Behold, the realm of digital gold, where fortunes are forged and shattered with the swiftness of a merchant’s ledger! On this Sunday morn, Bitcoin doth linger at $114,627, its soul trapped in a narrow dance between $114,575 and $115,549. A market capitalization of $2.28 trillion-like a gilded crown upon a head of sand-and 24-hour volume of $25.22 billion, all whispering of a stalemate. The beast consolidates, as if brooding over its next move, much like a drunkard weighing whether to stumble home or brawl in a tavern.

Bitcoin

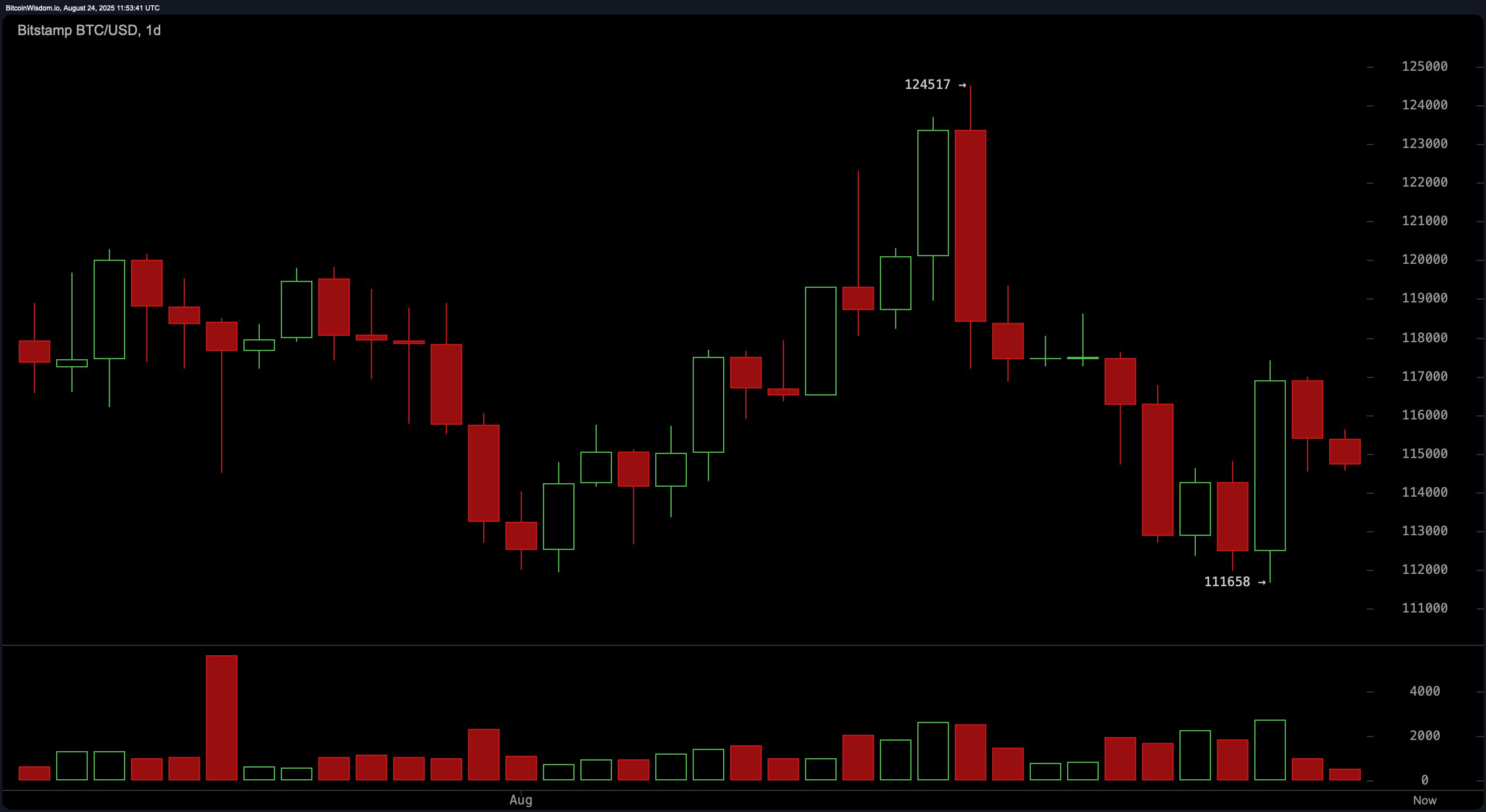

On the 24th of August, the daily chart reveals a tale of woe. A double top near $124,000-a folly of hubris-and a breakdown below $117,000, the sacred support now a tomb for bullish dreams. The rebound from $111,658, once a savior, now falters like a drunkard’s last attempt to stand. Volume, that fickle friend, betrays the bulls with red candles roaring like a bear’s growl. Traders, dear souls, take heed: $117,000 is your Promised Land, and $111,658, the abyss. 🐻❄️

