Ah, the theater of regulation! Behold, as the Philippine SEC, with quill in hand and a furrowed brow, doth accuse the global crypto exchanges of mischief most foul! 🕵️♂️ These digital scoundrels, it seems, have dared to woo Filipino users without the sacred blessing of compliance. Tsk, tsk! 😏

The SEC’s Lament: “Thou Shalt Not Trade Without Our Say-So!”

On the fourth day of August, the Philippine Securities and Exchange Commission (SEC), with a flourish of its advisory, did proclaim: “Beware, dear investors, of these rogue platforms that lurk beyond our shores! 🌊 They offer their crypto wares without our seal of approval, a sin most grievous!” The regulator, with a wag of its finger, declared that these digital asset providers are but vagabonds, operating sans authorization. “Fie upon them!” it cried, “for they defy our newly minted rules!” 📜

“Mark well, good sirs and madams, these rules do bind any scoundrel who doth offer, promote, or facilitate crypto trading! Be it buying, selling, or derivatives, none shall escape our watchful eye! 👀”

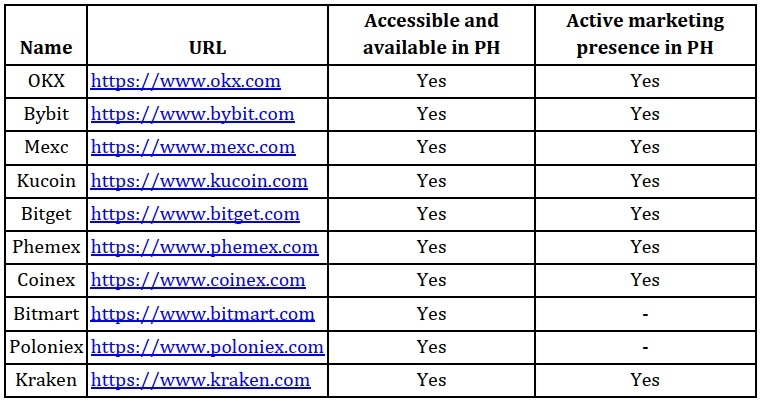

And lo, the SEC did name the culprits-a rogues’ gallery of ten exchanges: OKX, Bybit, Mexc, Kucoin, Bitget, Phemex, Coinex, Bitmart, Poloniex, and Kraken. 🦜 These miscreants, it seems, have dared to ply their trade within the Philippines, unencumbered by the SEC’s license. “A pox upon them!” the regulator cried, “for they flout Memorandum Circulars No. 4 and No. 5, which came into force in the year of our Lord 2025!”

But hark! The SEC did add, with a sly grin, “This list is but a fragment! Other platforms, too, may be guilty of this transgression. Woe betide those who offer their services without our blessing, for they are but outlaws in our eyes!” 😈

And what of Binance, you ask? Ah, that tale is already told! Yet, the SEC doth reveal that other platforms still linger, like unwelcome guests at a feast, marketing their wares to the Philippine populace without license. “They must be stopped!” it thundered, “lest they lead our citizens astray!” 🚫

“These exchanges, with their siren songs of crypto riches, do tempt the unwary! But fear not, for we shall protect thee, even if it means dragging them to court or enlisting the aid of tech giants! 💻”

Yet, beyond the farce of investor protection, the SEC did warn of graver dangers. “These unregulated entities,” it intoned, “operate beyond the reach of the Anti-Money Laundering Act (AMLA)! They keep no records, report no suspicions, and thus may aid the nefarious deeds of money launderers and other miscreants! 🕵️♂️” The regulator, with a dramatic flourish, declared that such laxity could lead to the Philippines being gray-listed-a fate most dire! 😱

And so, the SEC doth prepare its arsenal: cease and desist orders, criminal charges, and the like. But hark! Some crypto proponents, with a wink and a nod, suggest a more amicable approach. “Collaborate, good SEC,” they plead, “lest you stifle innovation and drive the digital asset sector into the shadows! 🤝”

Thus ends this act of the Philippine crypto drama. What shall the next scene bring? Stay tuned, dear reader, for the plot thickens! 🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Will Ethereum’s $5K Destiny Unravel as Whales Assert Themselves? 🐋💰

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Meme Coins: September’s Silent Revolution? 🤑

- The Winklevoss Twins Cash In: Bitcoin Firm Goes Public & Gemini’s Big IPO

- Bitcoin’s Wild Ride: Will It Hit $150K or Crash Harder Than Your Ex’s Texts? 🚀💸

- Bitcoin Flees, Ethereum and Friends Throw a Wild Party 🎉💸

2025-08-05 06:57