In the grand theater of finance, where the curtain falls with a thud upon the stage of $115,000, the Bitcoin saga unfolds like a peasant’s lament. One might ponder—does this mark the twilight of the bull run, or merely a yawn from the market’s insomniac muse? The on-chain whispers hint at a farce still in its third act.

Joao Wedson, that crypto oracle in a tweed coat, declared on X that the long-term holders (LTHs), those noble scribes of Bitcoin’s ledger, have begun their slow dance toward the exit. “Aged coins stir,” he intoned, “as if roused from a century of slumber by the scent of profit and the distant echo of ETFs.” Yet, with 50% of ETF-held Bitcoin already sold, Wedson, ever the optimist, insists the bull market will persist “for at least two more months”—a promise as certain as Tolstoy’s belief in the redemption of man.

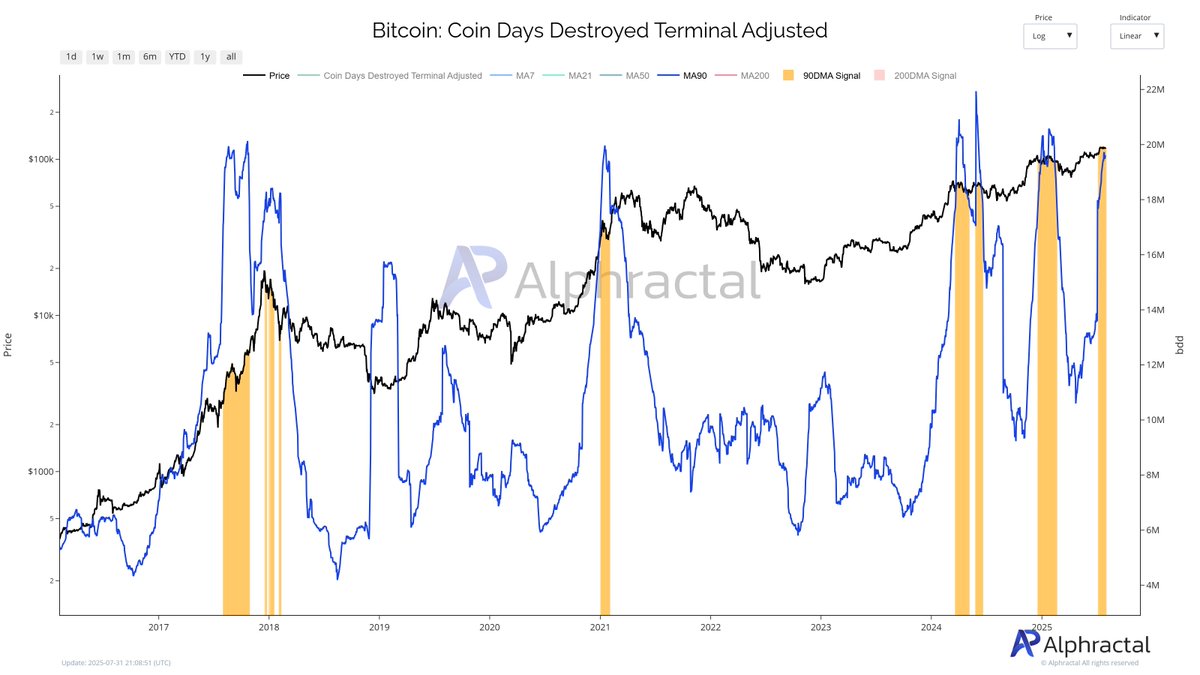

The Coin Days Destroyed Terminal Adjusted Metric, that most arcane of financial runes, now blinks ominously. Three warning signs, like three fates spinning their threads, suggest a local top. But ah, the Reserve Risk Indicator dances to a different tune, its “warning zone” a mere suggestion to the LTHs, who sell with the enthusiasm of a Cossack at a barn sale.