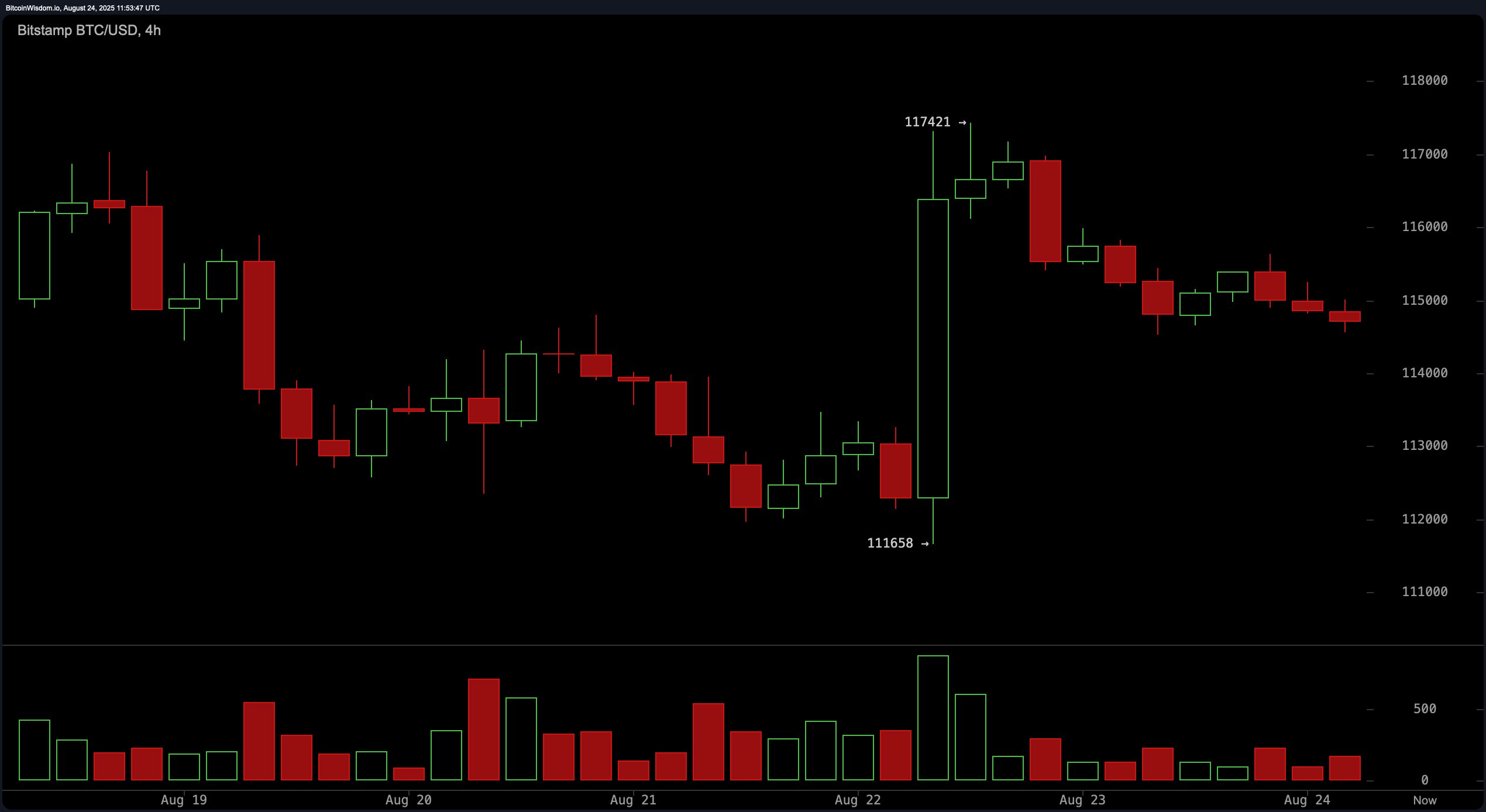

The 4-hour chart, a microcosm of despair. A wick from $111,658 to $117,421-a short squeeze masquerading as hope-only to crumble under its own weight. Lower highs, like a poet’s meter, mark the waning of momentum. Panic buying, not accumulation, fuels the volume spike. Short entries await the fall of $114,000-$114,500, a price drop that could send Bitcoin tumbling like a drunkard from a hay cart. 🚜

