In the grand theater of cryptocurrency, Ethereum (ETH) has taken center stage, delivering a performance that would make even the most seasoned actors weep with envy. With a triumphant leap, it has shattered its previous all-time high of approximately $4,860, a feat reminiscent of a daring acrobat defying gravity. On a single fateful Friday, this digital titan surged over 13%, marking a watershed moment in the tumultuous saga of the market, and affirming the indomitable spirit of Ethereum’s ongoing rally.

Ah, the bulls! They are galloping with unrestrained enthusiasm, while Bitcoin, that once-mighty beast, languishes in a state of stagnation, clinging to the same price range it occupied a month ago. Meanwhile, Ethereum has seized the reins, leading the charge for an extended altcoin rally. The market, it seems, is entering a new chapter, where altcoins are flexing their muscles, and Ethereum is the valiant knight at the forefront of this noble quest.

Adding a sprinkle of optimism to this already vibrant tapestry, the esteemed analyst Ted Pillows has graced us with his insights, proclaiming Ethereum’s unwavering dominance in the realm of decentralized finance (DeFi). He has boldly asserted that Ethereum remains the number one chain in DeFi, a veritable backbone of the sector. With institutional adoption on the rise, exchange supply dwindling, and derivatives activity heating up like a summer’s day, many are convinced that Ethereum is poised for a sustained rally. Who wouldn’t want to ride this wave of optimism?

Ethereum Netflows Surge Amid Fed Speculation

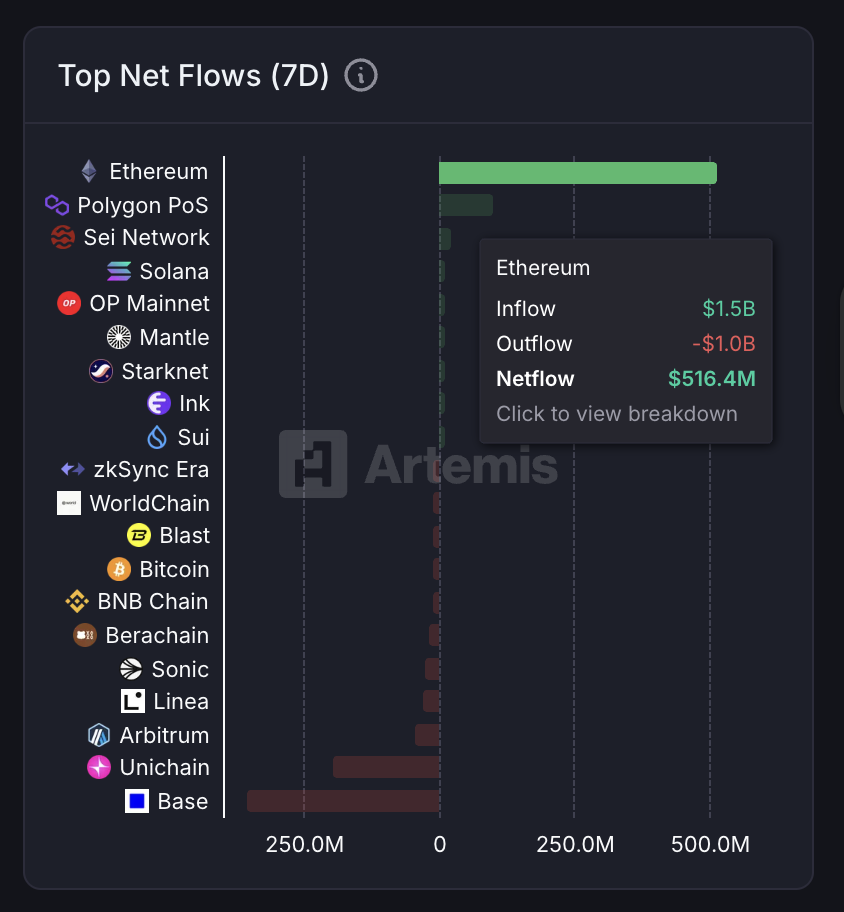

Once again, Ethereum’s supremacy in the crypto market has been underscored by its recent on-chain activity. In a mere seven days, Ethereum recorded a staggering netflow of +$516.4 million, leaving all other networks in its dust. To put this into perspective, the second-largest contender, Polygon, managed a paltry $102.9 million during the same period. This yawning chasm of difference serves as a testament to Ethereum’s prowess in attracting and retaining liquidity. Bravo!

The timing of this meteoric rise is intricately woven into the fabric of macroeconomic developments. Markets began to simmer after Federal Reserve Chairman Jerome Powell’s remarks at Jackson Hole, where he hinted that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Such words have ignited a wildfire of speculation that the Fed might cut interest rates in September, breathing new life into both traditional and crypto markets. Who knew a few words could stir such excitement?

Ethereum’s robust netflows are a reflection of both institutional and retail conviction. Investors are positioning themselves for further upside, eagerly anticipating improved liquidity conditions. This surge in inflows signals not just buying pressure, but a growing recognition of Ethereum as the primary vehicle for DeFi, staking, and treasury strategies. It’s a veritable gold rush!

Weekly Price Analysis: Reaching New ATH

Ethereum (ETH) has officially ventured into uncharted territory, setting fresh all-time highs on the weekly chart. The breakout above the 2021 peak near $4,860 confirms a major bullish structure after months of consolidation and a sharp rally in recent weeks. ETH closed this candle with a flourish, near $4,876, representing an almost 9% surge within the week. Bravo, Ethereum, bravo!

This structure highlights a sustained bullish momentum. With ETH trading well above its 50-week ($2,823), 100-week ($2,794), and 200-week ($2,446) moving averages, the alignment is nothing short of poetic. Shorter-term moving averages are dancing above the longer-term ones, reinforcing the bullish trend. Momentum indicators suggest that buyers remain firmly in control, buoyed by institutional flows and derivatives positioning. It’s a beautiful sight to behold!

Key resistance now lies only in the realm of price discovery, as ETH has no historical levels above its current price. In such exhilarating phases, rallies often extend rapidly, especially when combined with rising open interest and strong on-chain accumulation trends. On the downside, immediate support rests around the $4,300-$4,200 zone, which coincides with the breakout region. Losing this area could invite deeper corrections, but fear not, for the bulls are currently defending it with the fervor of a mother bear protecting her cubs.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- DOGE PREDICTION. DOGE cryptocurrency

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Coinbase Aims for a Billion-User Open Era

2025-08-23 11:12