Ah, Bitcoin, once the shining beacon of digital wealth, now sits precariously above the $110,000 mark. Analysts, with their ever-so-studious gaze, insist that this level is “critical.” Well, isn’t that just dandy? It’s as though Bitcoin is on a tightrope, and bears are shaking it with all their might. Investor sentiment? Let’s just say they’re not exactly throwing confetti in celebration.

Now, here’s the twist in our tale: Ethereum. Oh yes, the underdog is making a grand entrance, snatching capital from Bitcoin faster than a cat burglar. Ethereum’s resilience and, dare we say, the whale accumulation have Bitcoin loyalists shaking in their boots. If this keeps up, Bitcoin might find itself dethroned as the king of crypto.

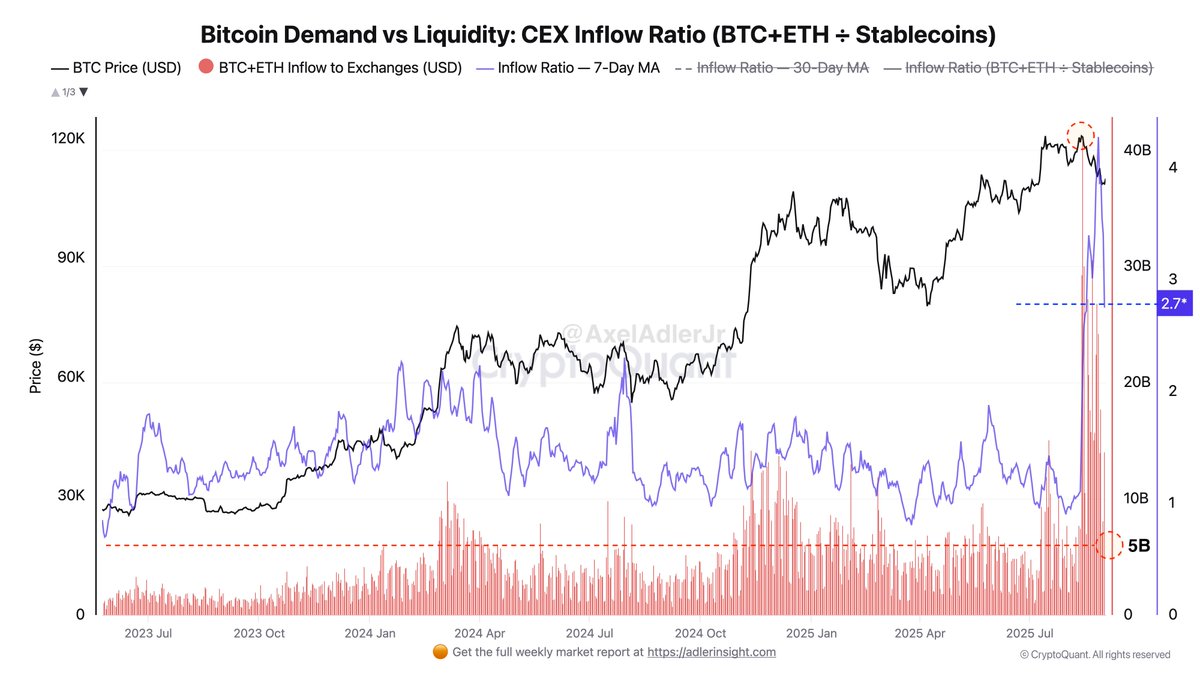

And just when you think things can’t get spicier, top analyst Axel Adler steps into the fray with some fascinating data. Apparently, after Bitcoin’s record-breaking high of $124,000, BTC and ETH inflows to exchanges surged like a tidal wave. But wait-where are the stablecoins? Nowhere to be found! This imbalance is like a game of musical chairs-only, the music stopped and everyone’s left holding empty bags of Bitcoin.

Bitcoin Inflow Ratio: A Bearish Symphony

Axel, ever the maestro of market analysis, points out that Bitcoin’s recent stumble is tied to what he calls the “Inflow Ratio.” This ratio is like a balance scale, measuring the flow of Bitcoin, Ethereum, and stablecoins. And guess what? It’s currently tipping heavily in favor of the volatile cryptos, with little stablecoin liquidity to soak it all up. Imagine a flood of Bitcoin crashing onto a shore with no sand to absorb the impact. That’s what’s happening, folks, and it doesn’t end well for Bitcoin.

But fear not, dear readers, for things aren’t entirely grim. The Inflow Ratio has cooled a bit, sitting at a slightly less alarming 2.7×. That’s like a brief respite after a storm. However, Adler warns that the lack of fresh demand means Bitcoin’s upward movement is about as likely as a snowstorm in the Sahara. In short, it’s not looking great for Bitcoin in the short term.

Yet, the world of crypto is like a soap opera-full of drama and twists. Adler reminds us that things can change at the drop of a hat. A sudden influx of stablecoins or a heroic return of institutional demand could flip the script. But for now, the scales remain tipped towards a bearish narrative.

Bitcoin’s Battle at $111,192: Will It Break Through?

Bitcoin, dear reader, is currently in a bit of a tiff with its resistance level at $111,192. It’s a modest recovery after last week’s plunge below $108,000. And what’s standing in Bitcoin’s way? The 100-day moving average. It’s like an invisible wall saying, “Not so fast, my friend!” If Bitcoin wants to prove it’s still the champ, it must break through this barrier. Will it? Time will tell, though Bitcoin’s recent inability to maintain gains above this level has sellers grinning from ear to ear.

If Bitcoin can push past the 50-day moving average ($115,638), the path might just be clear to retest the local peak of $123,217. But let’s not get ahead of ourselves. For now, the bears are lurking, ready to pounce.

Support is a mere $108,000 away, with an even more dramatic plunge possibly dragging Bitcoin to the psychological $100,000 level. Oh, the drama! Bitcoin remains stuck in a consolidation zone, stuck between moving averages like a confused soul. Bulls, take note: defend $108,000, or else… well, you know what happens next.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Silver Rate Forecast

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

2025-09-03 20:23