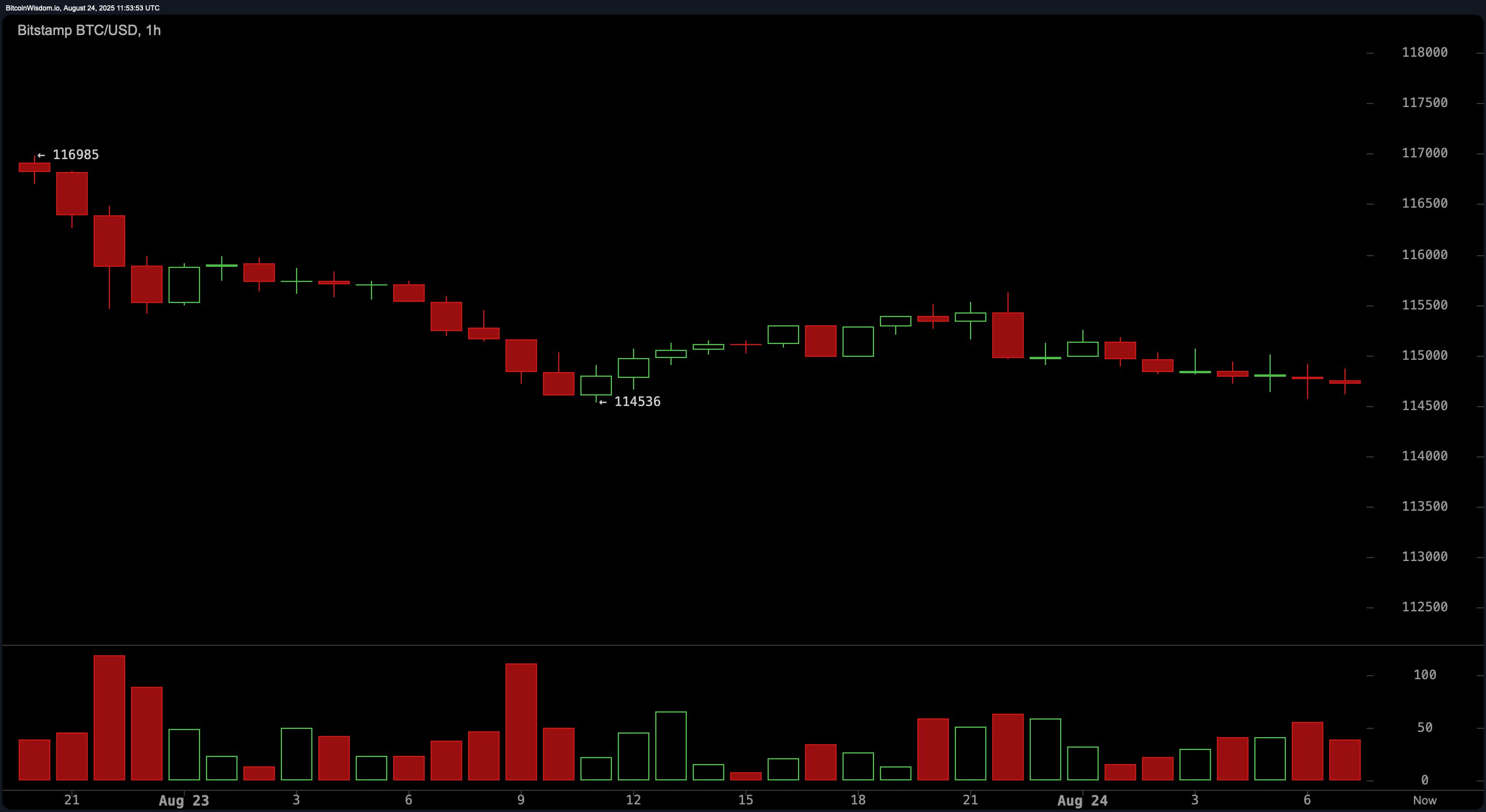

The hourly chart, a cage of indecision. Resistance at $115,000 looms like a mountain, while tight candles and dwindling volume paint a portrait of a market holding its breath. Breakout above $115,500? A fleeting dream. Rejection? A descent to $114,000, where the bears await with pitchforks. 🛡️

Momentum indicators, these modern-day prophets, offer a cryptic scroll. RSI at 47-a neutral nod. Stochastic at 31, a yawn. CCI at −62, ADX at 16: all whisper of a market too tired to choose a side. MACD at −365, the bear’s grin. One might say the indicators are as helpful as a pocket watch in a storm. ⏳

Moving averages, those ancient sages, lean bearish. The 10-, 20-, 30-period EMAs and SMAs all point downward like a chorus of grumpy elders. Yet the 100- and 200-period MAs, positioned below like a mother’s hand, hint at structural support. A tale of two timelines: the present, a wasteland; the future, a mirage. 🌵

If Bitcoin, with the grace of a phoenix, reclaims $117,000 with volume as bold as a general’s march, the bulls may yet rise. Until then, hope is a currency with no intrinsic value. 💸

Bear Verdict:

The bears, ever the pragmatists, hold the reins. A collapse below $114,000 could see Bitcoin plummet to $111,000 or lower. The market’s next move? A tragedy in five acts. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- USD GEL PREDICTION

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- OKB PREDICTION. OKB cryptocurrency

- The XRP Secret: When Network Activity Talks, Prices Listen 📈🤫

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- The AI Exodus: Cash App’s Bitcoin Empire

2025-08-24 16:28