What to know:

- The number of S&P 500 companies mentioning ‘recession’ in earnings calls has dropped significantly.

- Despite fears of economic impact from President Trump’s tariffs, markets have largely ignored recession concerns, with the S&P 500 rising 28% since April.

- Over 80% of S&P 500 companies have beaten earnings expectations in the second quarter, marking the strongest performance in four years.

Ah, the grand theater of Corporate America! The specter of a looming economic recession has dissipated with the swiftness of a summer breeze, leaving behind only the faintest whisper of its presence.

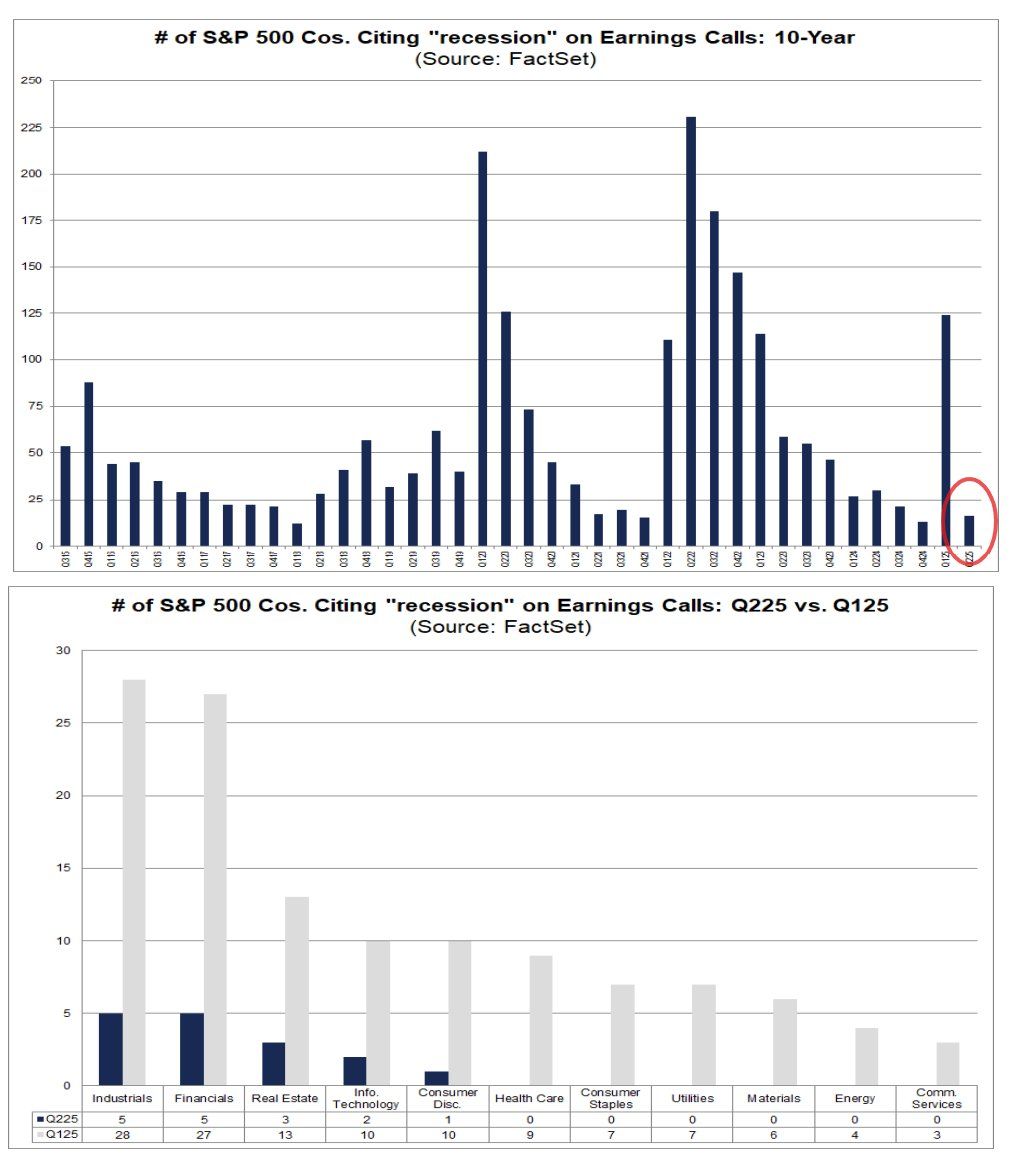

In a most curious turn of events, the number of S&P 500 companies daring to utter the word “recession” during their second-quarter earnings calls has plummeted to a mere 16, a staggering drop from 124 in the first quarter, as revealed by the ever-reliable FactSet. One might ponder, what is a recession, if not two consecutive quarters of negative growth? A rather dreary affair, indeed.

“Recession was uttered just 16 times so far on earnings calls this quarter (4%), down from 124 in Q1 and the 10-year average of 61. After Q4 ’24 it was the least of any quarter since Q4 ’21,” remarked Neil Sethi, managing partner at Sethi Associates, in a moment of statistical revelation on X, quoting FactSet. One can only imagine the collective sigh of relief from the corporate boardrooms.

Yet, amidst this newfound optimism, some observers cast wary glances towards President Donald Trump’s trade tariffs, fearing they might cast a long shadow over the economy. Perhaps these company leaders are clinging to the hope that the elevated tariffs will soon be “watered down” through negotiations, rather than remaining a persistent economic albatross.

In a rather theatrical flourish, Trump recently unveiled sweeping tariffs, adding to those announced in April, all in the name of igniting a manufacturing renaissance. This bold move has propelled the average U.S. tariff rate to a staggering 20.1%, the highest sustained level since the 1910s, according to the estimable World Trade Organization and the International Monetary Fund.

Yet, the markets, in their infinite wisdom, have chosen to look past these tariff-induced recession fears, with the S&P 500 soaring 28% since the early April dip. Bitcoin, that whimsical creature of the financial world, has surged to $122,000 from a mere $75,000-a 62% increase in just four months, as per CoinDesk data. One can only chuckle at the absurdity of it all.

According to the ever-watchful JPMorgan, traders have been focusing on resilient corporate earnings and the anticipated economic recovery following the interim slowdown. More than 80% of S&P 500 companies have recently reported their second-quarter earnings, with over 80% surpassing earnings expectations and 79% exceeding revenue forecasts. A performance so robust, it could make even the most stoic of investors crack a smile.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- ETH PREDICTION. ETH cryptocurrency

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

2025-08-11 11:28