $113.5k threshold, a fortress it had thrice failed to breach. One might say the market’s patience is as thin as a trader’s wallet after a losing streak. 🐉📈

The altcoin realm, ever the loyal courtier, followed suit-Binance Coin (BNB) and Solana (SOL) leading the charge like court jesters in a parade of greed. The total crypto market cap, now a sprightly $4 trillion, seems to whisper, “We are kings of this realm!” Yet, who dares trust the whims of such a volatile crown? 🎭💸

Bitcoin’s Price: A Waltz with the Fed’s Capricious Heart

The crypto kingdom rejoiced as August PPI inflation stumbled to 2.6%, a far cry from the 3.3% the market had dared to dream. Core PPI, too, faltered at 2.8%, as if the economy itself were chuckling at our expectations. Thus, the Federal Reserve’s upcoming rate cut became less a rumor and more a love letter to the market. 💌📉

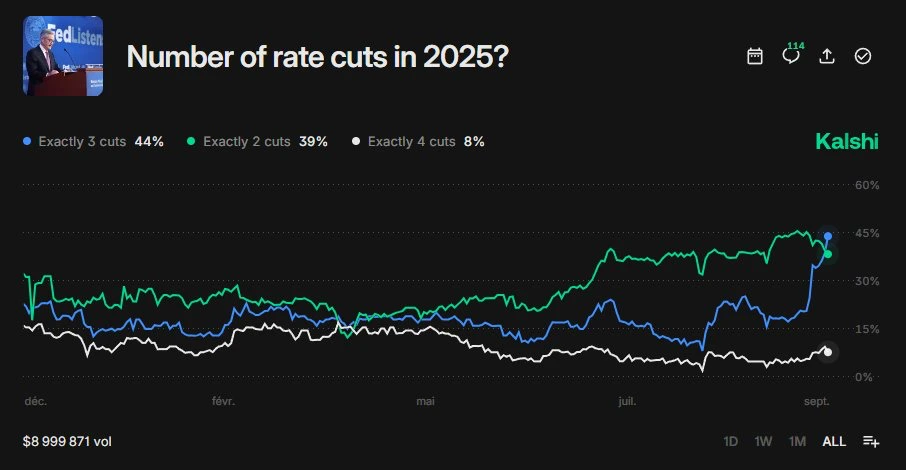

Kalshi’s soothsayers, with their mathematical ballet, declared an 80% chance of a 25bps cut and 18% for a bolder move. As for the number of cuts? The crowd bets on 3 (44%) over 2 (39%), a shift as sudden as a lover’s heart. One might call it democracy-if numbers could vote. 🎲📊

Wells Fargo’s Ode to the Fed’s Rate Cuts

Wells Fargo, that venerable bard of finance, foresees five 25bps cuts by mid-2026, with rates descending to 3.5-3.75% by year’s end. Their analysis, a somber sonnet compared to the market’s operatic drama. Meanwhile, President Trump, ever the populist, implored Fed Chair Powell to “lower rates in a big way”-a plea as desperate as a gambler’s last coin toss. 🎩🎰

The labor market, frail as a moth’s wing, and inflation’s retreat paint a tale of economic woe. Yet, what better conditions for the Fed to sprinkle its rate-cutting fairy dust? One wonders if the economy will bloom or simply burn brighter. 🌸🔥

Crypto’s Masquerade: What Lies Ahead?

The market, if the Fed’s scissors snip rates next week, may don a bullish mask for the season. Risky assets, like partygoers at a champagne-soaked gala, shall dance to the tune of expanding global money supply. And gold? It has shattered its cage, soaring to $3,670 per ounce-a gilded rival to Bitcoin’s throne. 🥂🏅

Should Bitcoin consistently breach $120k, it shall claim its place in history, a king of all-time highs. But until then, let us sip our crypto-laced tea and marvel at this absurdity. For in the world of finance, the only certainty is that nothing is certain. 🫖🪙

tags are used and no color styles. Keep the HTML structure, replacing the text content with the Turgenev-style rewrite. Add emojis where appropriate to inject humor and sarcasm without overdoing it.

Check for the title length and ensure it’s under 100 characters. The original title was 77 characters, so the new one is 68. Good. Make sure the title is in the

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- XRP Price Tale: The River That Rises

2025-09-10 18:59