In the quiet hours of the morning, when the coffee was cold and the screens flickered with numbers, Ethena’s USDe had quietly reached a $10 billion market cap, a feat that made even the most stoic analysts twitch with a mix of awe and existential dread. One might think it was a miracle, but then again, miracles are just crypto with better PR.

Yet, whispers of skepticism linger like a bad odor at a dinner party. “UST 2.0?” some mutter, sipping their lukewarm espressos, as if the ghost of Terra’s collapse still lingers in the chatrooms. But let’s not spoil the fun just yet-after all, who doesn’t love a good financial rollercoaster?

Ethena’s $10 Billion Milestone: A New Chapter (or Is It a Cliffhanger?)

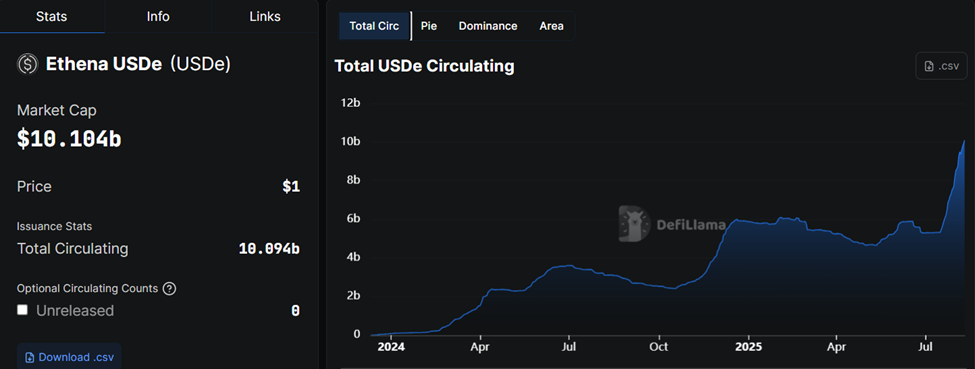

Ethena’s Total Value Locked (TVL) broke the $10 billion mark on a Sunday, doubling in under a month. The past week? A fee-generating spectacle, with over $475 million in fees-enough to buy a small island and name it after someone’s ex.

The supply? Doubled. Investors? Now watching with the intensity of a cat eyeing a laser pointer. One wonders if they’ve all forgotten the last time someone said “explosive growth”… 😂

Analyst Crypto Stream, a name that sounds like a TikTok influencer, claims ENA is on the verge of unlocking a “revenue engine” so powerful it could power a Tesla factory. Four of five governance conditions are met, including USDe’s supply surpassing $8 billion, protocol revenue hitting $43 million, and a Reserve Fund that’s 1% of supply. The cherry on top? An APY spread of 10%, which is 2.5% more than promised. Progress!

The final hurdle? Listing on Binance or OKX. Because what’s a stablecoin without a little regulatory drama to keep things spicy?

“Fee switch turned on: Ethena is a revenue monster. At some point, revenue will be funneled into ENA,” Crypto Stream posted, calling ENA their “largest spot position.” One can almost hear the sound of a thousand keyboards clacking in existential dread.

But Binance and OKX? Still missing. Binance’s EU troubles, caused by some MICA compliance hiccup, are the plot twist no one saw coming. Yet, the EU’s rejection might just be the catalyst for a global listing-because nothing says “success” like being banned in Europe. 🇪🇺

Details on the missing Binance integration:

USDE was not integrated into Binance due to a regulatory issue in Germany regarding MICA compliance.

The bad news is that: It seems the issue cannot be resolved, so USDE will not be able to operate in the EU market in the foreseeable…

– Crypto Stream (@CryptoStreamHub) August 10, 2025

Still, off-boarding EU users earlier this month may clear the path for a global USDe listing. A bittersweet victory for the continent that invented the euro but can’t handle a stablecoin.

Converge: The Yield Powerhouse (or the Next Great Collapse?)

Analyst Jacob Canfield, who seems to have a sixth sense for crypto trends, points to Ethena’s blockchain, Converge. The plan? Merge TradFi and DeFi with USDe as the hero of the hour. Validators will stake ENA to earn transaction fees, turning it into a yield-bearing asset. Sounds like a dream, unless you’re a validator who’s about to lose sleep.

Introducing @convergeonchain: The settlement network for traditional finance and digital dollars, powered by @ethena_labs and @Securitize

Our vision is to provide the first purpose built settlement layer where TradFi will merge with DeFi, centered on USDe & USDtb and secured by…

– Ethena Labs (@ethena_labs) March 17, 2025

Crypto Stream also highlights StablecoinX’s Nasdaq listing plans, which could attract institutional investors like bees to a crypto-flower. Circle’s USDC success is a reminder that TradFi loves stablecoins-until it doesn’t.

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol “USDE”, which includes a $60 million contribution of ENA from the Ethena Foundation…

– Ethena Labs (@ethena_labs) July 21, 2025

Arthur Cheong of DeFiance Capital, a man who knows a thing or two about tokens, claims funds dismissed ENA because of its “too many unlocks” problem. One wonders if they’ve ever heard of patience-or maybe they just prefer their tokens to be as stable as a house of cards.

“You guys simply have no idea how many funds… casually dismissed $ENA with one simple reason of ‘too many unlocks’ and ignored the potential growth ahead and the tier S execution of the team,” Cheong said. A poetic injustice, if ever there was one.

Yet, despite the hype, USDe’s rise has drawn comparisons to UST’s collapse. Critics whisper of synthetic stablecoins’ fragility, while Ethena’s founder, Guy Young, insists on risk controls and diversified DeFi collateral. One can only hope the “controls” aren’t just a PowerPoint slide.

If Binance or OKX ever list USDe and the fee switch activates, ENA holders might see revenue flow in. And if the Fed cuts rates? Well, lower funding costs are the crypto equivalent of a warm hug. 🤝

As of this writing, Ethena was trading for $0.7759, up by over 3% in the last 24 hours. A modest gain, perhaps, but in crypto, 3% is the difference between a nap and a heart attack.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- AVAX PREDICTION. AVAX cryptocurrency

2025-08-10 21:38