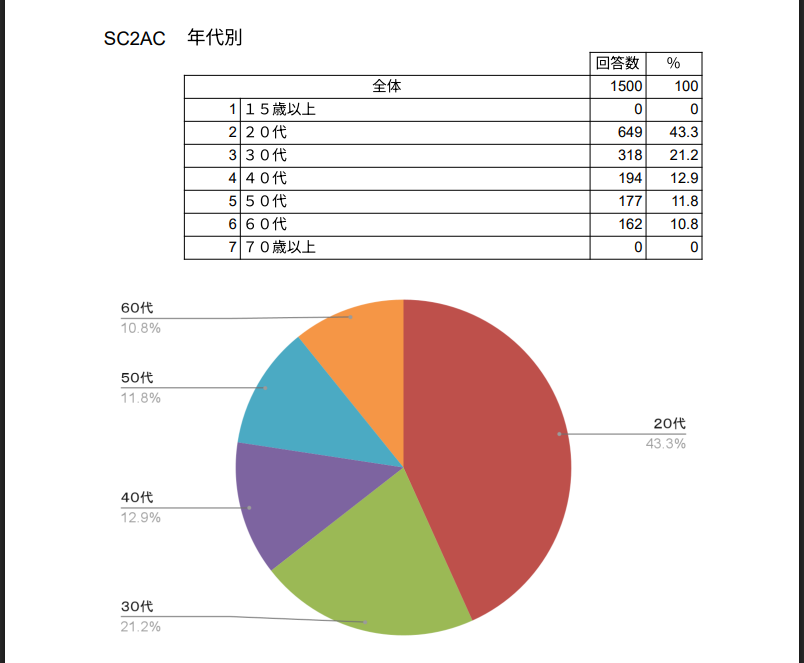

In the land of the rising sun, where bureaucracy reigns supreme and the taxman wields his katana with precision, the humble crypto enthusiast finds himself shackled. Japan’s draconian tax regime, a relic of a bygone era, stifles both the eager buyer and the reluctant seller. A survey of 1,500 souls, conducted in the cruel month of April, revealed that a mere 13% have dared to embrace Bitcoin, Ethereum, or their digital brethren. Yet, many whisper in the shadows, “If only Tokyo would loosen its grip, we would dance into the crypto fray!” 🌸💸

The Flat Tax: A Beacon of Hope? 🌟

The Japan Blockchain Association, a voice in the wilderness, proclaims that 84% of the 191 crypto holders would double down if profits faced a mere 20% flat levy. And lo, 12% of the uninitiated—1,309 strong—declare they would join the ranks under such a rule. A revolution, perhaps? Yet, today’s system chains crypto gains under the oppressive “other income” label, a yoke too heavy for many to bear.

Behold, the current tax rates soar as high as 55%, a burden that would make even the stoutest samurai wince. Compare this to the 10–20% flat rate for stocks in other lands, and one wonders: is Japan’s crypto market a prisoner of its own making? The JBA, with the fervor of a zealot, pleads to reclassify crypto as capital gains, promising a surge in trading volumes that would make local exchanges sing. 🎌📈

Simplicity: The Cry of the Masses 🗣️

Three quarters of the surveyed, weary of paperwork, beg for taxes to be withheld at the source. The JBA, ever the advocate, urges Tokyo to grant traders the choice: pay at the point of sale or during the annual return. A small mercy, perhaps, but one that could soothe the headaches of both the hobbyist and the professional. 🧠💼

Yet, the poll reveals a deeper truth: only 8% blame high taxes for their crypto abstinence, while 61% confess ignorance. Ah, the curse of knowledge! The sample, a microcosm of society, skews 60% male, 40% female, with an average age of 38. Students, a mere 5.3%, and the unemployed, 213 strong, round out this tapestry of hesitation. 📚🚫

The FSA’s Gambit: A New Dawn? 🌅

Whispers from the Financial Services Agency speak of broader reforms. A proposal to bring Bitcoin under the Financial Instruments and Exchange Act looms on the horizon. If passed, digital assets would be crowned as financial products, paving the way for a unified 20% tax by next year. Exchanges like bitFlyer, where Ethereum trades already dominate, stand poised to reap the rewards. A simpler market, a broader fold—could this be Japan’s crypto renaissance? 🏛️🔮

And so, we wait. Will Tokyo’s tax tango end in a triumphant waltz, or will the crypto dream wither under the weight of red tape? Only time will tell. 🕰️🤔

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- USD PLN PREDICTION

- JPMorgan & Coinbase Join Forces: Crypto Gets Its Official Big Kid Pants

- UK Adopts a Quixotic Crypto Quandary with BoE’s Capri-cious Stablecoin Strategy

- DOT PREDICTION. DOT cryptocurrency

- Oh My Goodness! Will PENGU Balloons to a Whopping 38%? Find Out Now! 🐧💥

- Winners & Whiners: PUMP Tokens Soar After Pump.Fun Grabs Padre, But Not Everyone’s Happy!

- Crypto Market Madness 🚀

2025-07-21 15:13