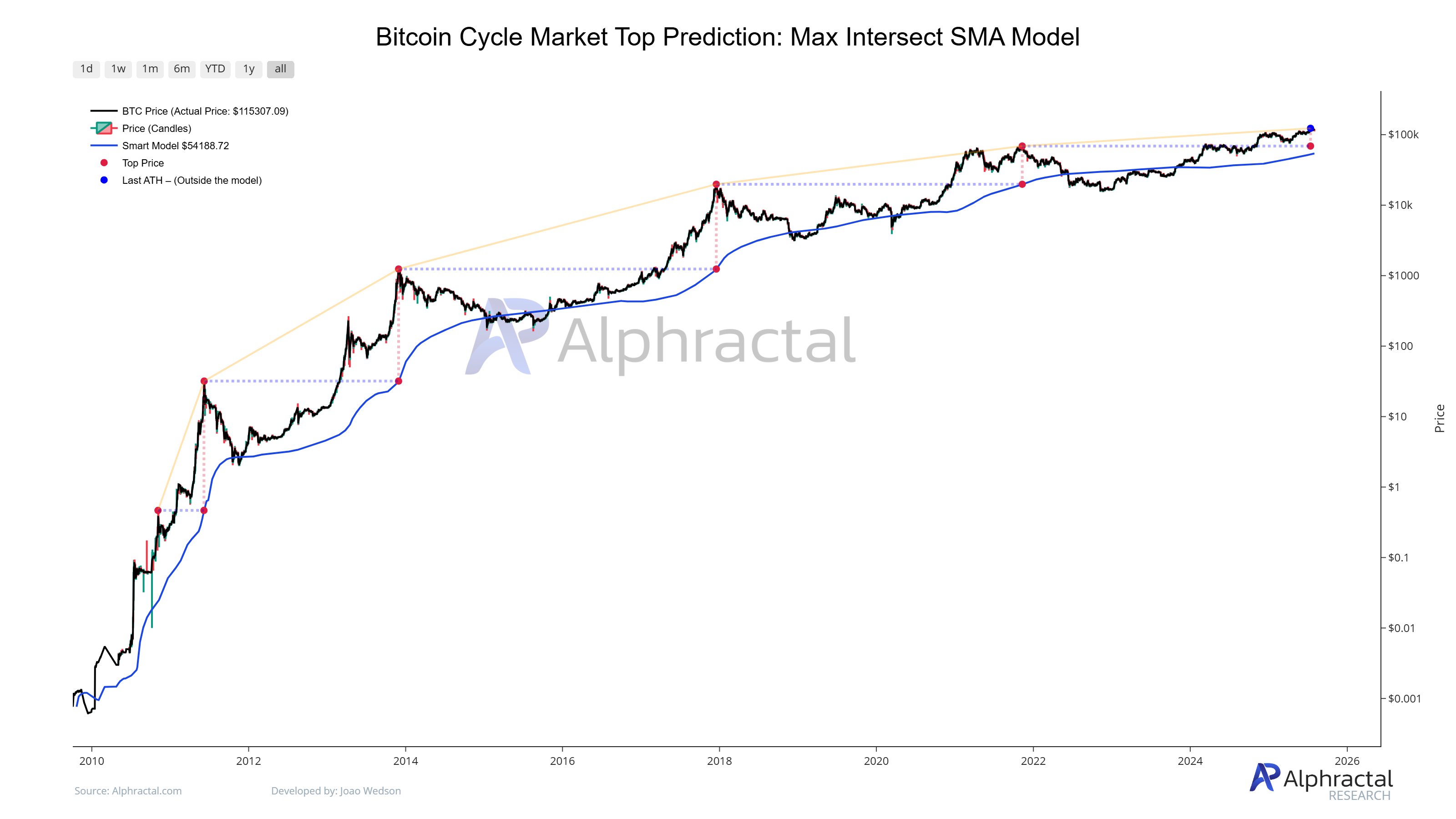

The Spent Output Profit Ratio (SOPR), that ledger of greed and guilt, now whispers of bearishness. “Profit-taking,” Wedson sighs, as if describing the last gasp of a doomed hero. Yet the Max Intersect SMA Model, hailed as “the most accurate metric in the world,” remains silent. Until the blue line reaches $69,000, the final top remains a phantom, like the ghost of a Czar haunting a blockchain.

And so, dear reader, the market teeters between despair and delusion. At $113,052, Bitcoin’s price dips like a peasant bowing to a tsar, yet the cycle endures. As Tolstoy might say: “All is flux, but the LTHs sell. All is chaos, but the bulls persist. And the people? They scroll, they trade, and they wonder.”

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- BNB: To $1,000 or Total Chaos? 🤯

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- XRP Price Tale: The River That Rises

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

2025-08-03 02:11