Ah, the theater of the markets! Behold, Bitcoin, that grand doyen of cryptocurrencies, hath ascended to a new zenith of $126,198, a feat so audacious it doth drag poor Ethereum along in its wake. Lo, Ethereum, the faithful squire, hath breached the $4,700 mark after a month of languishing in the shadows. 🌟

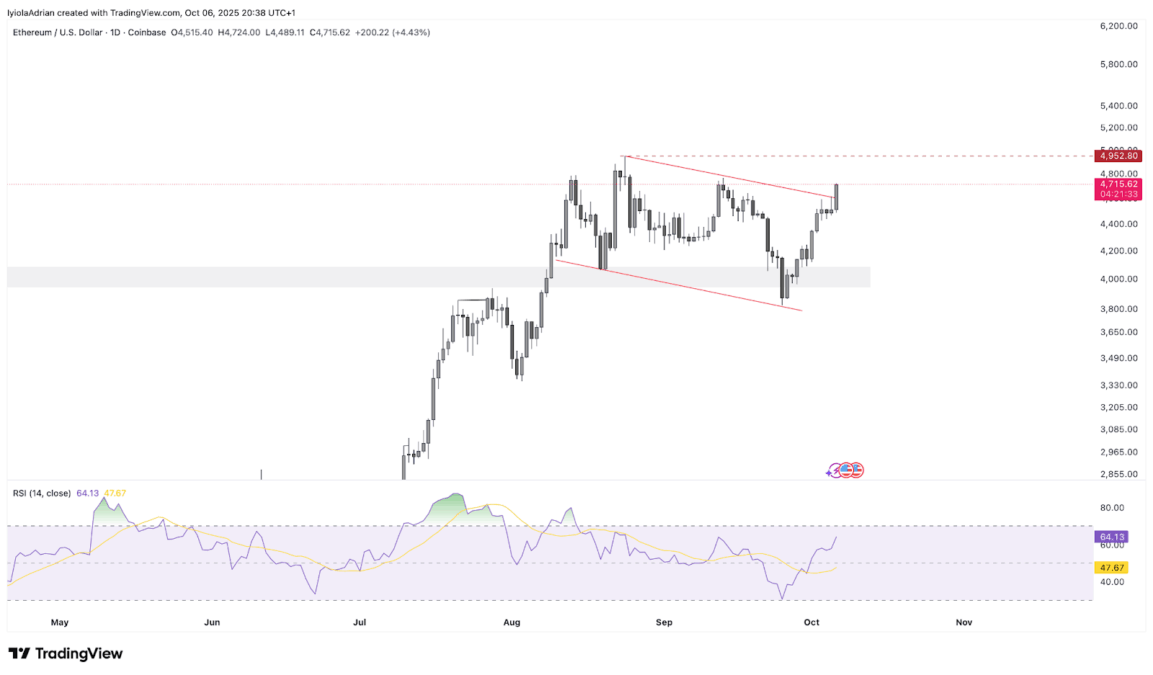

At this very hour, Ethereum trades at $4,711, a price it hath been flirting with for two moons, forming what the wise ones call a “bullish flag pattern.” Yet, inspired by Bitcoin’s bravado, it hath broken forth today, surging by 4.66%-a veritable triumph! 🎉

By the tomes of CoinMarketCap, ETH stands but 5% shy of its all-time high of $4,953, achieved on the 25th of August. The soothsayers predict this breakout shall lend it the momentum to crown itself anew. And lo, the Relative Strength Index (RSI) rests at 63, a clear sign the bulls hold the reins, with room yet for more merriment. 🐂

Whales and Their Pecuniary Capers

Mark well, dear reader, the antics of the whales! In a missive on the platform X, the sage Ali doth proclaim that these leviathans of finance have gobbled up 800,000 ETH in the past week-a sum exceeding $3.6 billion, or 25% of the crypto’s circulating bounty. 🦈💰

800,000 Ethereum $ETH bought by whales over the past week!

– Ali (@ali_charts) October 5, 2025

And lest we forget, the allure of Ethereum ETFs groweth ever stronger, with over $1 billion flowing into these vessels since the month’s dawn. Meanwhile, the hoard of Ethereum coins on exchanges hath dwindled to a nine-year low of 16.1 million, as investors retreat to the safety of private wallets, thus diminishing the specter of sell-offs. 🏦

Grayscale’s Grand Entrée into the ETF Arena

As if by divine providence, this surge coincides with Grayscale’s unveiling of spot crypto exchange-traded funds in the U.S. Among them, the Ethereum Trust ETF (ETHE), Ethereum Mini Trust ETF (ETH), and Solana Trust (GSOL), as chronicled by the CryptoTimes. 🎭

“Staking in our spot Ethereum and Solana funds is exactly the first mover innovation Grayscale was built to deliver. As the world’s #1 digital asset-focused ETF issuer by AUM, we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors.” Thus spake Peter Mintzberg, CEO of Grayscale, with a flourish. 🎤

These offerings, managing over $8.25 billion in assets for U.S. clients, also boast a staking feature, allowing investors to reap rewards while holding their cryptocurrency. Grayscale assures us that staking shall be conducted through a network of custodians, in the name of transparency. 🔒

In their wisdom, they explain that staking permits investors to passively garner rewards from proof-of-stake blockchains, all while keeping their holdings accessible through mundane brokerage accounts. A marvel of modern finance, indeed! 🏛️

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB: To $1,000 or Total Chaos? 🤯

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- Ethereum’s Fusaka Upgrade: Will It Save ETH or Just Make It Fancier? 🎉

- CNY JPY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

2025-10-07 00:40