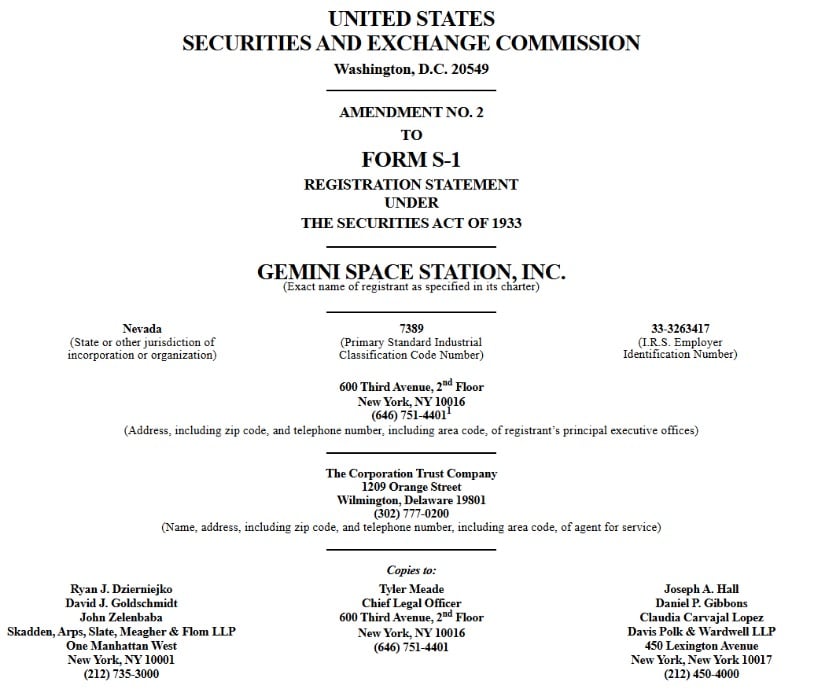

So, the Gemini crypto exchange, helmed by those ever-lovable Winklevoss twins-yes, the same duo famous for their Harvard rowing and lukewarm Facebook drama-has thrown its hat into the IPO ring. They’re aiming to raise a cool $317 million, possibly making 2025’s biggest crypto public debut (move over, Dogecoin, your moment is fleeting). 🎩🚀

If everything goes swimmingly and investors cough up at the higher end of that range, Gemini might parade around Wall Street with a tidy $2.22 billion valuation. The stock will sashay onto Nasdaq under the ticker “GEMI,” which sounds suspiciously like a sparkling new gemstone, but hey, crypto is full of surprises.

Big Banks Say “We Got This” (Goldman, Citi & Friends)

The usual suspects of high finance-Goldman Sachs and Citigroup-are headlining Gemini’s underwriting party, with Morgan Stanley and Cantor joining the bookrunning festivities. This kind of backing is Wall Street’s way of whispering, “We trust you… kind of,” which in financial terms means they’ve done their homework and smell some money.

This IPO isn’t coming out of the blue. Crypto firms have recently tasted IPO glory: Circle saw its share price leap 168% on day one (that’s not a typo), and Bullish swaggered in by raising $1.1 billion and watching stocks shoot up over 80%. Apparently, the public really likes gaming the crypto rollercoaster.

Gemini’s Strong Suit: $18 Billion and Counting

Gemini’s not just a flashy startup with blockchain dreams-they’re holding more than $18 billion in customer assets and catering to 14.6 million verified users worldwide. That’s roughly the population of Switzerland if everyone suddenly decided to trade Bitcoin during their coffee break.

The exchange handles everything from trading to custody, staking, and even a crypto rewards credit card-because why not toss “rewards” into the digital gold rush? Their 2024 revenue came in at $142.2 million, a hefty jump from $98.1 million the year before, riding on the back of Bitcoin’s ever-yo-yoing price. Founded in 2014, Gemini prides itself on a “security-first” mantra, which is a fancy way of saying, “We might lose your keys less often than others.”

Oh, and don’t forget their in-house stablecoin, the Gemini Dollar (GUSD)-because every good crypto outfit needs its own currency, like a corporate-version of Monopoly money. They even offer institutional custody for over 10,000 business customers and recently added an XRP-loving credit card and Ripple’s RLUSD stablecoin to their bag of tricks.

Regulatory Winds at Their Back (Mostly)

Timing is everything, and Gemini is riding a regulatory wave thanks to the GENIUS Act, signed into law by President Trump in July 2025 (yes, the timeline gets complicated). This act is basically the government’s way of saying, “Okay, let’s try to make sense of stablecoins without losing our minds.”

This new legislation demands stablecoin issuers keep full dollar and Treasury-backed reserves, stamp out shady money flows with AML rules, and offer consumer protections previously as elusive as a honest politician. In other words, the playing field for U.S. crypto firms just got a bit less like the Wild West and a bit more like… Wall Street.

With these clearer rules, compliant companies like Gemini are now flexing their muscles against offshore rivals, wooing institutional clients who’d rather not sleepwalk into regulatory nightmares.

Show Me The Money… Or Not So Much

Before you start picturing piles of gold, there’s some real financial fun here. Despite the respectable revenue climb, Gemini is also racking up losses that might make your accountant swoon: a net loss of $282.5 million in the first half of 2025, which is about seven times more painful than the $41.4 million loss over the same period last year. Meanwhile, cash reserves have taken a little nosedive, dropping from $341.5 million at the end of 2024 to $161.9 million mid-2025. Someone’s been hitting the crypto casino hard.

Luckily, they’ve got a safety net-a $75 million credit line from Ripple, which can double to $150 million if they need more (because when those Internet coins get temperamental, sometimes you just need a sugar daddy loan).

True to the Winklevoss style, control stays in the family: public folks get Class A shares with a single vote each, but the twins keep their Class B shares with ten votes apiece. It’s like a royal crypto court where the Winklevoss crown stays firmly on their heads.

Battle for the Crypto Throne

If all goes well, Gemini becomes the third major crypto exchange lounging on U.S. stock exchanges, joining Coinbase and Bullish-a rather exclusive club where the dress code is compliance and the specialty cocktail is institutional trust.

Gemini’s “follow the rules” approach makes them a bit of a unicorn in an industry known for eyebrow-raising antics. While others have tangled with regulators (and occasionally lost), Gemini’s been the good kid in class, building relationships and keeping licenses in multiple spots on the globe.

Experts consider stablecoins the “gateway drug” of blockchain for serious finance types. Thanks to the GENIUS Act’s clarity, Gemini and other regulated stablecoin issuers stand to ride the wave of growing institutional adoption like pros catching the perfect surf.

This compliance-first game plan might just become more valuable than any fancy token or NFT as old-school banks warm up to crypto’s weird charms.

Looking Ahead-Because This Story’s Just Begun

Gemini has filed all the paperwork, which means SEC’s stamp of approval is the next hurdle before “GEMI” can start flashing on ticker boards. The timing? Well, that depends on how fast the regulators zip through their to-do list and whether the markets feel cheerful enough to party.

Looking at recent crypto IPOs, appetite for digital asset darlings seems strong enough to give Gemini a fair shot. Circle and Bullish have baked a promising pie for Gemini to devour, so fingers crossed investors find regulatory compliance appetizing enough to overlook those pesky losses.

The Crypto World Keeps Marching On

Gemini’s IPO isn’t just a financial event; it’s a big, flashy billboard announcing that cryptocurrency businesses are graduating from the speculative playground to the serious world of financial services. Clearer rules, glowing success stories, and Wall Street backing suggest that crypto is trying-ever so desperately-to play nice in the sandbox.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Silver Rate Forecast

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

2025-09-03 01:33