In the shadow of a world teetering on the brink of financial absurdity, Jack Dorsey’s Block has once again plunged into the abyss of Bitcoin, acquiring 108 more tokens in Q2. 🤑 As the pre-market trading bells chimed, the XYZ stock surged by 10%, a testament to the market’s unyielding faith in the cult of cryptocurrency.

Ah, the “Saylorization” trend-a term so grandiose, so laden with the weight of corporate hubris, it could only be birthed in the boardrooms of those who believe digital coins are the new gold. Block, alongside the likes of MicroStrategy and Twenty One Capital, marches forward, blind to the precipice, or perhaps, gleefully embracing it. 🤡

108 Bitcoins: A Drop in the Ocean of Folly

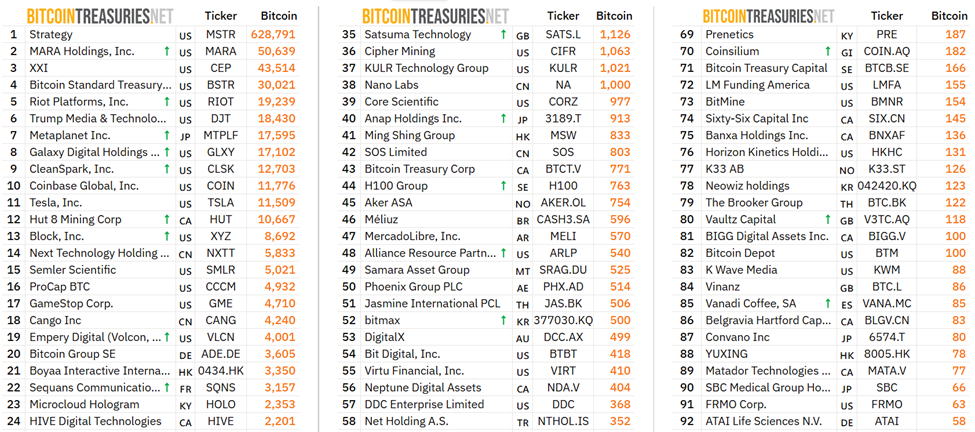

Filings with the US SEC reveal that Block Inc. has added 108 BTC to its hoard, valued at a staggering $12.58 million at current rates. With this, the firm now holds 8,692 BTC, a treasure trove worth over $1 billion. Behold, the 13th largest public company in the Bitcoin pantheon! 🏆 Yet, one cannot help but wonder: is this the wisdom of prophets or the madness of fools?

Max Keiser, the self-proclaimed Bitcoin oracle, proclaims with the fervor of a zealot: “For corporations to survive, they must mimic the Strategy’s process, they must ‘Saylorize’ or die.”

🦄 And so, the corporate world, ever eager to follow the latest fad, rushes headlong into the arms of Bitcoin, dreaming of a future where each coin is worth $2.2 million. Ah, the sweet delusions of the financially enchanted!

Meanwhile, Block’s XYZ stock soared nearly 10% in pre-market trading, a rally fueled not just by Bitcoin mania but also by a Q2 earnings report that exceeded Wall Street’s expectations. 🌟 The firm’s total revenue hit $6.05 billion, with gross profit climbing by 8.2% to $2.54 billion, thanks in no small part to the Cash App’s Bitcoin-related revenue. Bloomberg, ever the cheerleader, reported that Block has boosted its full-year profit outlook. 🎉

Profits Rise, But Bitcoin’s Shadow Looms

Yet, amidst the triumph, a shadow falls. Block’s Bitcoin holdings suffered a revaluation loss of $212.17 million, a reminder that the cryptocurrency’s fair value is as stable as a house of cards in a hurricane. 🌪️ As Bitcoin’s market price dipped, so too did the value of Block’s digital treasure. Ah, the bitter taste of volatility-the price one pays for dancing with the devil of decentralization.

And so, we stand at the crossroads of financial history, watching as corporations like Block bet their futures on the whims of Bitcoin. Will they emerge as visionaries or as cautionary tales? Only time will tell. Until then, let us marvel at the spectacle, popcorn in hand, and await the next act in this grand theater of the absurd. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- 🤑 Crypto Tragedy: Lambo, Bullets, and $19B Vanish! 😱

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Chainlink Soars, BNB Chain Joins the Party! What’s Next for LINK?

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- CNY JPY PREDICTION

- TRX PREDICTION. TRX cryptocurrency

2025-08-08 13:31