The iron fist of Bitcoin dominance loosens its grip, while Ethereum, like a sly fox, circles the throne, its eyes gleaming with the promise of a new dawn.

The once-mighty Bitcoin, its reign unchallenged for so long, now finds itself faltering. Its dominance, a chart etched with the sweat and tears of lesser coins, falters, unable to reclaim its former glory. Like a weary titan, it staggers, its weekly chart a testament to slowing momentum, a 50-week moving average flattening like a sigh of resignation.

Altcoins, those mischievous sprites, gather at the $175 billion mark, their whispers growing louder.

A lower high, a telltale sign, whispers of a shift in the wind. Michaël van de Poppe, that crypto soothsayer, proclaims it: the bull market, once Bitcoin’s sole domain, now beckons Ethereum, its horns gleaming with newfound strength. Yet, caution, dear reader, for ETH/BTC, though stirring, remains shackled below its 200-day average, a reminder that the old guard does not yield easily.

Dominance crumbles, a sandcastle before the tide. A lower high, a harbinger of change. I stand by my prophecy: this is not Bitcoin’s solo, but a symphony, with Ethereum poised to take the lead…

– Michaël van de Poppe (@CryptoMichNL)

But hope, like a spark in the darkness, flickers. Selling pressure, once a torrent, now trickles. Momentum, instead of plunging into the abyss, flattens, a pause before the ascent? Volatility, that wild beast, tightens its grip, forming a higher low, a potential springboard for the daring. Short-term flows, once hemorrhaging, now stabilize, a bandage on a wounded market.

A base, they say, is forming. For Ethereum to claim its rightful place, it must breach the 0.031-0.032 fortress, then conquer the 200-day average, a dragon guarding the treasure. Until then, we wait, not in despair, but with the anticipation of a child on Christmas Eve, for the market, though in transition, whispers of a coming altseason.

February’s capitulation, a violent purge, cleansed the market of its excesses. The altcoin market cap, now at $175 billion, consolidates, a phoenix rising from the ashes of leverage and weak hands. Resistance looms at $180-185 billion, a gatekeeper to broader participation. Volume, that trusty steed, must surge, its hooves pounding the ground in confirmation.

Image Source: TradingView

Bitcoin, once the undisputed king, now faces a challenger in Ethereum, its derivatives positioning lighter, its potential for upside greater.

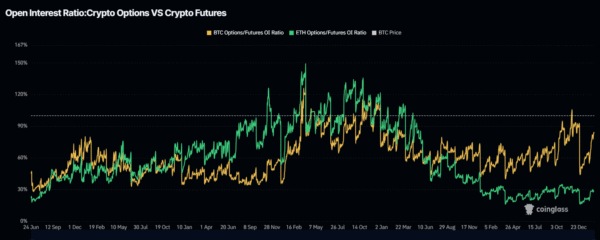

Options-to-futures ratios, those cryptic oracles, speak of Bitcoin’s entrenched position, while Ethereum’s, like a nimble dancer, lightens its step. Institutional hedging, ever cautious, still favors the old guard, but Ethereum’s lighter positioning leaves room for a swift and unexpected strike.

Image Source: CoinGlass

The signs, they say, are aligning. Bitcoin’s dominance, a lower high, a crack in the armor. ETH/BTC, emerging from its sideways dance, hints at a new rhythm. Altcoin market cap, stabilizing after the storm, awaits the signal. Ethereum derivatives, unburdened, stand ready for the charge.

Yet, let us not be fooled by the whispers. ETH/BTC must reclaim its lost territories, breach the 200-day average, a dragon’s lair. The altcoin market cap must surge, a tidal wave of participation. Until then, we remain in the twilight, a market in transition, yearning for the dawn of a new era.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Bitcoin Flees, Ethereum and Friends Throw a Wild Party 🎉💸

- DOGE PREDICTION. DOGE cryptocurrency

- Bitcoin’s Big Sigh: ETFs Flee as Miners Outpace Demand! 🐢💸

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- The Winklevoss Twins Cash In: Bitcoin Firm Goes Public & Gemini’s Big IPO

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

2026-02-19 01:01