As the clock struck 7:45 a.m. Eastern time on Aug. 30, 2025, Bitcoin was wobbling like a jelly on a trampoline, priced at $108,526-give or take a few nervous sweats. Its market cap? A whopping $2.16 trillion (enough to buy a small planet, or at least a very large yacht). Trading volume? $47.69 billion in 24 hours, which sounds impressive until you realize it’s mostly traders panicking and hitting “sell” while eating cereal.

Bitcoin

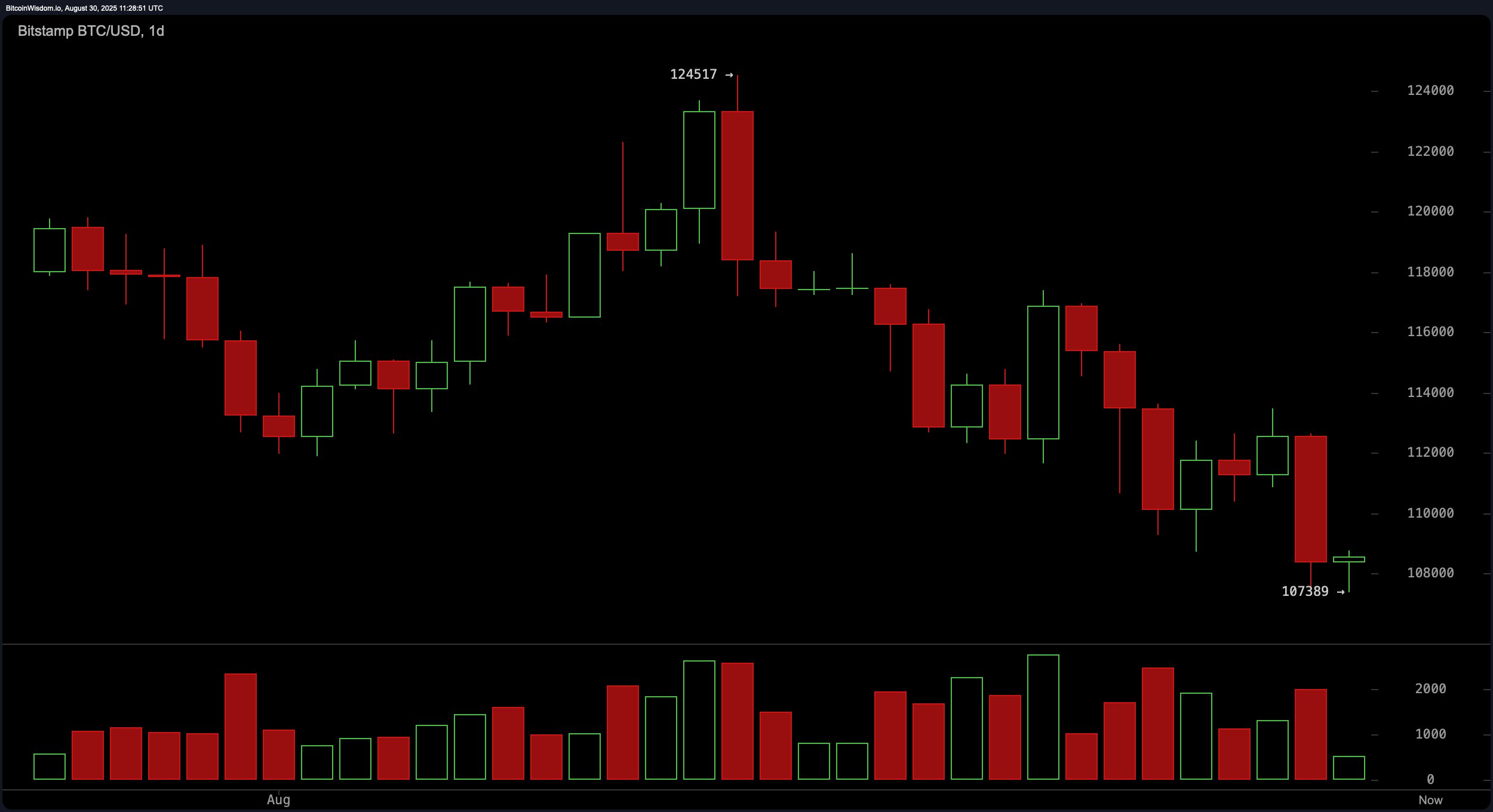

Ah, Bitcoin-the digital gold that’s currently behaving more like digital soggy toast. Despite a few hopeful nibbles from buyers, the bears are firmly in charge, laughing maniacally as they push prices lower. The charts? A tragicomic masterpiece of lower highs and lower lows, like a staircase leading straight into a pit of despair. The daily chart shows a local peak near $124,500 (ah, the good old days) and a recent low of $107,400 (cue the violins). Red volume spikes scream “SELL!” while green volume whimpers in a corner. Support at $107,000 is hanging by a thread, and resistance at $114,000 might as well be guarded by dragons. Until a bullish candlestick appears waving a white flag, long positions are as risky as licking a frozen lamppost.

The four-hour chart is no better-a rollercoaster of misery from $114,800 down to $107,400. Bitcoin’s current “consolidation phase” is less “calm before the storm” and more “napping on a sinking ship.” Sellers are having a field day, while buyers are too busy biting their nails to fight back. Support at $107,400 is like a trampoline with too many holes, and resistance at $110,500-$111,800 is where dreams go to die. Short sellers, rejoice! The bears are serving up fresh misery.

The one-hour chart? A chaotic waltz of indecision. Tiny candlesticks, low volume-traders are basically shrugging and waiting for someone else to make the first move. Support at $107,400 is like a soggy biscuit, while resistance at $108,800-$109,000 is where hope goes to evaporate. Scalpers might try buying near support and selling near resistance, but let’s be honest-it’s like playing Jenga in an earthquake.

Technical indicators? A mixed bag of “meh” and “oh no.” The RSI is at 38 (neither here nor there), Stochastic at 18 (barely awake), CCI at −140 (sad trombone), ADX at 19 (weak sauce), and the Awesome Oscillator at −4,917 (not so awesome). Momentum and MACD are firmly in bear territory, like a grumpy old man yelling at clouds. The message? Downside risk unless something miraculous happens (like Bitcoin discovering caffeine).

Moving averages? Almost all screaming “SELL!” except the 200-period ones, which are whispering “maybe someday…” like a delusional optimist. Until Bitcoin claws its way above key resistance, bulls should probably stick to watching cat videos.

Bull Verdict:

Sure, the long-term averages hint at hidden strength, like a superhero in pajamas. If Bitcoin holds $107,000 and breaks $109,500 with volume, bulls might dare to dream. But until then, optimism is as useful as a chocolate teapot.

Bear Verdict:

Bitcoin’s charts are a bear’s playground-lower highs, angry red volume, and moving averages aligned like dominos ready to topple. Unless it reclaims $114,000 with the fury of a thousand suns, the bears are feasting. 🍽️🐻

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

2025-08-30 15:59