Well, well, well, look who’s getting knocked down from its high horse! Bitcoin, which once strutted around boasting a record-breaking price of $123,731 on August 14, is now sitting sulkily at $113,167-a drop of about 10% in the past week. It seems that the ‘crypto king’ isn’t so untouchable after all.

The latest culprit? The miners! You know, the folks who dig up the digital gold. They’ve been busy offloading their precious holdings, and it’s got the market all twitchy about what’s coming next.

The Miners Are Getting Nervous

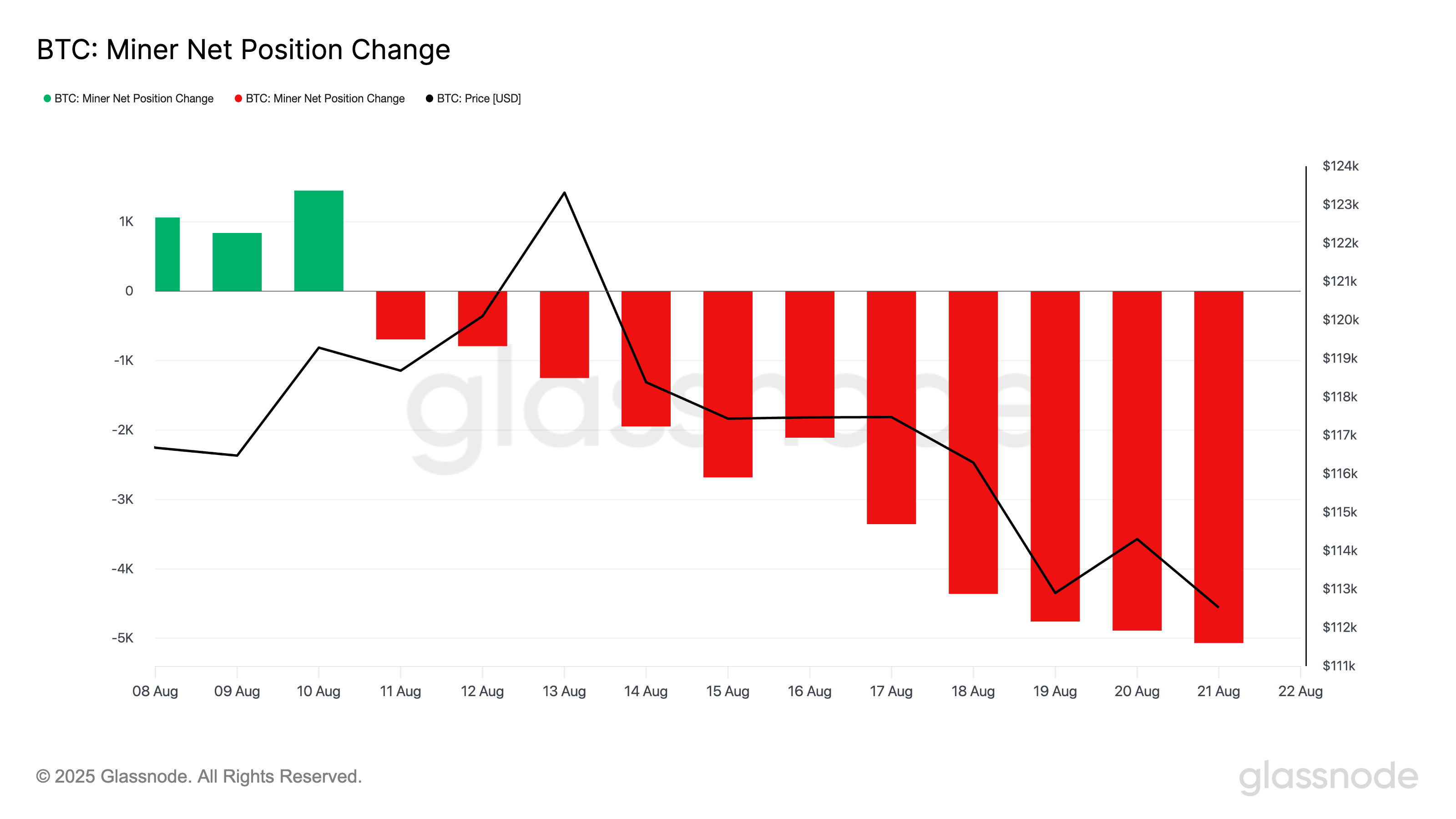

According to Glassnode (fancy name, right?), Bitcoin’s Miner Net Position Change has hit rock bottom for the year. We’re talking about a sharp drop to -5,066 on August 21-its lowest reading since December 2024. Yep, miners are practically throwing their bitcoins out the window.

