Bitcoin, that sly crypto jester, now struts through September with a grin wider than a Kremlin vault, its gains a mere 8%-a polite nod to the “Uptober” ritual. Analysts, armed with crystal balls and spreadsheets, whisper of a double-digit October crescendo, as if the market were a puppet on a string of historical patterns. One might think they’ve discovered a formula for immortality.

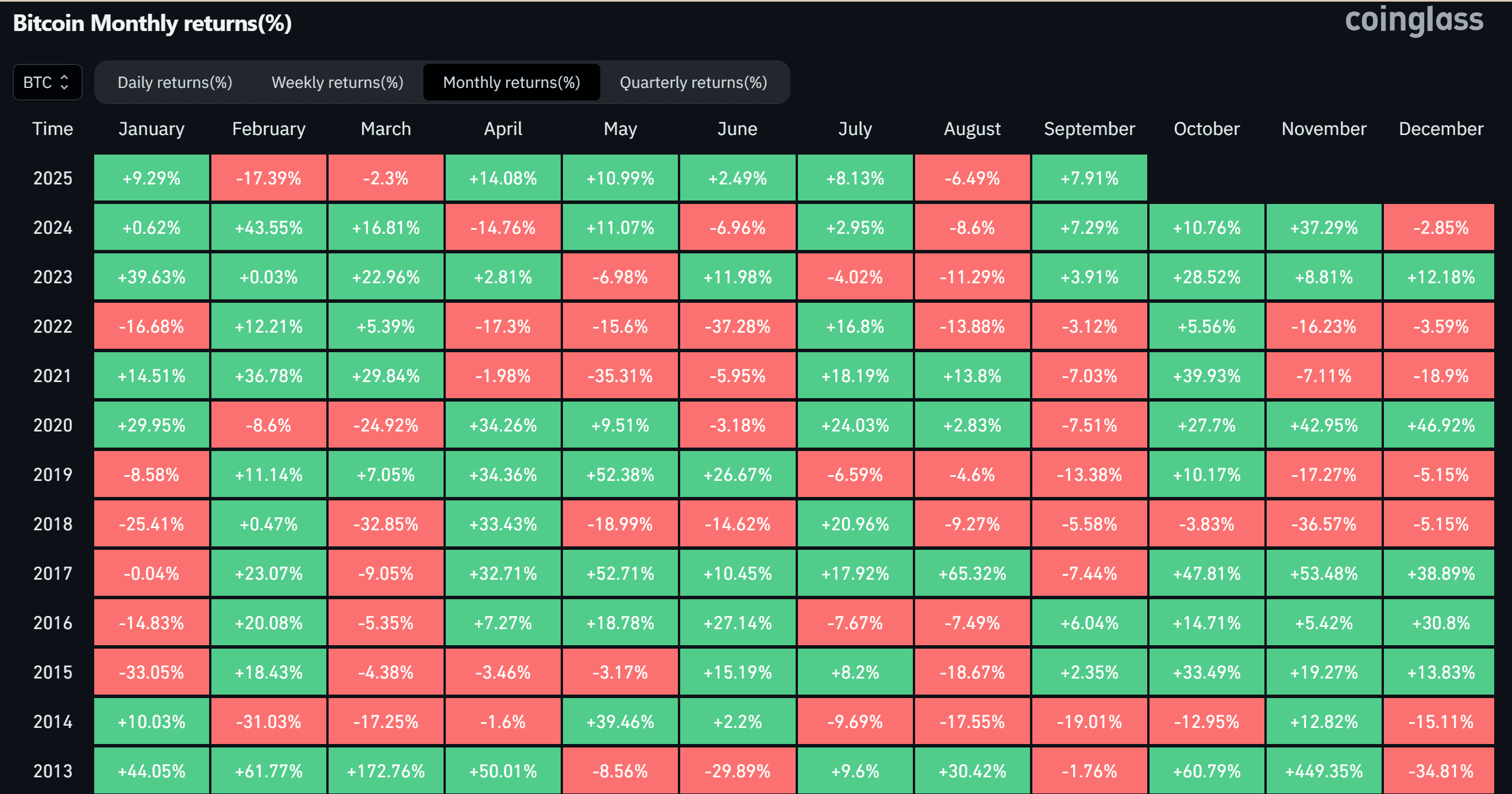

Behold the alchemy of “Uptober”: September’s green blush, October’s red-letter day. In 2024, BTC moonwalked +7.29% into a +10.76% October waltz. In 2023, a modest +3.91% September was followed by a +28.52% October tantrum. The chart? A parable of greed, or a cosmic joke?

This self-fulfilling prophecy, dear reader, is a masquerade of supply and demand. Traders, like lemmings with calculators, pour money into the void, creating a “Uptober” myth so potent it bends reality. A supply shock? The April 2024 halving, a ritual slashing mining rewards by 50%, now whispers of scarcity. One might call it a “supply-side serenade” to the gods of greed.

History repeats, or perhaps it’s just the market’s way of mocking us. The 2016 halving birthed a $20,000 Bitcoin baby in 2017. The 2020 halving? A $69,000 phoenix by November. October, it seems, is the month where dreams and wallets collide.

Macroeconomic Fairy Tales and Institutional Whimsy

The Fed, in a September 2025 epiphany, cut rates by 25 BPS-a gentle nudge for BTC to soar to $118K. Meanwhile, the Trump administration, with the seriousness of a Kremlin speech, unveiled a Strategic Bitcoin Reserve in March 2025. One might call it a “crypto New Year’s resolution” for the ages.

Spot Bitcoin ETFs, those modern-day grifters, now hoard $1.3 million BTC, their inflows a weekly spectacle. Institutions, like vultures with PhDs, outpace miners in a dance of supply and demand. The market, a carousel of hype and hubris, spins ever faster, leaving sanity in the rearview mirror.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- USD TRY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- EUR USD PREDICTION

2025-09-21 11:50