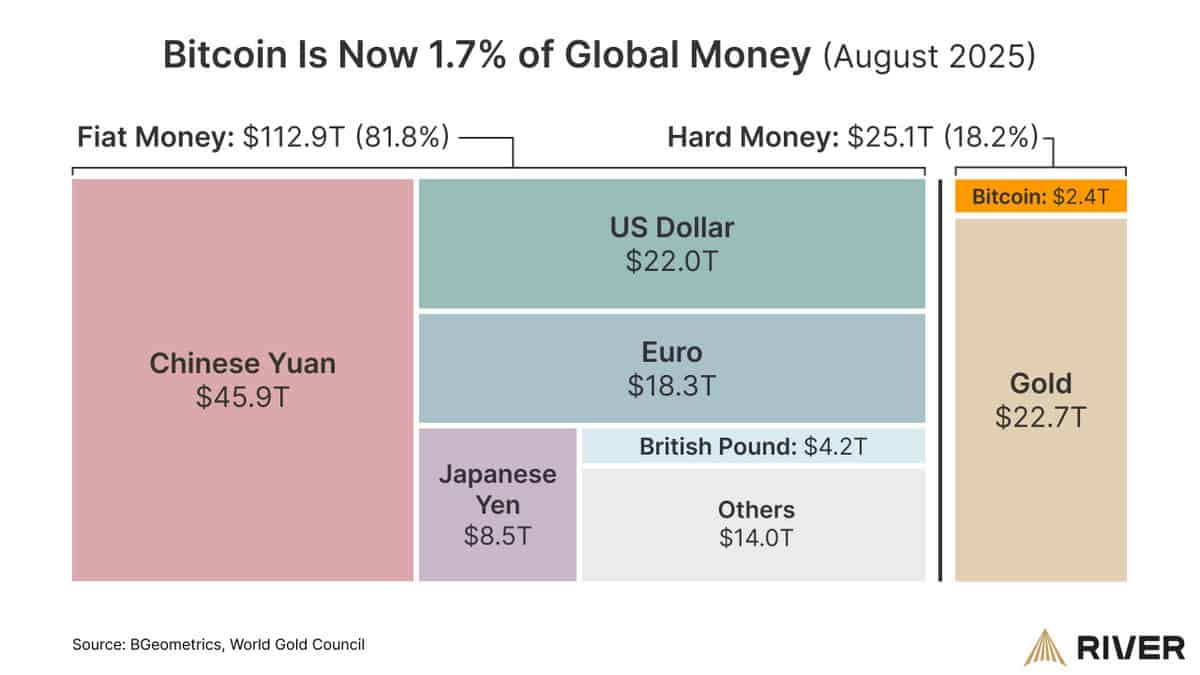

Ah, the divine comedy of finance! In a mere 16 years, Bitcoin has metamorphosed from a digital dalliance traded for a slice of pizza 🍕 into a $2.4 trillion behemoth, daring to waltz with fiat and gold. River, ever the astute observer, has benchmarked BTC’s market cap against the $112.9 trillion of fiat M2 and $25.1 trillion in hard money (gold, the poor darling, excluded its silvery and palladian cousins). At today’s $2.29 trillion cap, Bitcoin’s slice is a modest 1.66%-but oh, the trajectory! It’s as inevitable as a Wildean wit at a dinner party. 🥂

Gold had centuries to preen in its gilded cage. The dollar, a mere century to strut its stuff. And yet, Bitcoin, the enfant terrible of currency, is staging the same coup in under two decades. Bravo! 👏

In 16 years, Bitcoin ascended to 1.7% of global money, source: X

Central Banks: The Eternal Inkwells of Inflation

The Silent Pirouette

At the Jackson Hole Economic Symposium, Powell, that maestro of monetary equivocation, effectively announced the next act of easy money:

“Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.”

