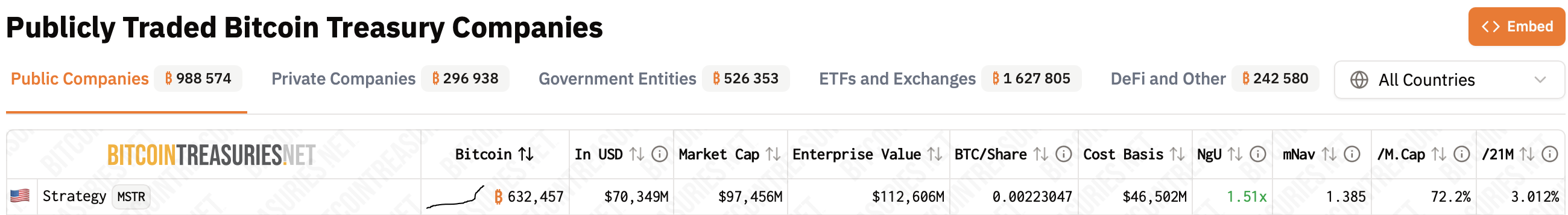

Ah, mes chers lecteurs, behold the grand spectacle of Michael Saylor’s Strategy, the paragon of corporate Bitcoin (BTC) folly! With a flourish of his quill, this modern-day Midas hath amassed a staggering 632,457 Bitcoins (BTC) in his coffers. 🧐 Such audacity hath propelled Strategy to the lofty heights of 3% of the BTC supply-a feat so grand, it doth make the sun blush! ☀️

Strategy, the Titan of BTC Hoarding

Strategy (MSTR), a company of such renown in the land of Uncle Sam, hath increased its Bitcoin (BTC) treasure to 632,457 BTC, purchased at the princely sum of $73,527 per coin. 🏰 Lo and behold, this hoard now surpasseth 3.012% of the sacred 21 million BTC that shall ever grace this earth, as decreed by the Bitcoin Treasuries tracker. 📜

Formerly known as MicroStrategy, this corporate behemoth now wields $70.4 billion in Bitcoin (BTC), a sum so vast it composeth 72.2% of its market cap. 🤑 On the 25th of August, 2025, Strategy, ever the glutton for digital gold, acquired an additional 3,081 BTC-a mere $356.9 million-at the exorbitant price of $115,829 per coin. 🪙

Pray, compare this to Marathon Holdings (MARA), Strategy’s humble rival, whose BTC stake is but a pittance-12.5 times smaller! 😏 Corporations, in their collective wisdom, have allocated nearly $110 billion in Bitcoin (BTC), claiming 4.7% of its total supply. The greatest returns, alas, have been claimed by Riot Platforms and ProCap BTC, leaving others to gnash their teeth in envy. 😤

Bitcoin’s Price: A Dance of Folly and Fate

Latecomers to this grand ball, such as the “Japanese Strategy” Metaplanet Inc., have but 19,000 BTC to their name, with a paltry 1.09x ROI. 😢 Bitcoin (BTC), the crown jewel of cryptocurrencies, tradeth at $112,236, a 2% dip in the last 24 hours. Some doom-mongers predict the rally’s end, yet Glassnode, that wise oracle, proclaimeth that the greatest gains are yet to come. 🔮

Relative to prior cycles, #Bitcoin’s all-time highs in 2017 and 2021 were reached just 2-3 months ahead of today’s point in the cycle. While history is a limited guide, it’s a noteworthy context given recent profit-taking and elevated speculative activity. 🎭

– glassnode (@glassnode) August 25, 2025

Based on the annals of 2017 and 2021, the peak phase may arrive in 2-3 months. Yet, the cycles of crypto, like the whims of the gods, grow ever longer with the swelling capitalization of these digital realms. 🌪️

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- ETH PREDICTION. ETH cryptocurrency

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

2025-08-25 19:48