Want to stay ahead of the market? Keep up with all the juicy crypto updates with Harsh Notariya’s Daily Crypto Newsletter-because who doesn’t want to be the smartest crypto player in the room?

Now, when this particular metric drops, you can bet your bottom dollar that miners are getting twitchy. Selling pressure from this influential bunch can really put the brakes on any Bitcoin rally. More supply, fewer buyers… you get the picture.

And it looks like this downward momentum could drag on for a bit longer. Who’s ready for another dip?

ETFs Join the Party of Pain

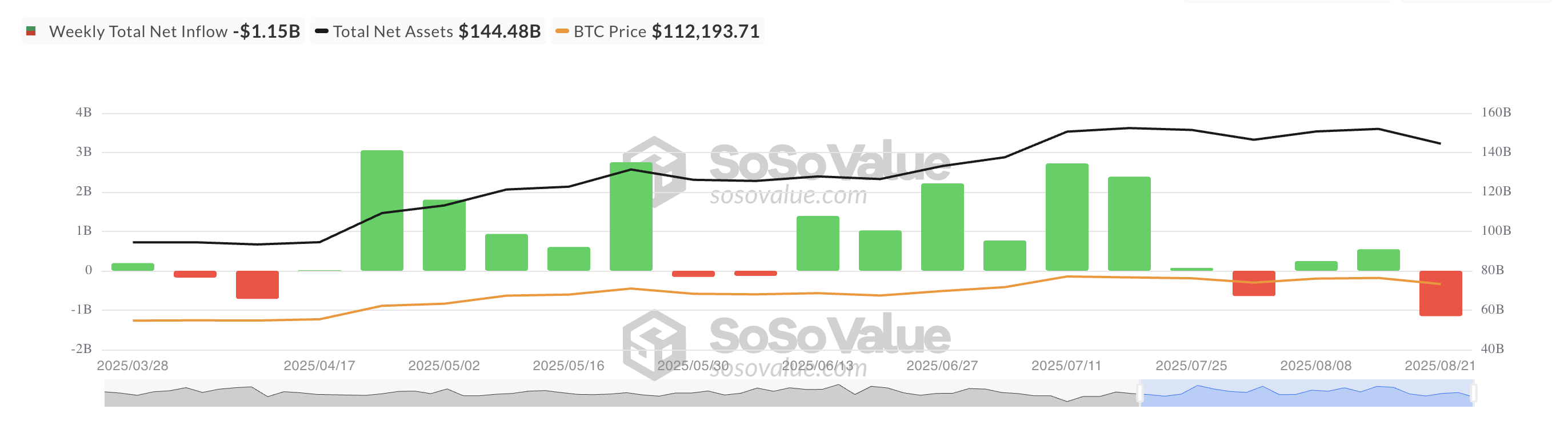

If you thought miners were the only ones making Bitcoin sweat, think again. Institutional investors have been pulling out of BTC ETFs faster than a kid running from homework. A cool $1.51 billion has flown out of these funds this week, and at this rate, it could be the biggest weekly outflow since February. Ouch!

This exodus from ETFs is like adding a bit of hot sauce to an already spicy situation. It’s only making the miners’ sell-offs hit harder, and don’t expect Bitcoin to bounce back too quickly under these conditions.

Is Bitcoin Heading for $107,000?

At this point, Bitcoin’s clinging to a thread of support around $111,961. But if the miners keep dumping and ETF outflows keep climbing, it could slip right past that and dive down to around $107,557.

But wait! If Bitcoin gets some new demand-say, a sudden surge of interest from traders or miners buying back in-then all bets are off. We could see Bitcoin climb back to $115,892 and leave this current slump in the dust. But let’s not hold our breath!

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Silver Rate Forecast

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

2025-08-22 12:36