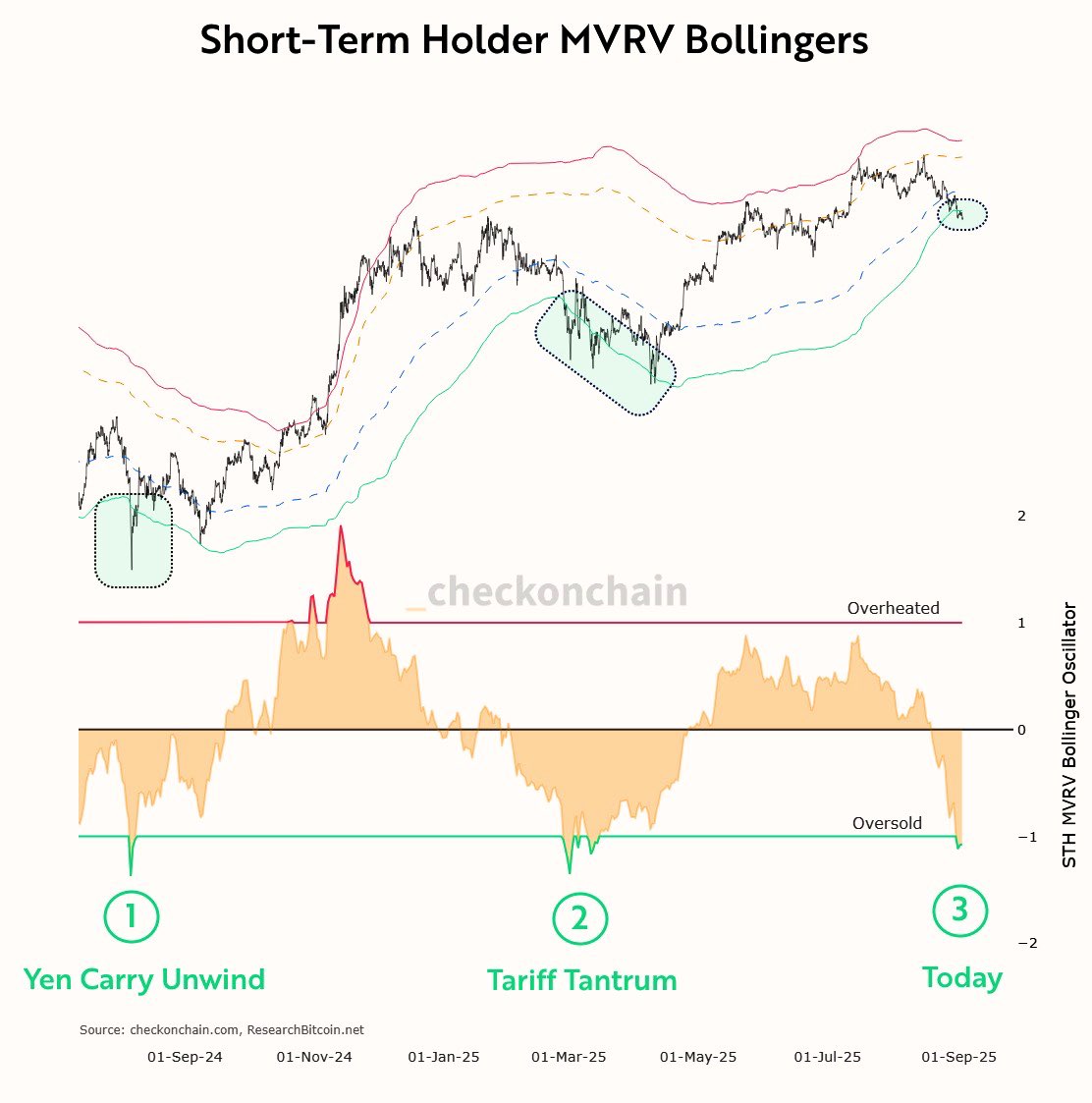

In the grand tapestry of human folly and financial frenzy, Bitcoin hath whispered a fleeting “buy” signal, a ghostly echo of its past debacles at $49,000 and $74,000, as the esteemed Frank AFetter of Vibe Capital Management hath proclaimed. “Behold! The Oversold print on the short-term holder MVRV bollinger bands,” he scribbled on X, reminiscing of the “Yen Carry Unwind” and the “Tariff Tantrum,” now joined by today’s $108k spectacle-a modern-day tragedy where coins are sold by the desperate, bought by the delusional, and all parties retire to their respective corners of madness. 🤯

The metric in question, a curious alchemy of the short-term holder market-value-to-realized-value ratio and Bollinger Bands, seeks to measure when the newest coins-those shiny, untested treasures-are trading at a price that makes one question their life choices. In Frank’s chart, the STH-MVRV Bollinger oscillator hath dipped into the “oversold” realm, a place where sellers have exhausted their tears and buyers have exhausted their wallets. A true romantic’s paradise. 💔

