TL;DR

- Bitcoin, steady as a mule on a dusty trail, hovers near $115,500, with analysts whispering of a slow climb before the 2025 frenzy. 🌾

- Sell-Side Risk Ratio dips below 0.1%, like a farmer holding onto his last grain, showing holders are hoarding instead of selling. 🤑

- Eyes are glued to $117K-if it breaks, $3B in shorts could go up in smoke, fueling a rally hotter than a summer in the Salinas Valley. 🔥

Market Sentiment and Long-Term Outlook

Bitcoin, stubborn as a donkey in a ditch, traded around $115,500 at press time, unchanged on the day but up 3% over the week. Daily trading volume hit $44.3 billion, though the momentum feels as sluggish as a Sunday afternoon nap. 😴

Daan Crypto Trades, with the wisdom of a man who’s seen too many market cycles, observed,

“The market’s been as quiet as a mouse in a grain silo for 10 months now, since the last time it got overheated.”

He noted the last frenzy came after the election, when Bitcoin and altcoins surged like a flash flood in a dry riverbed. Now, he says, it’s a “slow grind up,” with sentiment as neutral as a fence-sitter and retail activity as scarce as rain in a drought. 🌵

Looking ahead, he predicts another overheated phase by late 2025, but added with a shrug,

“If the market decides to take the scenic route into 2026, I’ll just sit tight and enjoy the ride.”

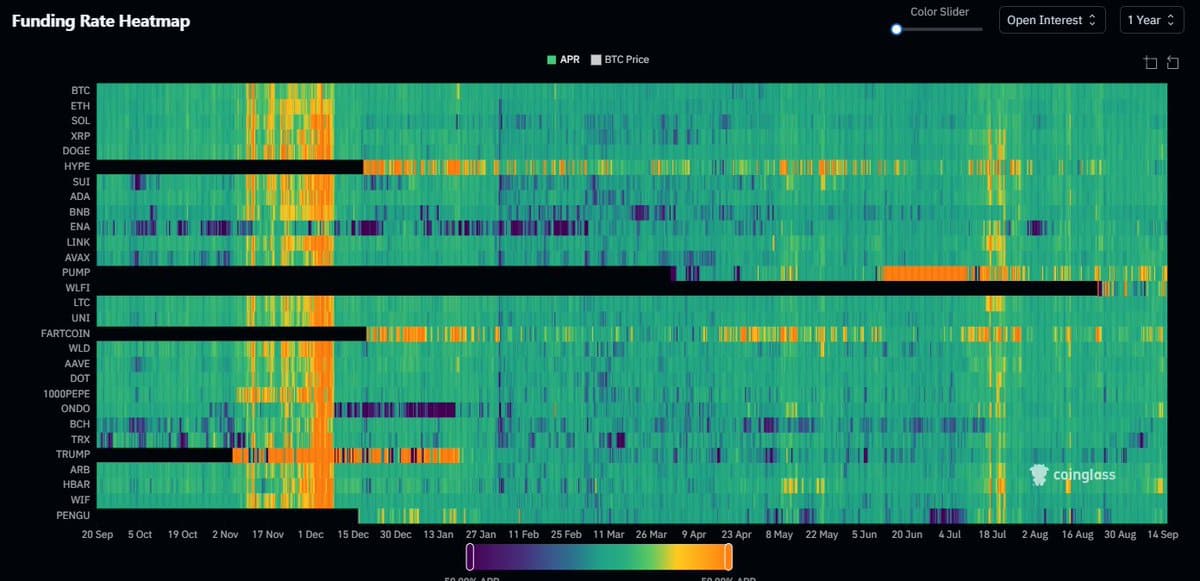

Funding rate data from Coinglass shows Bitcoin and its altcoin cousins trading in a balanced state, like a well-tended orchard. Funding rates, which reflect the cost of holding long or short futures positions, rarely hit extremes, suggesting traders aren’t betting the farm on rallies just yet. 🌳

For most of the year, funding has hovered around neutral or slightly positive levels, with only brief spikes of excitement. This suggests the market is consolidating like a farmer saving for a rainy day, neither soaring too high nor sinking too low. 🌧️

On-Chain Data Points to Accumulation

Ali Martinez, with the keen eye of a hawk spotting a mouse, reported that Bitcoin’s Sell-Side Risk Ratio has dropped below 0.1%, saying this level “often signals local bottoms, accumulation phases, and low sell pressure.” The metric, which compares realized profits and losses, shows holders are clinging to their coins like a miser to his gold. 🧑🌾

Bitcoin $BTC Sell-Side Risk Ratio just dropped below 0.1%. This level often signals local bottoms, accumulation phases, and low sell pressure.

– Ali (@ali_charts) September 16, 2025

Past drops below this threshold in 2023, 2024, and early 2025 matched phases where Bitcoin consolidated before bouncing back, like a resilient weed after a storm. This pattern suggests the current market is ripe for accumulation, with selling pressure as low as a snake’s belly. 🐍

Key Levels and Liquidation Risks

CryptoWZRD, with the caution of a man crossing a rickety bridge, described the latest daily close as indecisive but sees room for a bullish impulse toward $120,000, especially with rate-cut whispers from the Federal Reserve. They warned, “A move below $114,800 would keep Bitcoin as weak as a kitten.” On intraday charts, BTC pushed above $117,000, which could open another trade setup if sustained. 🐱

Meanwhile, Kyle Chassé, with the foresight of a weatherman predicting a storm, warned that “$3B in shorts will be liquidated when $BTC hits $117K.” Exchange liquidation data shows a pile of short positions just above the current price, like kindling waiting for a spark. If Bitcoin moves higher, a wave of forced liquidations could fuel a rally hotter than a wildfire. 🔥

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- Mark Twain’s Take on Solana vs. Ethereum: A Tale of Two Blockchains 🌐🔥

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

2025-09-16 15:50