Amidst the tumultuous sea of Ethereum (ETH)’s latest price rally, a chorus of voices has risen, each claiming to hold the key to the future. Analysts, ever the prophets of profit and peril, pore over charts and whispers of past cycles, hinting that history might just be repeating itself, but with a twist. If their divinations prove true, ETH could be mere weeks away from reaching the zenith of its current cycle, a decisive moment that prompts investors to ponder the age-old question: Is it time to sell everything and retire to a tropical island, or to double down and embrace the storm? 😅

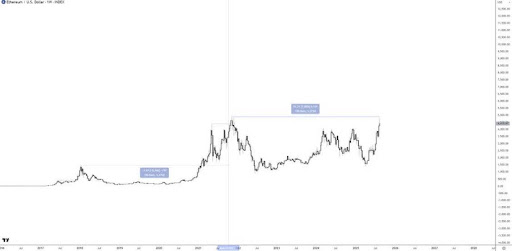

Crypto seer Jackis has ventured into the fray, sharing his insights on Ethereum’s recent price movements. Through the lens of social media, he notes that ETH’s price action eerily mirrors its behavior from previous cycles. A glance at the chart reveals that Ethereum hit major cycle tops in January 2018 and November 2021, each followed by a precipitous fall. Both peaks were heralded by a sharp upward trajectory, only to succumb to the weight of its own success. Jackis observes that in those cycles, ETH soared well above prior highs before crashing back to earth. This time, however, the altcoin has not yet breached its all-time high, though it is drawing dangerously close to that critical threshold. 📈

The timing of ETH’s current setup is nothing short of significant. According to the four-year cycle theory, the cryptocurrency could be just four weeks away from a major top, with September looming as a critical juncture. Jackis warns that this window is a moment for investors to reassess their risks and consider whether “selling everything” is indeed the prudent course. 🚨

Yet, the landscape is not uniform. While Ethereum’s structure exudes strength, many altcoins lag far behind, like stragglers in a marathon. Binance Coin (BNB), XRP, and Dogecoin (DOGE) have already marked their peaks in 2021 and remain well below those lofty heights. Jackis notes that their price action suggests a market environment more akin to ETH trading around $2,200, rather than its current valuation below $4,500. Bitcoin, the elder statesman of cryptocurrencies, has steadily climbed since its November 2022 lows, forming a bullish pattern of higher lows and higher highs. 🐬

But not all experts see the impending doom. Crypto market sage Ether Wizz argues that the current panic selling of Ethereum is a familiar refrain, echoing the mistakes traders made with Bitcoin in past cycles. He contends that early sellers often underestimate the resilience of institutional demand and long-term buyers, only to witness BTC soar beyond their wildest dreams. 🌠

Ether Wizz points to a recent rebound in the Ethereum price above the 50-week Simple Moving Average (SMA), a historical harbinger of explosive rallies. The parallels between Ethereum’s 2025 chart and its 2017 breakout are striking. In both instances, the cryptocurrency consolidated, reclaimed its moving average, and then surged with renewed vigor. 🚀

Despite the optimistic outlook, Ether Wizz acknowledges that Ethereum could face a short-term correction of 5% to 10%. However, he remains steadfast in his belief that ETH has not yet reached its peak. Instead, he sees the cryptocurrency in the early stages of a move that could propel its price toward a new all-time high of $10,000. 🌟

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Bitcoin’s Big Sigh: ETFs Flee as Miners Outpace Demand! 🐢💸

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Dogecoin’s Descent: Will It Hit $0.13? 🐕💸

- DOGE PREDICTION. DOGE cryptocurrency

- 🇯🇵 Yen Stablecoins: Japan’s New Digital Samurai Sword? 🗡️💰

- Bitcoin Flees, Ethereum and Friends Throw a Wild Party 🎉💸

2025-08-18 19:38