More Reasons To Be Bullish For Bitcoin

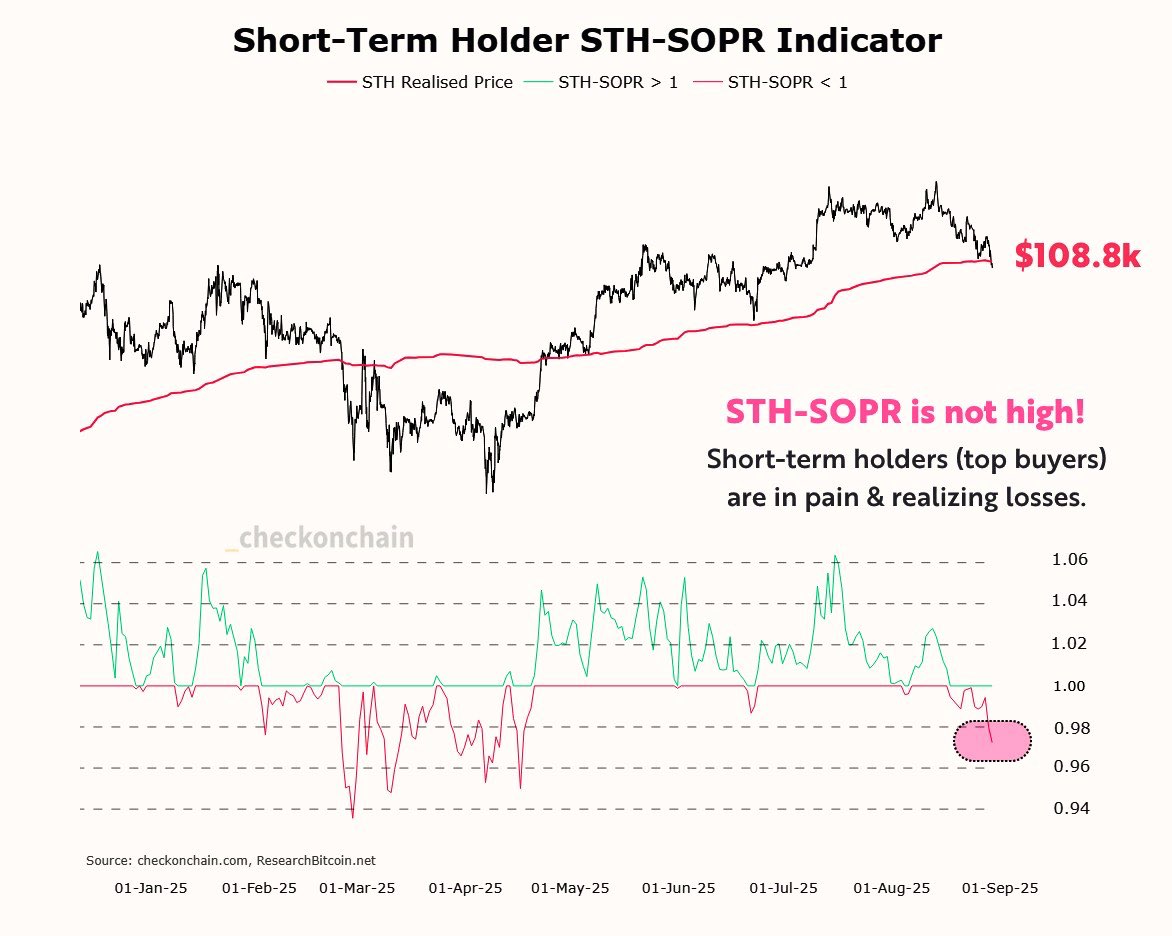

On a companion panel, the STH-SOPR gauge-a ledger of profits and losses for coins younger than 155 days-remains below 1.0, a number so meek it makes one weep for the recent buyers. “Short-term holders (top buyers) are in pain & realizing losses,” Frank lamented, as if he were a 19th-century poet mourning the fall of a nobleman. The STH-SOPR, he insisted, is “not high!”-a statement so profound it could only be followed by a period and a sigh. 😬

