Well, butter my biscuit and call me a hodler-Bitcoin’s gone and tumbled below the 0.95 Cost Basis Quantile, a line in the sand so sacred it makes the Mississippi River look like a backyard creek. This ain’t just a stumble, folks; it’s a full-on belly flop into the profit-taking pond. Unless this digital darling can climb back up quicker than a cat on a hot tin roof, we’re in for a ride bumpier than a wagon on a dirt road. 🌪️

According to those number-crunching wizards at Glassnode, Bitcoin’s breach of this quantile is like a canary in a coal mine-only this canary’s got a wallet and a bad case of the jitters. If it don’t reclaim that level pronto, we’re looking at a slide down to $105K or even $90K, faster than a hound dog after a rabbit. The price is sittin’ pretty at $112,565, but that’s a 0.48% dip today, and trading volume’s drier than a bone in the Sahara at $49.5 billion. Seems like the market’s got cold feet and a case of the “what-ifs.” 🤔

#Bitcoin’s taken a header below the 0.95 Cost Basis Quantile, a line that’s stickier than molasses in January. Reclaim it, and we’re back in the saddle. Fail, and we’re in for a tumble down to $105K-$90K. Y’all better buckle up. 🚀

🔗

– glassnode (@glassnode) September 24, 2025

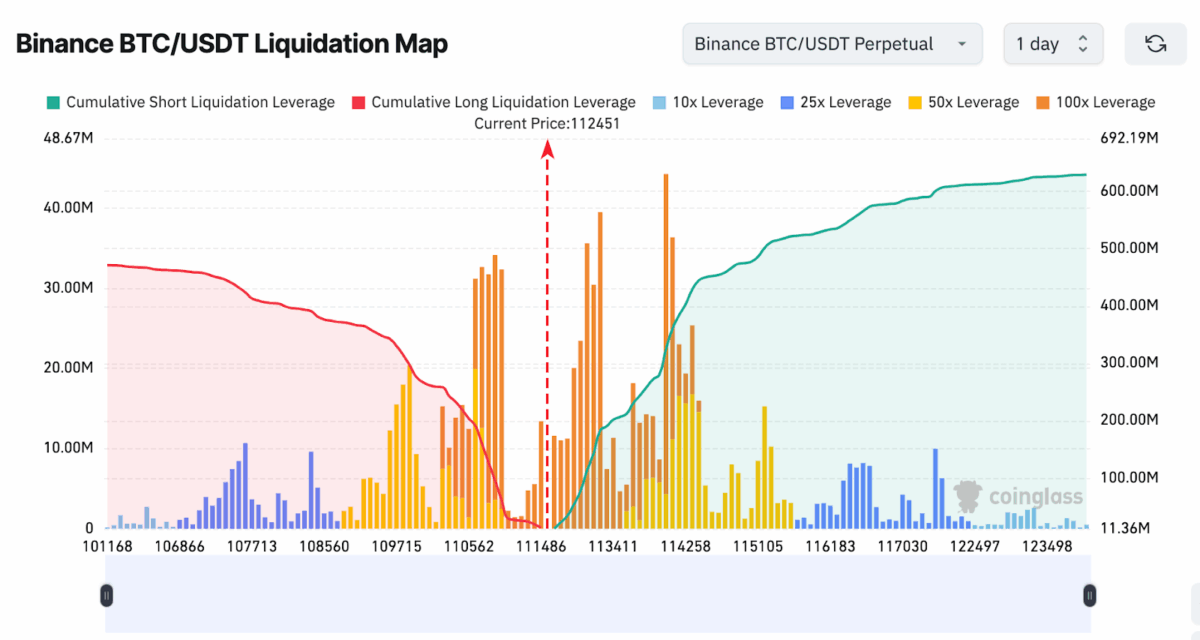

Leverage, Liquidity, and a Whole Lot of Nerves

Now, it ain’t just the charts that are lookin’ grim. Coinglass says there’s a pile of high-leverage long positions stacked up between $110K and $114K-50x, 100x, you name it. That’s like buildin’ a house of cards in a tornado. And just below the current price, liquidity’s clumpin’ up near $107K like a magnet for trouble. Break into that zone, and we’re lookin’ at liquidations so massive they’ll make a stampede look orderly. Volatility’s already higher than a Georgia pine, and this could send it straight to the moon. 🌕

Meanwhile, the rest of the crypto circus ain’t doin’ much better. The global market cap’s shrunk 0.52% to $3.89 trillion, and volume’s down over 10% to $163.97 billion. That’s less conviction than a politician at a town hall meeting. Retail and institutions alike are sittin’ on their hands, wonderin’ if this is a dip to buy or a cliff to avoid. 🧐

Bitcoin hit its all-time high of $124,457 back in August, but since then, it’s fallen harder than a pie off a windowsill-over 10% down. Now it’s teeterin’ on the edge of some structurally significant zones. If it don’t bounce back above that Cost Basis Quantile faster than a jackrabbit, we’re headed for $105K-$90K, a range so historical it’s got its own Wikipedia page. But beware, folks-that’s also liquidation territory, and nobody wants to be caught in that ruckus. 🤠

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

2025-09-25 00:33