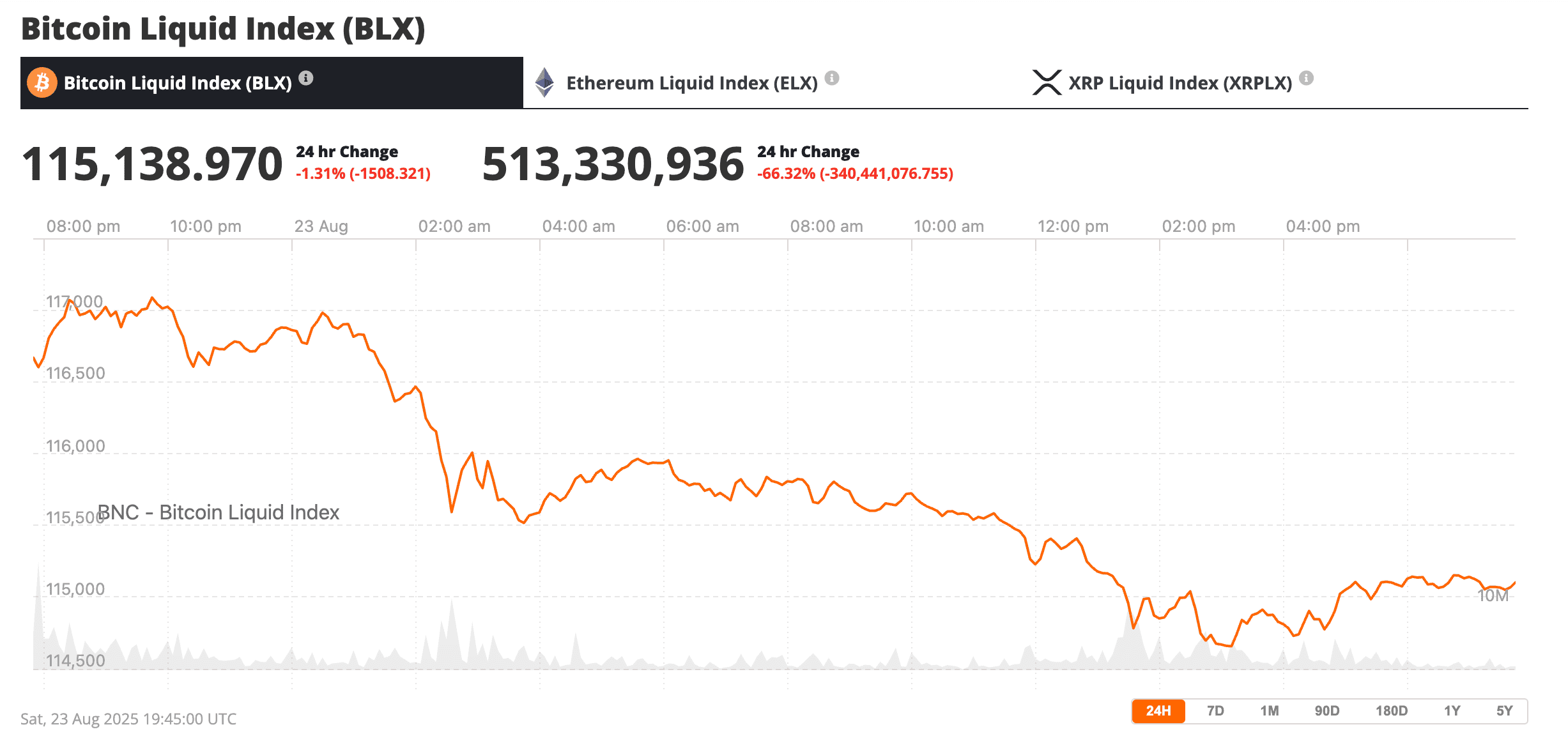

Translation: rate cuts are en route, darling. And the market, ever the keen observer, knows it. Within minutes of Powell’s speech, Bitcoin leapt 2%, touching $116,000. According to CME futures data, 75% of investors now anticipate a 25 bps cut in September. The plot thickens, does it not? 📉

Why It Matters, Darling

Bitcoin and its crypto cohorts have always danced as high-beta liquidity plays. When global money expands, so do their valuations. But the difference now is scale: Bitcoin is no longer a fringe hedge-it’s a $2+ trillion counterweight to fiat and gold combined. In a world where the Fed can’t resist the urge to “print and cut,” Bitcoin’s share of global money is no mere curiosity-it’s a monetary revolution in slow motion. 🌍

The only question left, my dear reader, is this: will central banks adjust to Bitcoin’s rise, or will they continue to accelerate the very forces making it inevitable? If you don’t already own Bitcoin, now is the time to consider it. Is it time to buy Bitcoin? The answer, like a Wildean quip, is both obvious and elusive. 🧐

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

2025-08-24 02:18