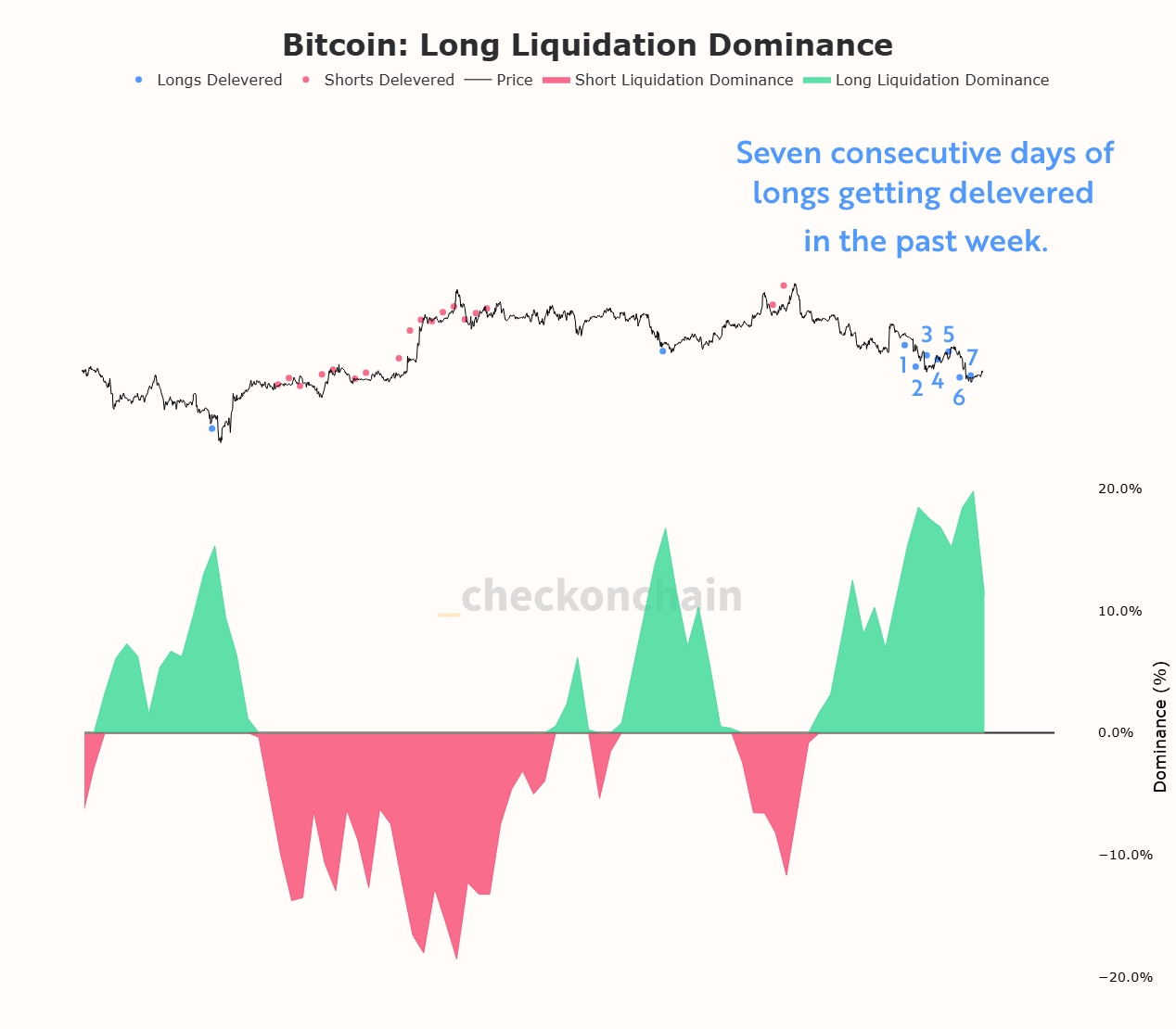

In the realm of derivatives, the positioning hath turned “cleaner,” a word that sounds innocent until one realizes it means “everyone is scrambling to avoid responsibility.” “Longs got ‘delevered’ every day last week-that’s seven straight days of magic blue dots,” Frank declared, as if describing a witch hunt. He now watches for the “flip,” a moment when the longs, in their infinite wisdom, might short with leverage-because nothing says “bull market” like a collective panic attack. 🚀

Macro context, that ever-elusive specter of economic theory, may offer solace. “Gold hit new highs last week. ‘Gold leads, bitcoin follows,’ ” Frank mused, as if quoting a divine prophecy. Gold, the old man of the market, “sniffing out the debasement trade,” while Bitcoin, the reckless youth, chases its shadow. If Bitcoin lags, perhaps it will “catch up,” a phrase that sounds less like a promise and more like a dare. 🤞

Risk markers, those stern guardians of chaos, remain clear. Frank pegs the short-term holder realized price at $108,800, a number that glows like a siren’s song. “If BTC breaks down below… it may want to investigate demand at the 200-day moving average,” he warned, as if Bitcoin could reason or care. A layered support map, he insists, frames the signal as “tactical,” a word that makes one imagine generals in crypto helmets. 🧠

Taken together, these signals form a “strong confluence,” a phrase that sounds impressive until one realizes it’s just a fancy way of saying “maybe.” Whether history rhymes again depends on spot demand and “aggressive shorting,” a combination that could either ignite a rocket or a firework in a gas station. “If we are in a bull market-and I believe we are-this is the kind of behavior that typically sets the stage for the next leg higher,” Frank concluded, as if he were both prophet and punchline. 🚀

At press time, BTC traded at $111,382, a number that makes one wonder: is this the dawn of a new era, or merely the calm before the next storm? Only time will tell-or perhaps the market’s next tweet. 📱

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Silver Rate Forecast

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

2025-09-03 08:15