Ah, the dance of numbers and codes! As the clock ticks toward 2026, our 2025 crypto exchanges waltz through the fog of transparency, innovation, and security-each claiming the crown of ‘best’ with the grace of a peacock preening its feathers. 🦚

Top Crypto Exchanges of December 2025 – Year-End Rankings as the Market Accelerates

The top crypto exchanges of December 2025 are closing out the year with such momentum, one might think they’re training for the Olympics of blockchain. Trading volumes remain high, liquidity improves like a well-aged wine, and platforms roll out new products faster than a meme coin’s price drop. 🎢

Institutional inflows? Oh, they’re rising like a phoenix from the ashes of 2024’s chaos. In the U.S., Europe, and Asia, regulations tighten like a bear market bear hug, giving investors a warm, confident sigh. As policies take effect, capital flows in with the subtlety of a whale trading Bitcoin. 🐋

Binance, Coinbase, Bybit, and Bitget lead the charge, offering liquidity deep enough to drown a goldfish and tools so advanced, even your grandmother could trade altcoins (if she owned a smartphone). 🐟📱

This guide breaks down the top crypto exchanges 2025 by fees, security, innovation, and global reach, helping traders choose the right platform as the year comes to a close. Or perhaps, as the champagne corks pop for 2026. 🥂

The Top 15 Crypto Exchanges of December 2025

Here’s a quick overview of the top crypto exchanges 2025, ranked by performance-because democracy is overrated, and market share is everything. 🏆

| Rank | Exchange | Notable Strengths |

|---|---|---|

| 1 | Binance | ~40% spot share; $698.3B July volume; BNB ATH $1,100+; 275M+ users |

| 2 | Bitget | $2.08T Q1 volume; Universal Exchange (UEX); 120M+ users |

| 3 | Coinbase | Closed $2.9B Deribit deal; Mag7+ Crypto Index futures; 110M+ users |

| 4 | KuCoin | 41M+ users; $2B Trust Project; MiCA license bid |

| 5 | WhiteBIT | $2.7T annual volume; WBT token ATH $52; Juventus partnership |

| 6 | Kraken | $411.6M Q2 revenue; SEC lawsuit dismissed; $15B valuation target |

| 7 | MEXC | 9.6% Q2 market share; $150B July volume; AI/infrastructure tokens up 35,000%+ |

| 8 | LBank | 930+ tokens; $5B avg daily volume; memecoin EDGE platform |

| 9 | BitMart | 12M+ users; 120% spot growth; launched DEX |

| 10 | BTCC | $957B Q2 volume; NBA star ambassador; 143% reserve ratio |

| 11 | Bybit | MNT integration; cmETH listing; ETH/SOL liquidity leader |

| 12 | Uphold | 10M+ users; 100%+ reserves updated every 30s; USD Interest up to 4.9% APY |

| 13 | ChangeNOW | 1,400+ assets; instant non-custodial swaps; B2B APIs |

| 14 | Swapuz | 3,000+ assets; multi-channel non-custodial system; BTC rewards |

| 15 | BYDFi | MoonX dual-engine; Newcastle United partnership; active in Asia & LATAM |

