In what can only be described as a move typical of a coin toss, the Federal Reserve has decided to call it a day on its shiny new kid-on-the-block, the Novel Activities Supervision Program. Launched in 2023, it aimed to keep an eye on banks playing with digital toys like cryptocurrency, blockchain magic, and fintech Frankenstein experiments. But apparently, the Fed’s new hobby is ignoring novelty altogether, as they now say they’ve got the situation under control so well that they can pack up the supervision tent and go back to worrying about inflation and whether the coffee machine’s working.

Now, all the crypto shenanigans-stablecoins, tokenized securities, API bank-non-bank speed dating-will just be smeared across the usual roll of regulatory parchment. Because why bother with a dedicated program when you can just call it “business as usual” and hope it all doesn’t go sideways during lunch?

The official line? The Fed’s basically saying, “We’ve got this,” which is a little like a tightrope walker announcing they’ve learned to walk without a net, right after flipping the safety net upside down. They’ve somehow managed to believe that they know enough about these newfangled activities to let them flourish or flop on their own terms. A brave, if slightly questionable, gamble.

Treasury Gives Bitcoin the Cold Shoulder-No New Digital Gold Bars for You

Meanwhile, across the bureaucratic battlefield, US Treasury Secretary Scott Bessent (a name that sounds like a superhero leaving his cape at home) announced that the government will *not* be adding fresh Bitcoin to its shiny new “Strategic Reserve,” because who would want more of that volatile, digital pixie dust? The official stash, valued between $15 billion and $20 billion, will be built strictly from confiscated coins, as if they’re trying to turn crypto into the misunderstood rebellious teenager of the finance world.

In a flirtatious chat with Fox News, Bessent clarified that these Bitcoin reserves are meant to be… well, a “store of value.” Because, of course, gold’s traditional twinkle is just not shiny enough for modern tastes. Bitcoin is now basically the cool cousin who shows up at the family BBQ with a new gadget-the official reserve’s new best friend.

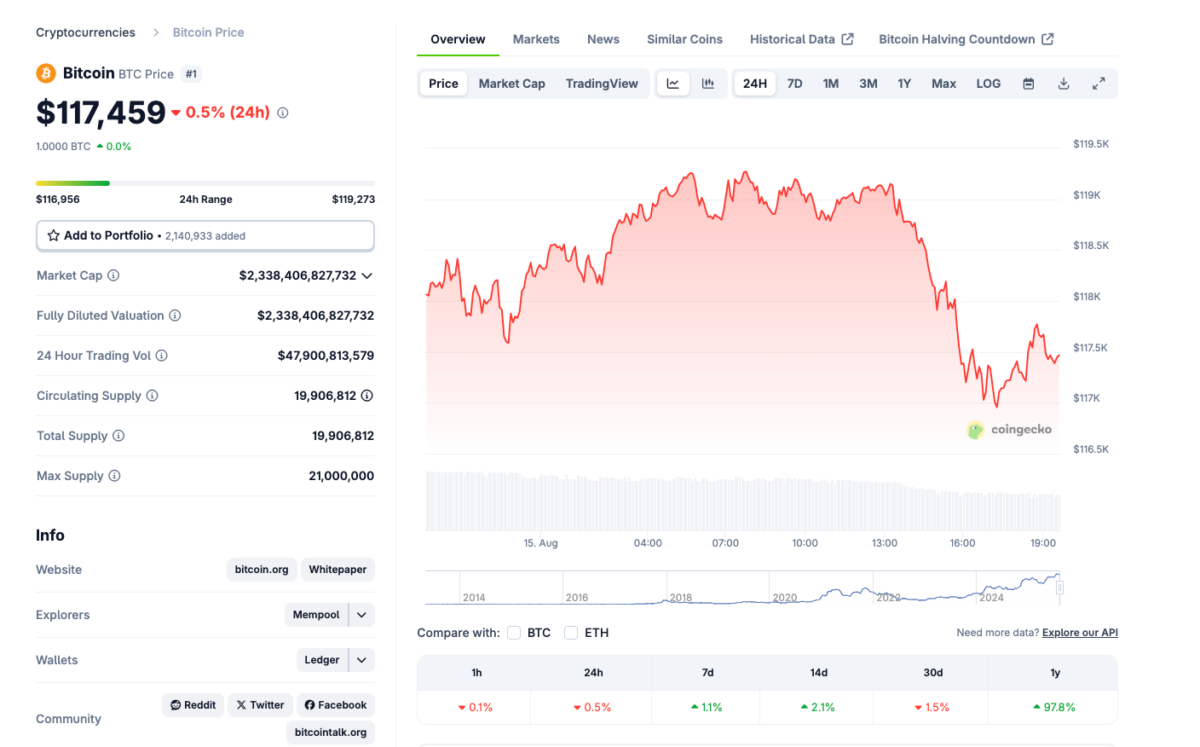

Bitcoin (BTC) Price Action | Source: CoinGecko

As if temper tantrums are part of the process, Bitcoin suddenly dipped to $116,856-about the same as a really expensive pizza-before bouncing back to a touching $117,500. Investors are already eyeing the second half of August 2025, quivering at the thought of more relaxed rules and a flood of corporate BTC adoption, because what could possibly go wrong?

Meet Maxi Doge: The Meme That Cried Wolf-or Just Raked in $1 Million?

Meanwhile, in the land of wild internet animals and speculative chaos, Maxi Doge ($MAXI)-the latest meme token-has decided to be the life of the party. With staking, contests, and partner platforms, it aims to turn “investing” into a game of hyper-juice high stakes. Meanwhile, traders are leveraging their house on this little pup, with 1000x leverage and a zero-sum stop-loss. Because what’s more fun than risking it all for the thrill of possibly losing it all?

Maxi Doge Presale

Currently riding the wave at just $0.000252, the presale has already scooped up over a million dollars-because nothing screams stability like a meme token in its final hours. With the next jump just around the corner, the brave and reckless are encouraged to visit the official site before this rocket either takes off or crashes spectacularly.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- Dogecoin’s Dashing Cup-and-Handle: Is $0.25 the New $10? You Won’t Believe It!

- Why Cardano’s Next Move Might Make You Say ‘Wow’ or ‘Oh No’

- Altcoin đang âm thầm tăng giá: Chưa đến 1 USD, nhưng sẽ vượt Dogecoin vào đầu năm 2025!

- Bitcoin’s Big Sigh: ETFs Flee as Miners Outpace Demand! 🐢💸

2025-08-16 00:21