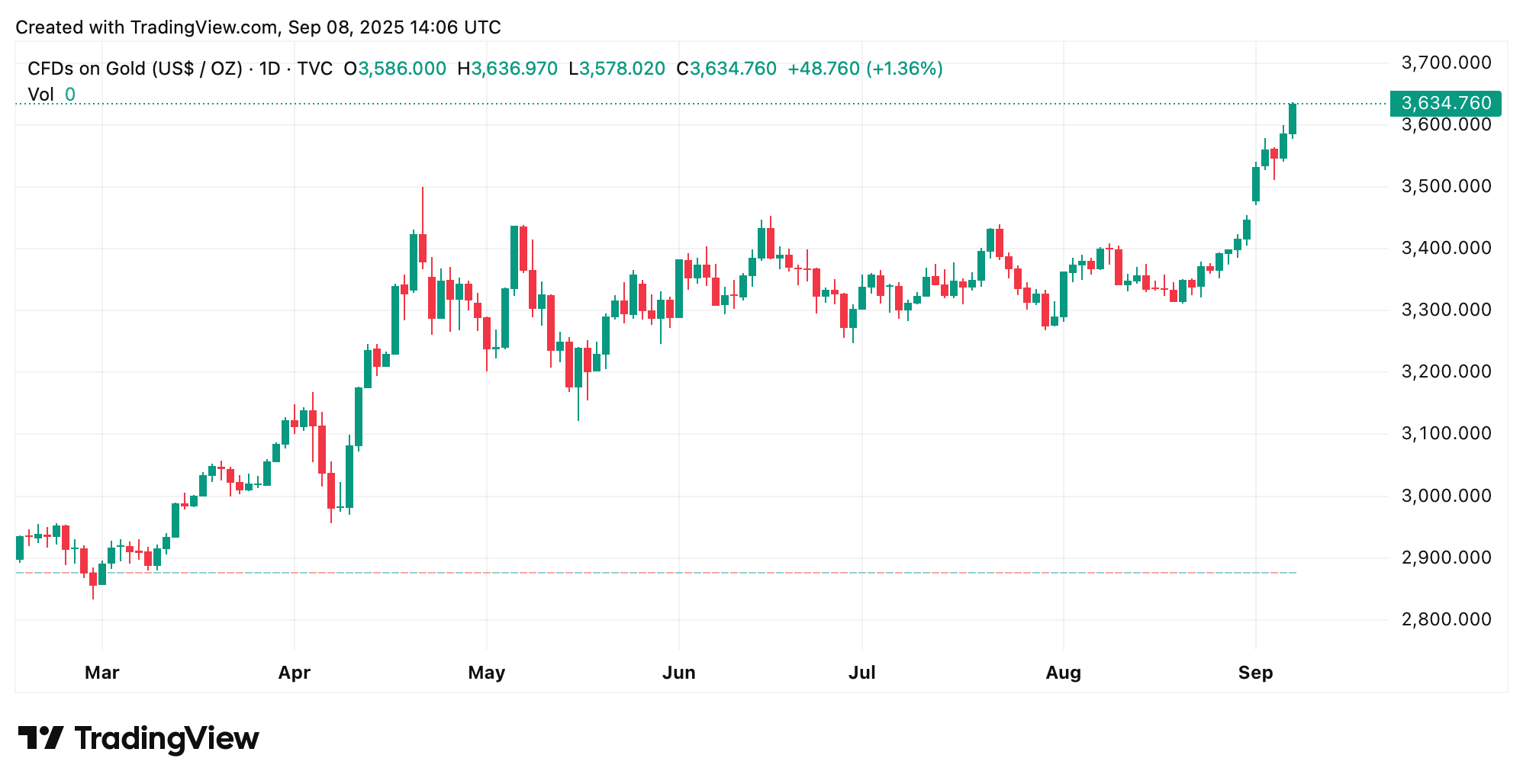

Gold just decided to show off – hitting a jaw-dropping, record-smashing $3,637 per ounce on Monday, Sept. 8. Apparently, it’s been feeling pretty fabulous lately, cruising about 1% higher than the day before and a whopping 44% up from last year. Not bad, huh? 🤑

Safe-Haven Stampede: When the Dollar Trips, Gold Throws a Party 🎉

So, picture this: at 10 a.m. Eastern on Monday, the OANDA data via TradingView reported an ounce of shiny gold flirting with $3,635. Just a hot minute earlier, at 9:46 a.m., it hit its peak moment of fame at $3,637 – like, lifetime achievement award level. This isn’t some random blip; it’s the perfect storm of economic chaos, political drama, and the usual financial shenanigans that make gold the cool, calm, and collected safe-haven everyone loves when the world’s a mess.

The markets are betting on the U.S. Federal Reserve playing the “cut interest rates” card soon, which makes gold suddenly way more tempting than sad little bonds or boring savings accounts. Meanwhile, inflation’s decided to stick around like that party guest who won’t leave, and the global economy is doing its best impression of a stressed-out cat. Oh, and the U.S. dollar? It’s not just slipping; it’s practically ice-skating on thin ice. That just makes gold look even shinier. Plus, thanks to trade tensions fueled by President Donald Trump’s trademark tariffs, investors are sprinting toward gold like it’s the VIP lounge.

