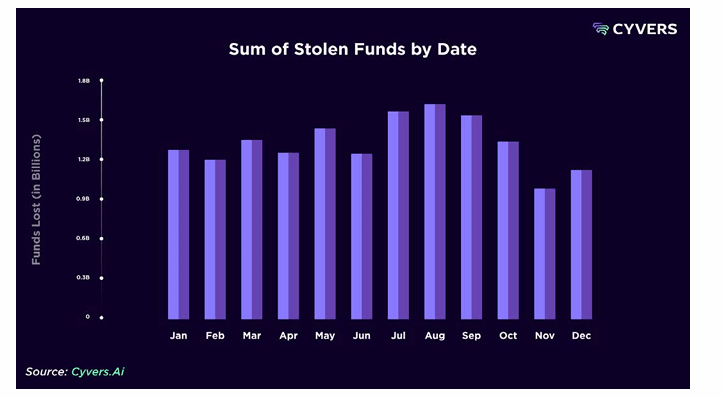

In that most labyrinthine year of 2025, the gleaming, lubricated serpent of Web3 fraud slithered forth, its scales shimmering with $15.87 billion-the price of optimism and misplaced trust. Ah, but the hacks? They mere whisperings in a cave, their $2.5 billion pittance drowned by the cacophony of millions of transactions, each a silent prayer to the god of predatory clusters and cross-platform chaos.

Artful Villains and “Authorized” Deceptions

2025: a year when the Web3 security realm, that delicate edifice of haste and hubris, crumbled under the weight of its own appetites. The Cyvers report, a tome of dread, tallied not just numbers but stories, for every dollar is a tragedy in disguise. $15.87 billion-yes, that abominable sum-was not stolen in heists of steel and shadow, but in whispers, in polite chases through 4.29 million transactions. The criminal, you see, wears a suit and a smile. 😈

Behold the “industrialized” crime, a Lothario of malice, weaving its attentions through clusters of addresses, threading itself across platforms like a spider drenched in joy. The poor exchanges, the payment service providers-poor souls-were mere stepping stones in a dance macabre. One could almost admire the elegance of it all… if one weren’t the victim. 🙊

The pinnacle of sophistication? “Authorized” fraud, a term as sly as a fox in a henhouse. Pig butchering schemes, they called them-a phrase that curdles the milk of humanity. No need to brute-force the blockchain; no, the villain merely convinces the mark, sways them with tales of riches, and then… liquidation. A word that sounds so clinical, so final, like the curtain call of a tragic hero. And yet, the victim is the executioner. 😅

Liquid Assets: The Triple Crown of Predation

Which tokens bore the brunt of this grand folly? None other than the sacred trinity: USDT, ETH, and USDC, their liquidity as smooth as silk in the claws of the predator. USDT, that noble bear of stability, carried 37% of the fraudulent flows. ETH, golden and gullible, contributed 36%. USDC, and let us not forget its 25%. A trinity worthy of Dante’s Inferno, if only the poets had imaginations as desolate as this data.

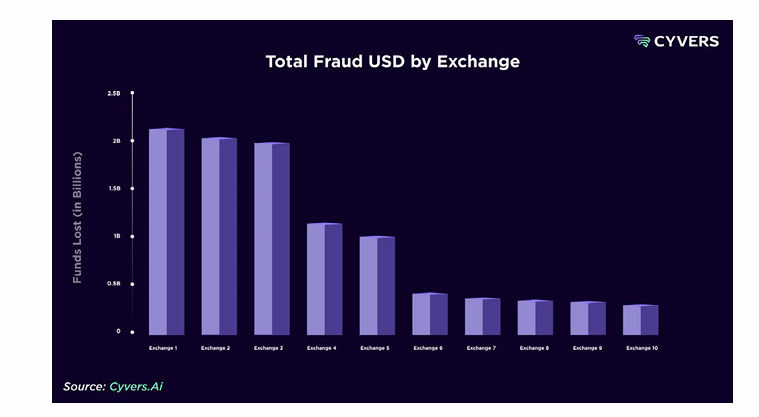

And the exchanges? Ah, the central ones-those modern-day cathedrals of capital-were the chosen altars of this carnage. One of them, unnamed but surely guilty, bore $2.3 billion in fraudulent offerings. Three of the top ten? Half of the game’s riches flowed through their doorways. A festival of folly, with the blockchain as the grandstand and the public as the fools. 😤

FAQ ❓

- How much Web3 fraud was detected in 2025? Enough to fund a thousand harebrained NFT art schemes. 😬

- What crime took the cake? Industrialized scams-address clusters, cross-platform ballets of deceit. 🦸♂️

- Biggest new trend? Authorized fraud! Because why steal when you can charm? 💃

- Top assets and victims? USDT, ETH, USDC-and the exchanges, poor darlings, were pawns. 🐮

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Cronos Rises as Crypto Markets Crumble! 💸📉

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

2026-01-17 13:32