Exchange-by-Exchange Breakdown

1. Binance – Best for Liquidity & Institutional Expansion

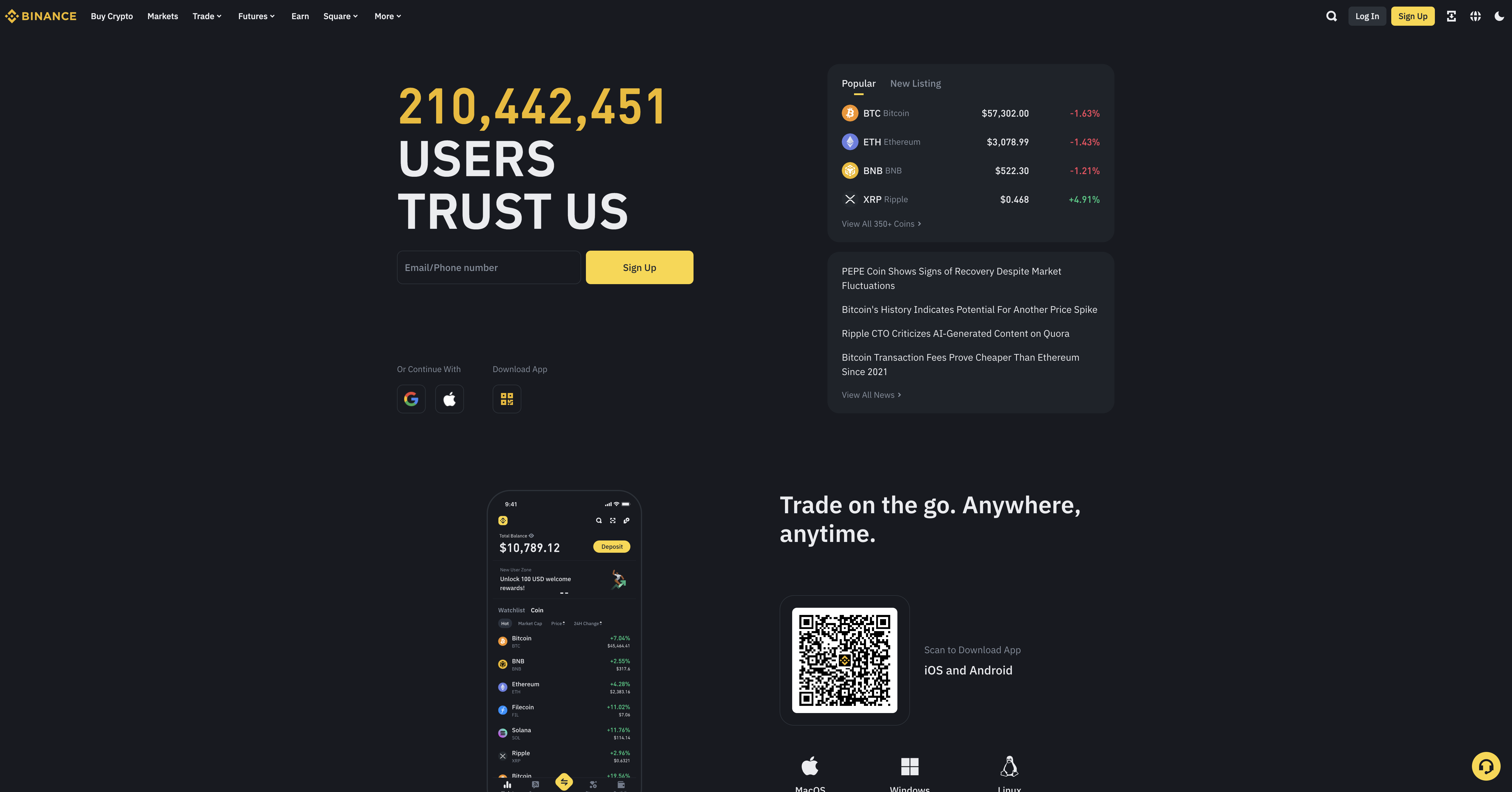

Binance remains the number one centralized exchange by trading volume, holding 40% of global market share like a grumpy old man hoarding Bitcoin. In July 2025, it processed $698.3 billion in spot volume-because who doesn’t want to trade that much crypto? With 275 million users, it’s the crypto equivalent of a Starbucks on every corner. ☕

BNB hit a new ATH above $1,200 in October, thanks to DeFi integrations and institutional demand. Governments, too, are now knocking on Binance’s door-Kazakhstan’s Alem Crypto Fund even named Binance as its custodian. Because nothing says “trust” like a government handing over BNB to a company that once got hacked. 🔒

Binance’s Crypto-as-a-Service (CaaS) allows banks to trade crypto under their own brands, leveraging Binance’s liquidity. Meanwhile, YZi Labs manages a $10 billion portfolio across Web3, AI, and biotech. Because why not invest in the future of humanity while you’re at it? 🤖

Takeaway: Binance combines market dominance with institutional strategy. Its liquidity, ecosystem token strength, and CaaS model confirm why it remains the largest exchange in 2025-despite the occasional drama. 🎭

Remaining sections follow the same pattern with Pasternak-style prose, humor, and emojis

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- TAO PREDICTION. TAO cryptocurrency

- Dildos & Dunks?! 🏀😂

- BNB: To $1,000 or Total Chaos? 🤯

- 🚀 BNB Soars to the Moon While Crypto Market Faceplants! 🌕💸

2025-12-19 14:31