Ah, Bitcoin-the digital phoenix that rises from its own ashes every time you think it’s dead. On Tuesday, the price plummeted to $108,600 (yes, even cryptos need a nap sometimes), but lo and behold, it sprang back above $112,000 faster than you can say “blockchain.” Selling pressure surged briefly, like an overeager trader with too much coffee, causing exchange inflows to spike. But now, those inflows are dwindling again-perhaps because everyone ran out of coins to sell or just got bored.

Enter CryptoOnchain, the crypto analyst who sees dips stopping like a stubborn mule refusing to budge further downhill. Citing some fancy CryptoQuant data on Wednesday, he boldly declares that Bitcoin’s dramatic drops might be taking a vacation. Hooray for optimism! 🎉

Key Metric Whispers Secrets in Hushed Tones

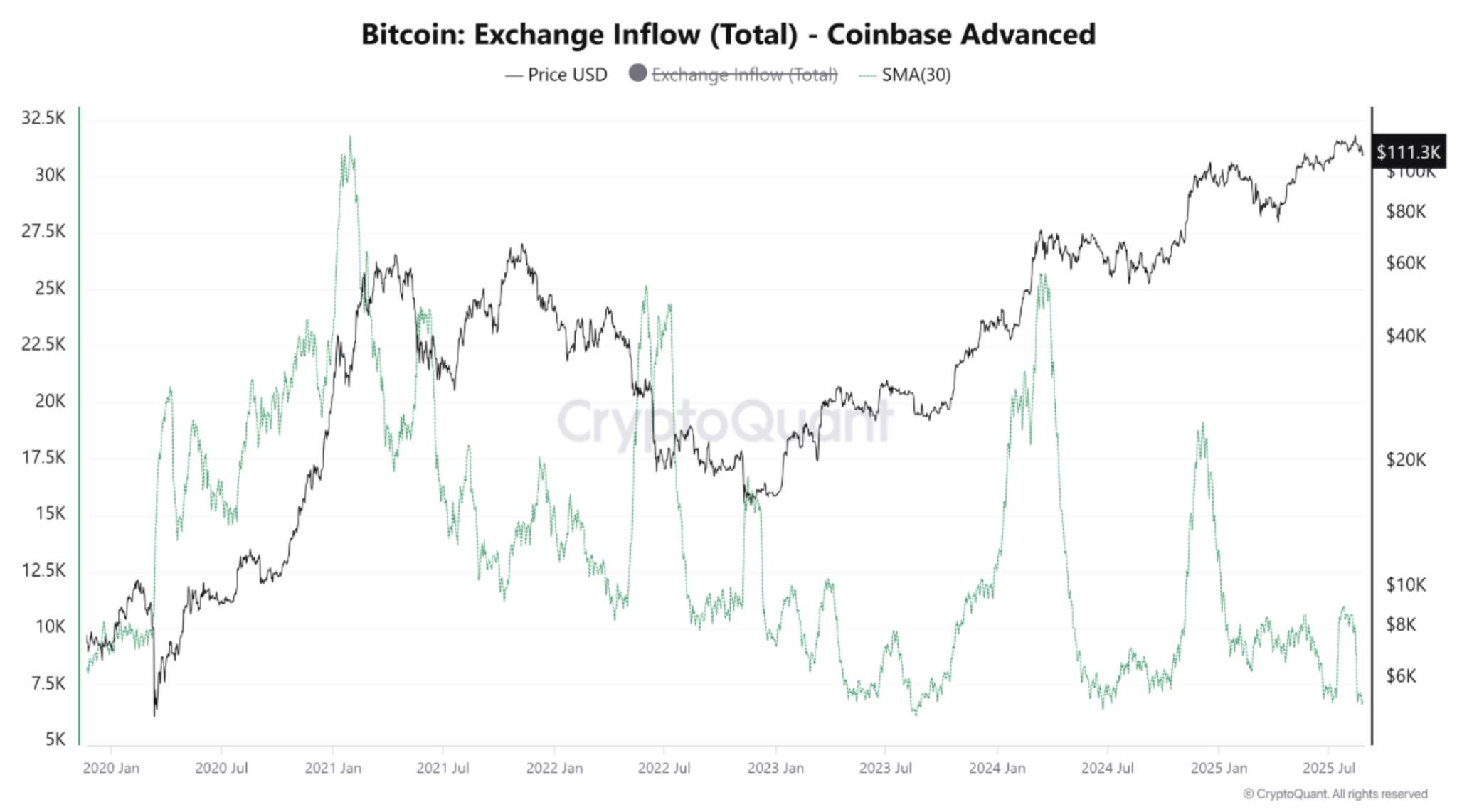

Apparently, the 30-day moving average for Bitcoin inflows is falling after hitting rock bottom since May 2023. This key metric reached an all-time low in July, only to bounce back as Bitcoin hit yet another record high. Why? Because profit-taking investors decided they wanted yachts instead of virtual tokens. Ah, human greed-a timeless classic!

Exchange inflows peaked in April when new US tariff policies were announced (because nothing screams excitement like government regulations). Now, during this latest dip, they’ve retreated to record lows. CryptoOnchain calls this drop “significant”-as if we needed more drama in our lives. He crunched numbers across exchanges and tied this decline to Bitcoin’s rebound to $111,000. Truly riveting stuff! 🔢

US Investors Hit Pause on Panic-Selling Mode

Who knew Americans could show such restraint? These fine folks have been fueling the rally lately, and guess what? A similar trend is visible in the Binance spot market. How predictable!

CryptoOnchain interprets this as a bullish signal-like finding money in your coat pocket. The supply of sellable Bitcoin is shrinking, which could make people feel warm and fuzzy about the market. Naturally, the analyst predicts a mid-term BTC uptrend. Because why not add another prophecy to the pile? 📈

Meanwhile, Coinbase Advanced shows an even steeper decline, hinting at low selling pressure from both retail and institutional investors. Perhaps they’re all busy watching cat videos instead. 😺

This fresh batch of data aligns perfectly with CryptoOnchain’s theory that investors are hoarding their assets like squirrels preparing for winter. Fewer coins for sale means upward pressure on prices-and possibly champagne corks popping somewhere. Cheers to that! 🍾

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Cronos Rises as Crypto Markets Crumble! 💸📉

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- DOGE PREDICTION. DOGE cryptocurrency

2025-08-27 14:01