Meanwhile, the greenback is wobbling at a multi-month low, which basically means gold is having a “Buy Me” sale for international buyers. Classic inverse relationship here: dollar dives, gold skyrockets. And just in case you thought a Fed cut might save the day, gold enthusiast Peter Schiff is waving a big, skeptical flag.

He weighed in on X with some epic shade:

“Lower interest rates won’t ‘help’ the economy this time,” Schiff brilliantly noted. “The markets will see through the political nature of inappropriate rate cuts despite rising inflation and soaring budget deficits.”

He didn’t stop there:

“The dollar will sell off and bond yields will rise, pushing up inflation and unemployment.” Charming, isn’t it? 🙃

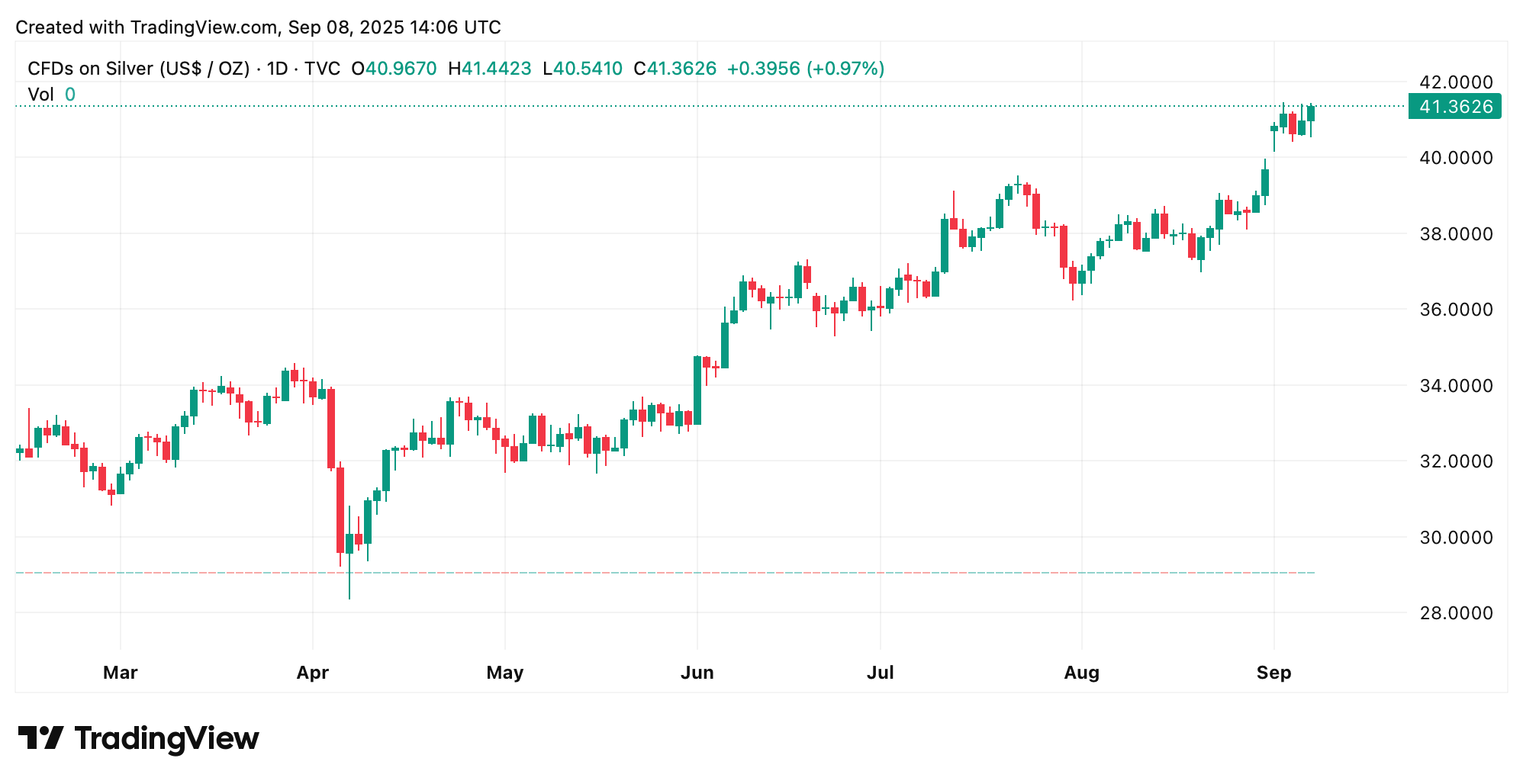

So yes, gold’s current glow-up is basically a masterclass in resilience during these rollercoaster times. And silver? It’s crashing the party too, climbing roughly 43% year over year and just about 1% higher over the past 24 hours. At press time, after an 8.26% moonwalk in the past month, silver is sitting pretty at $41.39 an ounce. Not bad for the underdog, huh?

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Chainlink’s Magical Leap: Trump’s Tariff Tricks & A Treasure Trove of Tokens 🪄💰

- BNB: To $1,000 or Total Chaos? 🤯

2025-09-08 18:18