So, there I was, minding my own business, when suddenly Ethereum decided to throw a party that even my cat, Mr. Whiskers, would be impressed by. In August, it hit a jaw-dropping $4,740! I mean, who knew cryptocurrencies could party like it’s 1999? Now, it’s entering a critical trading phase-the kind that says, “Make a wish and blow out the candles or face disappointment!” 🎉

Just when you think you have a grasp on this whole Ethereum saga, along comes a short-term pullback to remind us that markets can be as unpredictable as my Aunt Edna after three glasses of rosé. Still, the bright side? There’s institutional money flowing in faster than my neighbor’s dog sprinting after a squirrel. Keep scrolling if you want the details-trust me, it’s worth it. 👀

How Institutions Are Pumping Up Ethereum’s Party Buffers

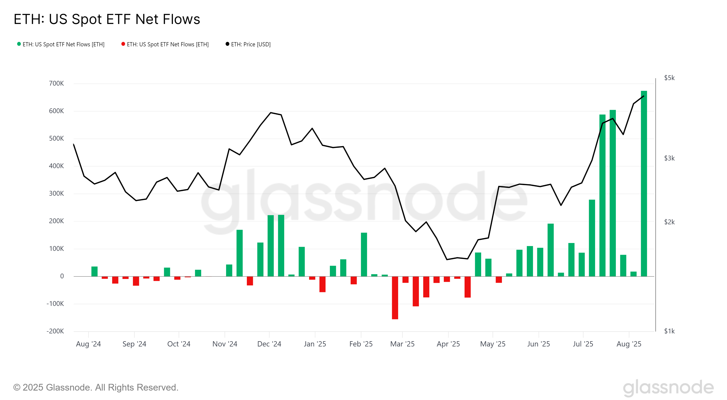

This quarter, institutional adoption is like a swoon-worthy rom-com plot twist. This little Ethereum miracle has managed to pull itself up to $4,740, fueled by nearly 674,000 ETH in net inflows from U.S. spot Ethereum ETFs last week. It’s like the Super Bowl of cryptocurrency inflows! 🏈

So, despite all the price fluctuations that make me feel like I’m on a rollercoaster designed by a caffeine-fueled toddler, Ethereum remains as steady as a rock-or at least, a rock that occasionally bobs in turbulent waters. This institutional interest is as promising as my mom’s meatloaf on a Sunday. They’re banking on good ol’ Ethereum to perform like a champ over the long haul.

Now, as of Tuesday, Ethereum is cozily resting at $4,297. That’s a respectable downgrade from the dizzying heights of $4,740-kind of like me after Thanksgiving dinner. Still, it’s firmly holding its title as the runner-up in the crypto Olympics, with a market cap of $518.14 billion-yes, with a B! And $43.99 billion in 24-hour trading volume. At this point, it’s practically a celebrity! 💰

The market dynamics have shifted from being a bit clingy to better supporting the price, like that one friend who knows when to give you space versus when to offer you snacks.

Now, for the big suspense: This zone is crucial for ETH/USD to pull off its dramatic come-back-think of a soap opera, but with potential price reversals and liquidity-driven moves instead of melodrama.

The Chart: Where Technicals Meet Drama

Recently, a tech genius-let’s call him Mister Crypto-sauntered across Twitter with news that Ethereum is making waves like a bold pantsuit at a corporate meeting. Apparently, it has been crafting a multi-month bullish broadening wedge pattern, which I’m told is a solid look for any digital asset aiming for stardom. 💼

As if this were a movie, the breakout in August was likened to a plot twist, suggesting a bullish signal right before an epic sequel. Analysts are now anticipating a little bit of a pullback, perhaps allowing Ethereum to revisit the $4,000 range-just enough to gather itself and prepare for a greater leap into the stars.

$ETH is doing a bullish retest of this Broadening Wedge.

A massive bounce is imminent!

– Mister Crypto (@misterrcrypto) August 19, 2025

Once this drama of consolidation reaches its climax, Ethereum might just be poised to soar past $8,000, ready to take center stage and steal all the thunder. Similar patterns have given Ethereum a favorable narrative arc, and every dip has been greeted with bidding like it’s Black Friday for the financially savvy. Talk about market dynamics being more supportive than my old schoolteachers! 🎓

In conclusion, that wedge pattern is the proverbial wind beneath Ethereum’s wings as it prepares for what could be its most significant breakout yet. Let’s just hope it doesn’t forget its lines like I did in the fifth-grade play! 🌟

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- STX PREDICTION. STX cryptocurrency

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Bitcoin’s Wild Ride: Will It Hit $150K or Crash Harder Than Your Ex’s Texts? 🚀💸

- ETH: A Fever Dream of Corporate Greed? 💸

- Big Ether Moves: ETH Strategy Attracts 12K ETH, BTCS Plans $2B Fundraise

- BNB’s Big Gamble: $160M Bet or Just Another Rich Kid’s Allowance? 💸🚀

- DOGE PREDICTION. DOGE cryptocurrency

2025-08-19 15:39