Oh, the sweet smell of crypto chaos. One minute you’re sipping your oat milk latte thinking, “I’m rich!” and the next, you’re Googling “how to live off ramen for a year.” The downturn caught traders completely off guard-like when you accidentally like an ex’s Instagram photo from 2017. Weeks of record highs had everyone feeling invincible, but then BAM! Whale activity, profit-taking, and macroeconomic uncertainty swooped in like that friend who always ruins brunch by reminding you about taxes. 😩

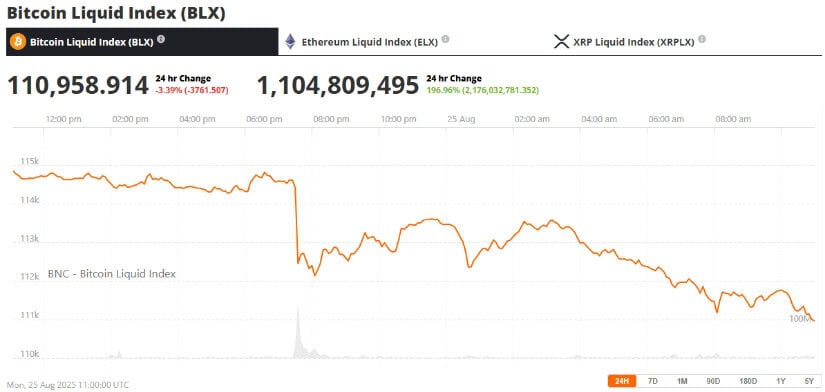

Bitcoin Flash Crash Below $111K (Because Who Needs Stability?)

Bitcoin took the biggest hit this weekend, dropping 3.39% to around $110,958 after some whale decided it was time to unload 24,000 BTC onto exchanges. That’s over $2.7 billion worth of Bitcoin, folks. It’s like dumping a truckload of anvils into a kiddie pool. 💸 This triggered forced liquidations exceeding $550 million, mostly targeting those brave souls with overleveraged long positions. Sunday trading is apparently the Wild West of finance-low liquidity and high drama, perfect for liquidation hunters looking to ruin your day. And despite recent highs near $125,000? Bitcoin is now clinging to support levels like a toddler refusing to let go of their blanket.

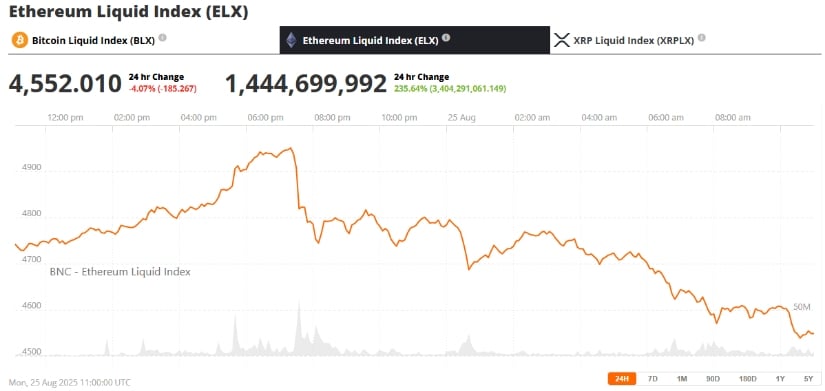

Ethereum Holds Up-but Faces Pullback Pressure (Cue Dramatic Music)

Ethereum, bless its little blockchain heart, tried to play the hero here. It held the $4,550 support level after climbing nearly 9% last week and even flirted with $4,945. Its market cap is approaching $600 billion, thanks to institutional demand and smart-contract infrastructure. But guess what? History has a way of being a real jerk. Since 2016, Ethereum tends to take a nosedive in September after rallying in August. Analysts are whispering about a potential 6.4% drop-because why not add more chaos to the mix? Still, ETF inflows have reached nearly $3 billion this month, so maybe we’ll all be okay. Or not. Who knows anymore? 🤷♂️

XRP Drops Below $3 Amid Market Ripples (Poor Little Guy)

Ah, XRP. The token that just can’t catch a break. Riding high on Powell’s rate-cut hints, XRP surged nearly 12% over the weekend, only to get dragged back below $3 thanks to Bitcoin’s flash crash. Poor thing. It’s like showing up at a party wearing your best outfit, only to realize everyone else is dressed as clowns. 🤡 Compounding matters? XRP’s history of boom-and-bust cycles makes it look like the emo kid of cryptocurrencies during broader market corrections. Can’t blame it for having trust issues.

Fed Commentary Sparked Initial Bounce (Yay? Nay?)

Let’s rewind for a second: remember when Federal Reserve Chair Jerome Powell hinted at easing interest rates? Markets went wild-Bitcoin climbed back to $116,500, and Ethereum tagged along like an overly eager puppy. MicroStrategy and Coinbase saw spikes too, because hope springs eternal. But alas, that optimism fizzled faster than a soda left open overnight. MicroStrategy slid 4.1%, and Coinbase dipped 2.9%. Classic case of “fool me once, shame on you; fool me twice, shame on me.” Or something like that.

Final Thoughts (Or Maybe Just Therapy?)

So here we are, folks. Today’s crypto meltdown is basically a soap opera starring whales, profit-takers, and macroeconomic uncertainty as the villains. As markets continue to bounce around like a hyperactive toddler, keep an eye on ETF flows, institutional activity, and whatever else might save us from financial ruin. Or don’t. At this point, I wouldn’t blame you if you just unplugged your computer and started growing vegetables instead. 🌱

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Eric Trump Gets Fired Up Over 1,414 Bitcoin Acquisition – And You Should Too! 🤑💥

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

2025-08-25 17:15